Great Range Capital has sold Fairbank Equipment to Pfingsten Partners

Fairbank Equipment Holdings, Inc. (Fairbank), a portfolio company of Great Range Capital, has been sold to Pfingsten Partners.

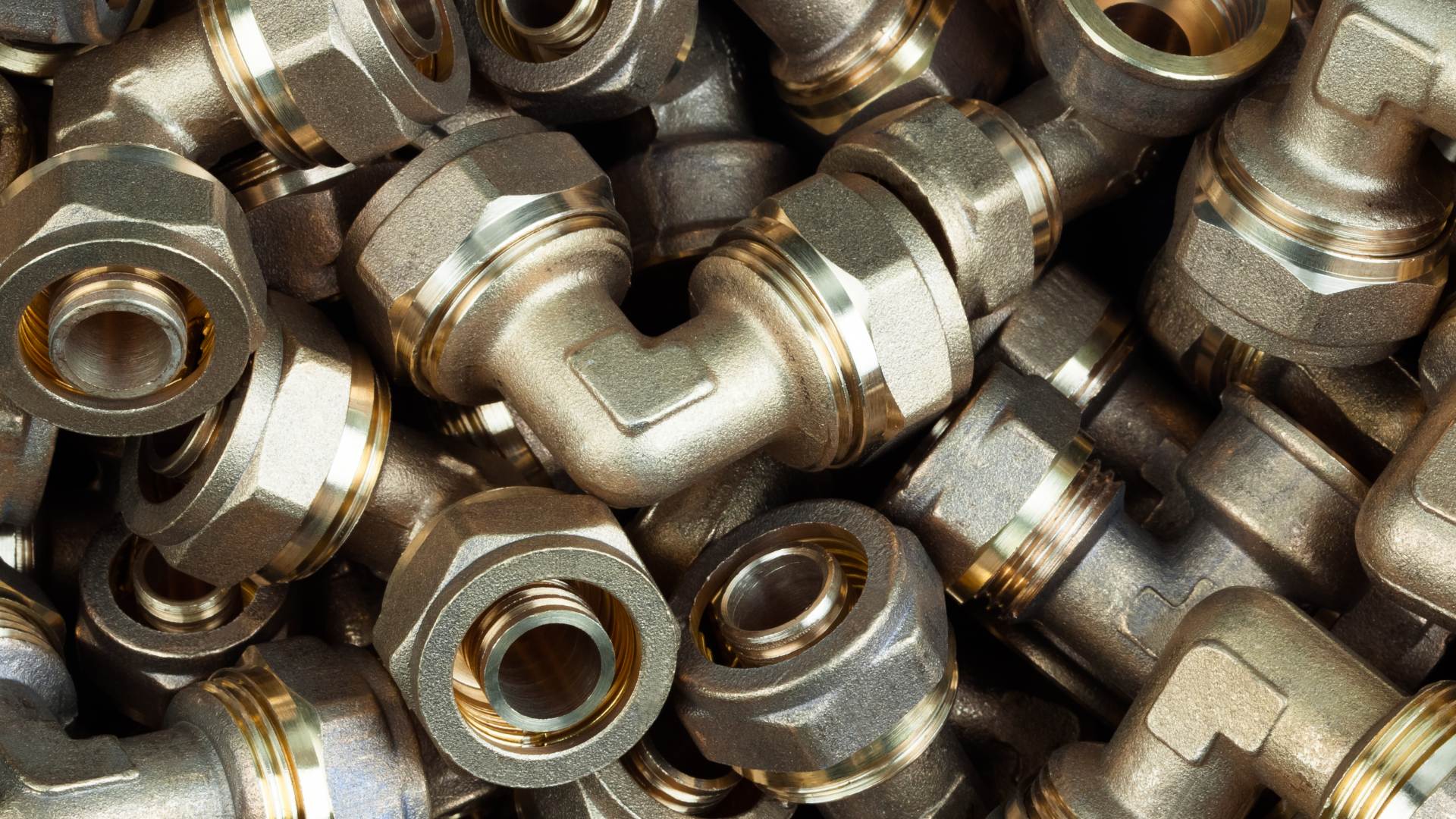

Based in Wichita, Kansas, Fairbank is a leading specialty distributor and dealer of agricultural and propane parts, specialty components and equipment add-ons.

Founded in 1989 and headquartered in Chicago, Illinois, Pfingsten Partners is a highly regarded private equity firm that invests in manufacturing, distribution and business services companies.

Great Range Capital is a leading middle-market private equity firm based in the greater Kansas City area, primarily investing in the niche manufacturing, business and industrial, consumer and retail, and healthcare services sectors.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Fairbank Equipment Holdings, Inc. in this transaction.

Ryan Sprott

Managing Partner, Great Range Capital

Talk to the deal team

Allan Cruickshanks

Oaklins TM Capital

Related deals

Triscan has joined APA and Riverarch to accelerate growth in the European aftermarket

Triscan AS, a leading provider of OE-quality automotive spare parts for the professional aftermarket in Europe, has been acquired by APA Industries, LLC, a portfolio company of Riverarch Equity Partners.

Learn moreTEAM Safety Services Limited has been acquired by Vadella Group

TEAM Safety Services Limited, a leading UK-based health, safety and fire safety consultancy, has been acquired by Vadella Group, a specialist provider of inspection-led compliance services for the built environment.

Learn more123.tv has been acquired by DVC Partners

123.tv, a digitally driven home and live shopping and e-commerce platform with a unique live auction format offered on its own TV channels and digital platforms, has been acquired by DVC Partners, a pan-European private equity firm.

Learn more