Diversified Gas & Oil Plc has raised funds to acquire EQT entities

Diversified Gas & Oil Plc (DGO) has raised US$250 million through an equity share placing to help fund the acquisition of EQT entities holding certain gas and oil assets for US$575 million.

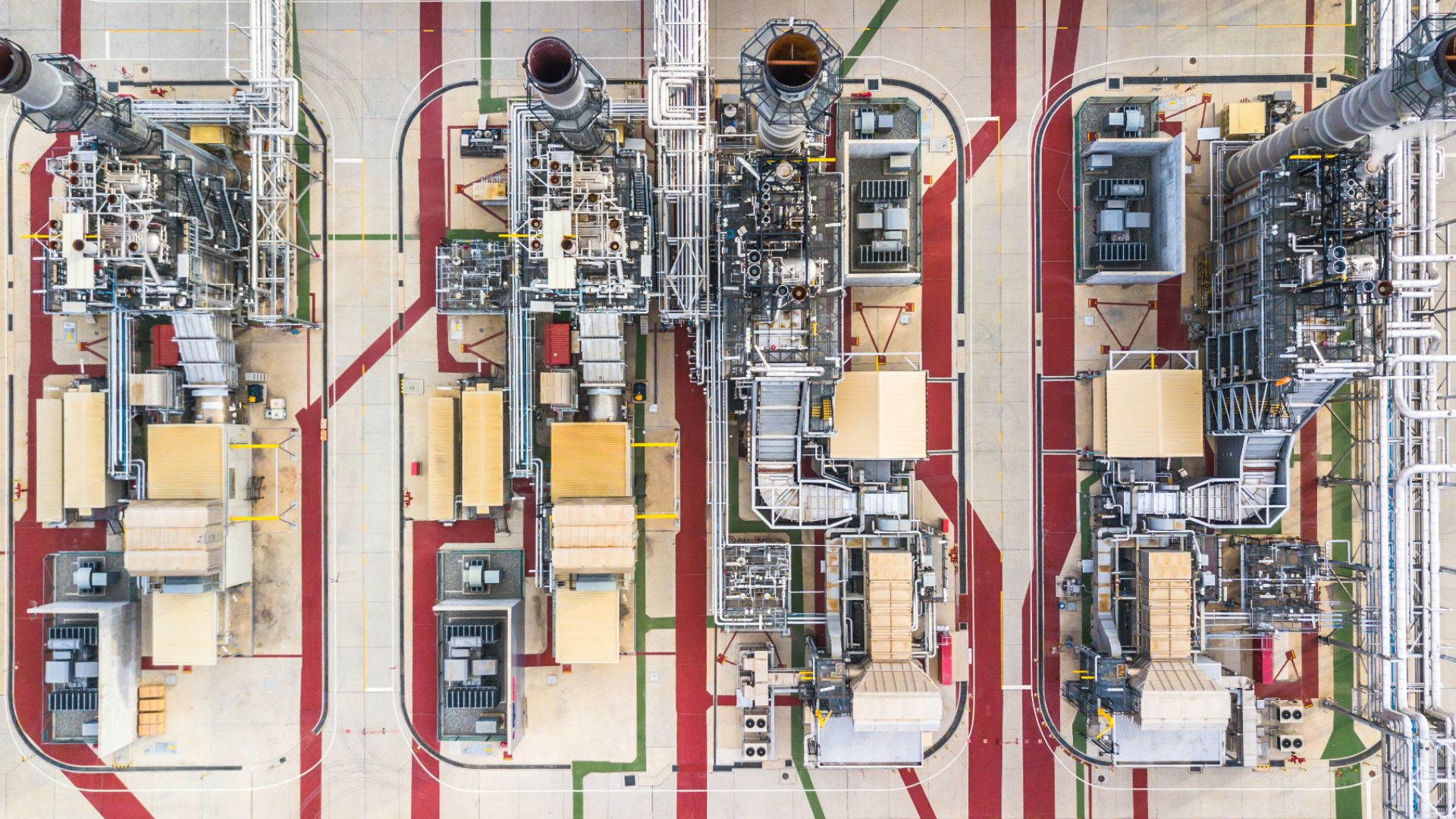

Diversified Gas & Oil is an independent gas and oil producer in the Appalachian Basin in the US.

Oaklins Smith & Williamson, based in the UK, acted as Nominated Advisor (Nomad) to DGO on the acquisitions and the share placing.

Talk to the deal team

Brian Livingston

Oaklins Evelyn Partners

Related deals

Winking Studios Limited completes a secondary fundraising of US$20 million

Winking Studios has successfully raised US$20 million to fund its business strategy and future plans, such as strategic acquisitions, alliances and joint ventures as well as secondary or dual listings, to grow the group’s market share and broaden its customer base globally.

Learn moreFRP Advisory Group plc has finalized a successful secondary placing

FRP Advisory Group plc has completed a fundraising. The book was oversubscribed and approximately £20.4 million (US$33 million) of shares were sold by certain directors and partners of FRP to new and existing institutional investors at 128 pence per ordinary share.

Learn moreSindal Biogas A/S has been acquired by CIP

Sindal Biogas A/S, a large-scale Danish biogas plant owned by KK Invest ApS and DBC Invest, has been partly sold to Copenhagen Infrastructure Partners P/S (CIP).

Learn more