Precision Fuel Components has been acquired by VSE Corporation

The shareholders of Precision Fuel Components, LLC have sold the company to VSE Corporation.

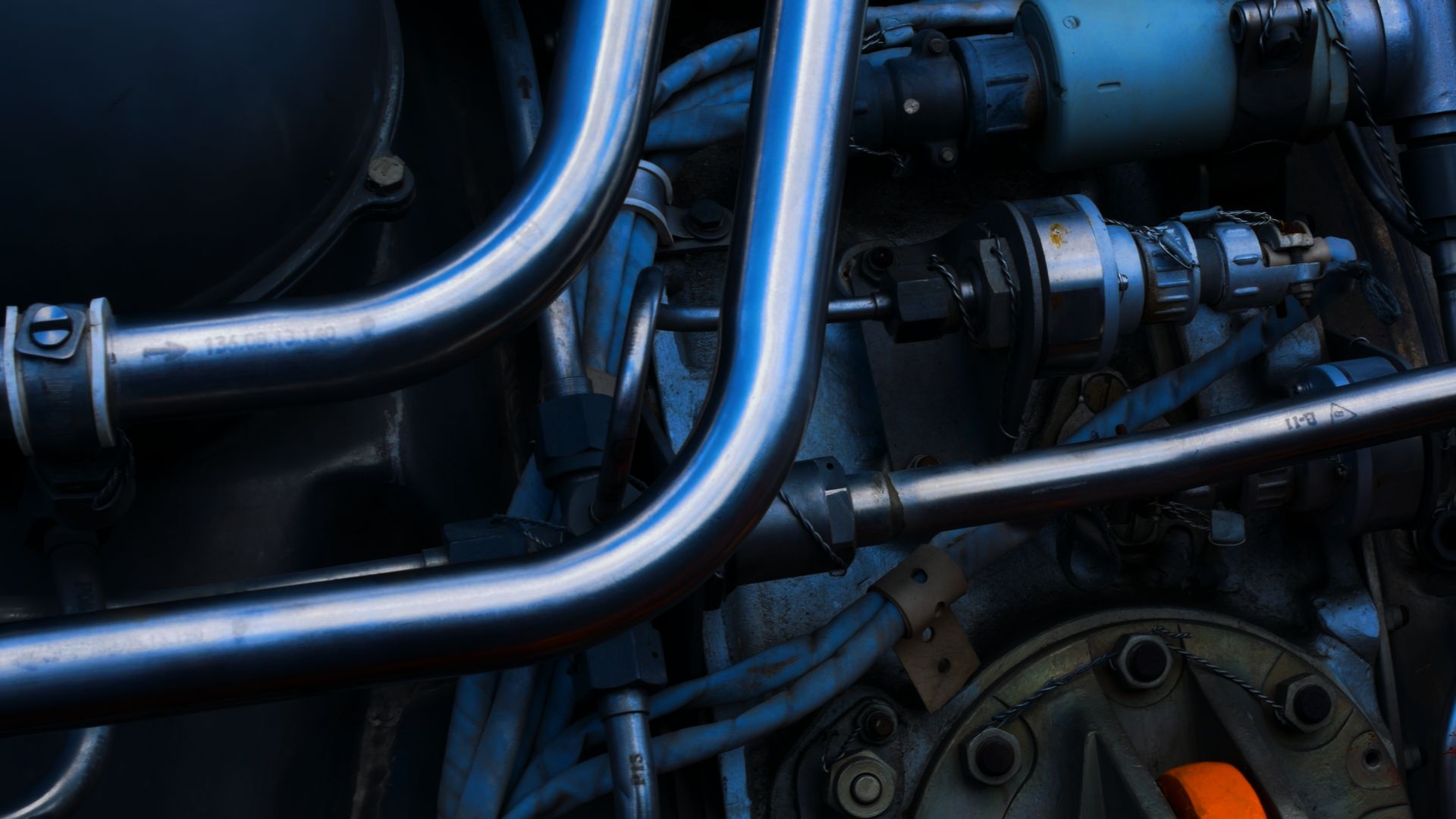

Precision Fuel Components is a market-leading provider of MRO services for engine accessory and fuel systems, supporting the business and general aviation market. Precision Fuel specializes in supporting small turbine rotorcraft fuel controls, governors, sensors, bleed valves and fuel pumps, along with radial engine components and Bendix-Stromberg carburetors. Precision Fuel is a member of the Honeywell Authorized Warranty and Repair Station (awards) network.

VSE Corporation is a diversified products and services company providing repair services, distribution, logistics, supply chain management support and consulting services for land, sea, and air transportation assets in the public and private sectors.

Oaklins Janes Capital, our aerospace, defense and security team in Irvine, acted as sell-side advisor in this transaction.

Talk to the deal team

Stephen Perry

Oaklins Janes Capital

Related deals

Lauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreOSL has been acquired by Terma

OSL Group Limited, a leader in counter-drone security and safety systems, has been acquired by Terma AS, a Denmark-based global provider of mission-critical solutions for defense, aerospace and security.

Learn moreScanfiber Composites has been acquired by Fjord Defence Group

Scanfiber Composites AS, a leading manufacturer of advanced ballistic protection solutions, has been acquired by Fjord Defence Group. The transaction represents a strategic step in expanding Fjord Defence’s footprint in the European defense market and provides Scanfiber with a strong platform to support its continued growth.

Learn more