LHN Logistics has raised S$5.0m (US$3.6 million) in gross proceeds

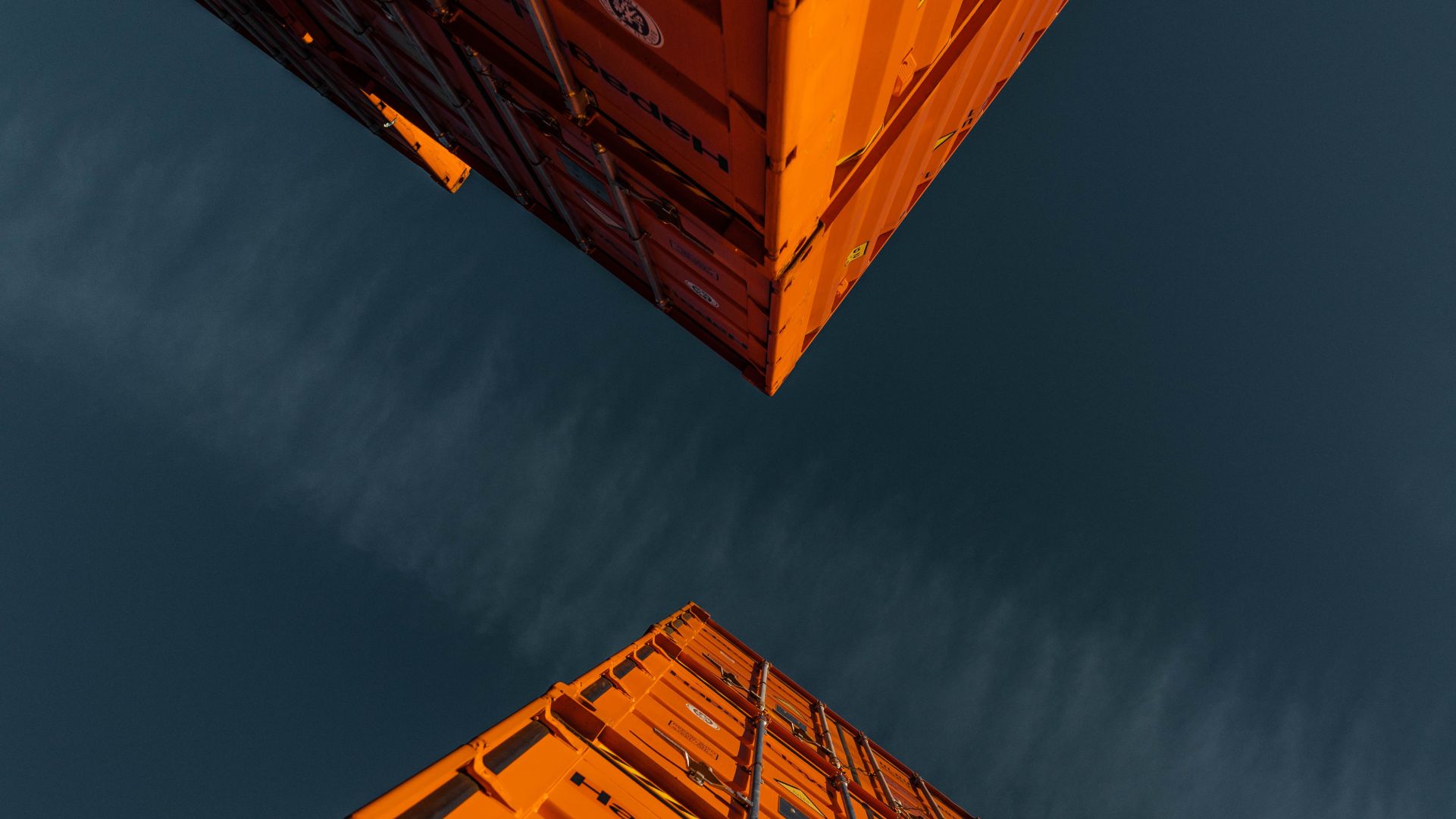

LHN Logistics Limited has completed a fundraising to partially finance the construction of an ISO tank depot, expand the transportation fleet and acquire moving equipment.

LHN Logistics is a services group with an operating history of approximately 19 years in two principal business segments, transportation and container depot services. Under its transportation unit, LHN Logistics provides ISO tank and container transportation for various petrochemical products, base oils, bitumen and bulk cargo to customers in Singapore and Malaysia, through its fleet of customized and licensed prime movers and trailers. Through its container depot services, LHN Logistics provides container depot management services in Singapore and container depot services to customers in Singapore and Thailand.

Oaklins’ team in Singapore acted as the sponsor, issue manager and co-placement agent for the admission of LHN Logistics to the Catalist Board (Catalist) of the Singapore Exchange Securities Trading Limited and the placement of 25,238,000 shares at S$0.20.

Talk to the deal team

Related deals

Backspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreOmer Engineering has completed an IPO

Omer Engineering Ltd. has successfully launched its IPO on the Tel Aviv Stock Exchange, pricing shares as part of a plan to raise approximately US$94 million at an implied pre-money valuation of around US$313 million. The offering included both newly issued shares and a secondary sale by existing shareholders, who retained a significant majority stake post-IPO. This transaction underscores strong investor interest in scaling the company’s operations and enhancing its capital.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more