Synergyc has been acquired by One Equity Partners (OEP) via its platform entity Kirey Group

One Equity Partners (OEP) has completed the simultaneous acquisition of Kirey Group and Synergyc with the clear goal to create a Pan-European IT Service champion.

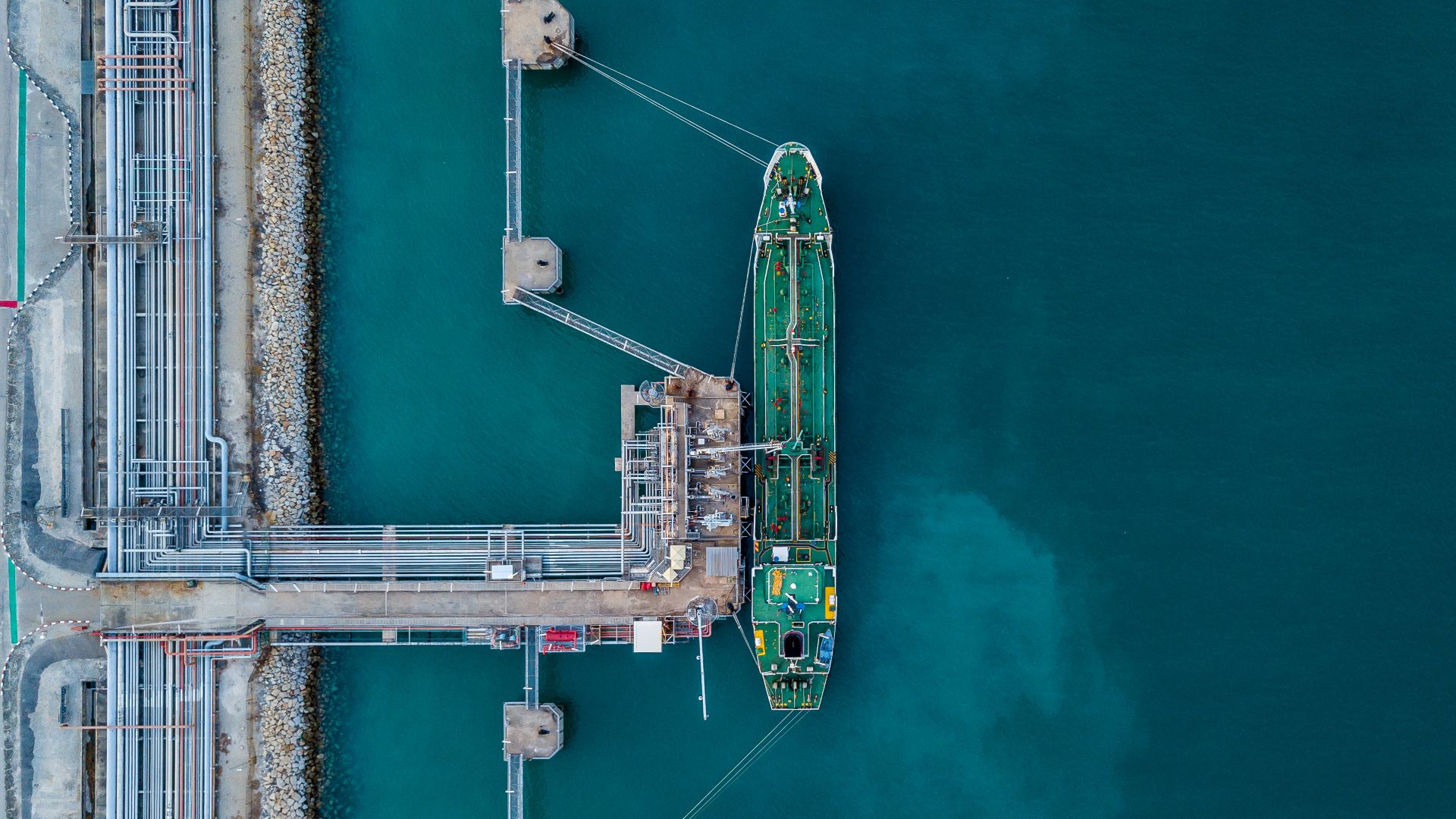

Synergyc is a progressive, growth-oriented professional services and consulting company servicing blue-chip enterprises from its headquarters in Sofia, Bulgaria. The company is focused on solutions that help its clients optimize organizational structures, decrease risk and costs and achieve greater operational efficiencies. Synergyc has a proven track record of leading and delivering transformative IT and finance services within the commodities and energy, oil and gas, and technology services sectors.

Kirey Group is an Italian IT systems integrator and technology solutions player that supports companies through digital transformation, offering customized solutions, strategic consulting and a full range of IT services. With over 950 employees, Kirey Group has offices in Italy, Spain, Portugal, Romania, Serbia, Croatia and Kenya.

OEP is a US-based middle-market, private equity firm focused on the industrial, healthcare and technology sectors in North America and Europe. The firm seeks to build market-leading companies by identifying and executing transformative business combinations. OEP is a trusted partner with a differentiated investment process, a broad and senior team, and an established track record generating long-term value for its partners. Since inception, the firm has completed more than 300 transactions worldwide. OEP, founded in 2001, spun out of JP Morgan in 2015. The firm has offices in New York, Chicago, Frankfurt and Amsterdam.

Oaklins’ team in Bulgaria acted as the exclusive M&A advisor to Synergyc by managing the overall sale process, including due diligence and negotiations, and provided assistance until closing.

P. Joseph Lazarus

Founder and CEO, Synergyc

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreSTAC has been acquired by n2 Group

Strategic Technology Analysis Center (STAC), a world leader in financial-technology benchmarking and events, has been acquired by n2 Group, the UK specialists in advanced computation and IT infrastructure.

STAC joins NAG and VSNi in the growing community of n2 Group companies dedicated to advancing computation through collective innovation, technical excellence and long-term strategic growth. STAC will operate as an independent business within n2, maintaining its brand, identity and ethos.

Winking Studios Limited completes a secondary fundraising of US$20 million

Winking Studios has successfully raised US$20 million to fund its business strategy and future plans, such as strategic acquisitions, alliances and joint ventures as well as secondary or dual listings, to grow the group’s market share and broaden its customer base globally.

Learn more