Crane Rental Corporation has been acquired by Maxim Crane Works, L.P.

Hammond, Kennedy, Whitney & Company has sold Crane Rental Corporation to Maxim Crane Works, L.P., the largest provider of comprehensive lifting services in the USA and a portfolio company of Platinum Equity, for an undisclosed consideration.

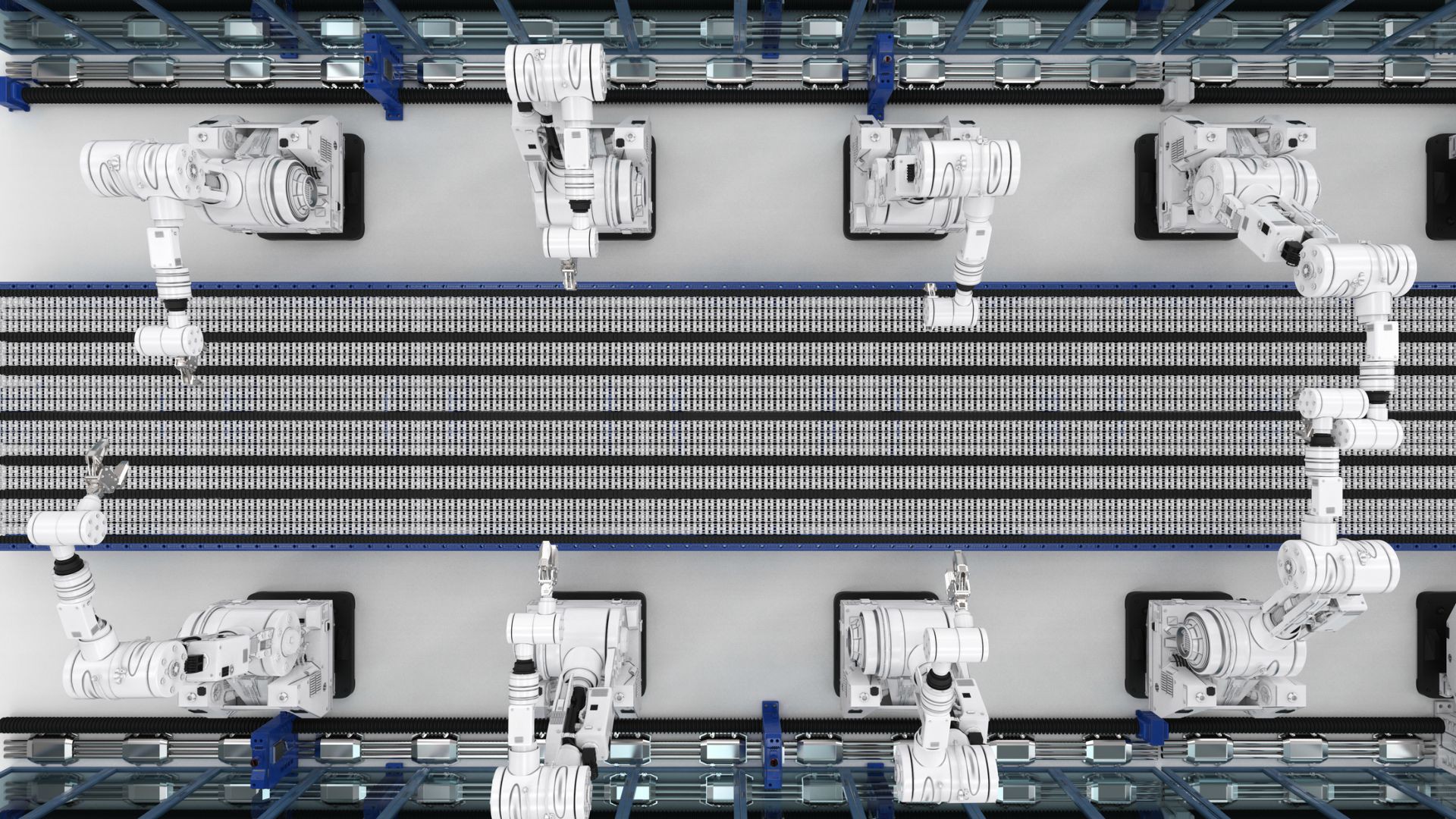

Founded in 1960, Crane Rental Corporation provides construction and industry machinery for rent. It offers hydraulic trucks, hydraulic all-terrains, electric tower cranes, conventional crawlers, heavy hauling and rigging equipment, rough terrain equipment, conventional truck, crawler towers, accessories, specialized equipment and used equipment. The company serves heavy civil construction, chemical and refining, industrial crane erection and relocation, industrial warehousing, nuclear energy, power distribution and power generation markets.

Maxim Crane Works, L.P. offers rental services and sells lift equipment in the USA. The company offers hydraulic truck, rough terrain, crawler, tower, and conventional truck cranes rental services; industrial cranes or boom truck rental services; operated and maintained crane rental and bare crane services; engineering and project management for crane rental projects; crane and lift training services; engineered crane lifts; rigging, transportation, heavy lifts/heavy transportation and on-site evaluation services; and new and used cranes. It serves power generation facilities, transmission and distribution, and wind and solar power markets; steel mills, pulp and paper facilities, refineries, chemical plants, and automotive markets; tower erection and modular building markets; educational, health care, food and beverage, and government facilities; and offices and warehouses, bridges and highways, high rise condominiums, hotels and motels, sports and entertainment facilities and residential markets.

Hammond, Kennedy, Whitney & Company is a private equity firm specializing in investments in later stage, mature, management buyouts of privately-owned businesses, subsidiaries and divisions of corporations and public companies; industry consolidations; corporate divestitures; generational changes in ownership; recapitalization transactions; and growth equity investments. The firm seeks to invest in small middle-market companies with low risk of technological obsolescence. The firm is a generalist that seeks to invest in the medical devices; aerospace and defense; water infrastructure, oil and natural gas; telecommunication services; information technology; materials; specialty and recreational vehicles; automation processing equipment; industrial burners and combustion equipment; financials; healthcare; energy; nuclear; coal; niche manufacturing; and utility related infrastructure, with a focus on industrial manufacturing, services, and distribution companies. The firm prefers to invest in companies headquartered in North America.

One of Oaklins' teams in the USA served as the exclusive financial advisor to the seller in this transaction.

Talk to the deal team

Paul Smolevitz

Oaklins TM Capital

Related deals

Triscan has joined APA and Riverarch to accelerate growth in the European aftermarket

Triscan AS, a leading provider of OE-quality automotive spare parts for the professional aftermarket in Europe, has been acquired by APA Industries, LLC, a portfolio company of Riverarch Equity Partners.

Learn moreTEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Learn moreTecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

Learn more