Diversified Gas & Oil Plc has raised funds to acquire EQT entities

Diversified Gas & Oil Plc (DGO) has raised US$250 million through an equity share placing to help fund the acquisition of EQT entities holding certain gas and oil assets for US$575 million.

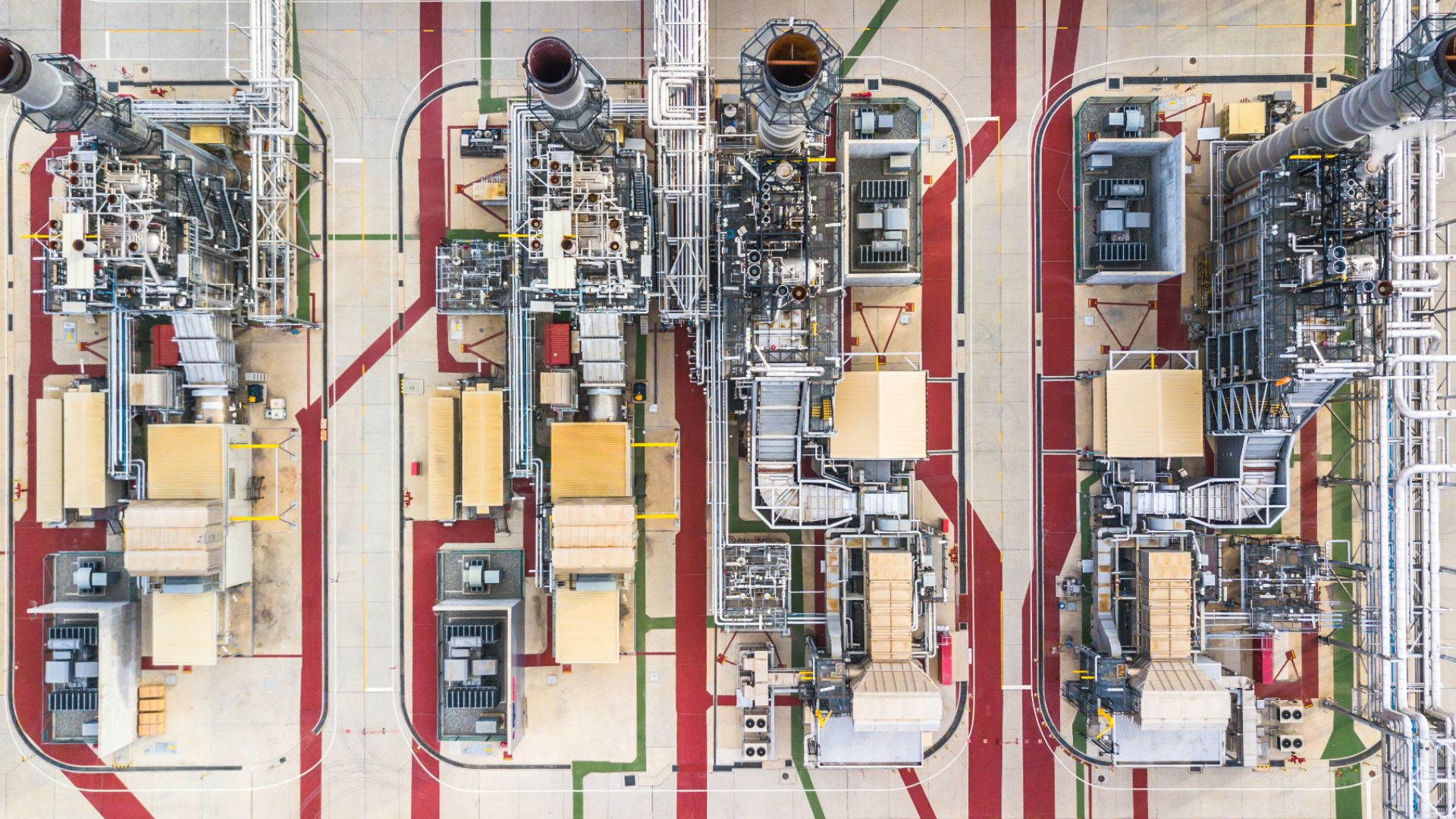

Diversified Gas & Oil is an independent gas and oil producer in the Appalachian Basin in the US.

Oaklins Smith & Williamson, based in the UK, acted as Nominated Advisor (Nomad) to DGO on the acquisitions and the share placing.

Talk to the deal team

Related deals

Presight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreStrawberry Equities has sold Ecohz to Caely Renewables

Ecohz, a global renewable energy company, has been acquired by environmental commodity trading house Caely Renewables from Strawberry Equities. The transaction marks an important new chapter for Ecohz and brings together two organizations with complementary strengths, aligned in their commitment to accelerating the global energy transition.

Learn more