Fortimedix has been acquired by Medtronic

Fortimedix Surgical has been successfully acquired by Medtronic (NYSE: MDT). Following the transaction, Fortimedix will operate as Medtronic Articulating Technologies.

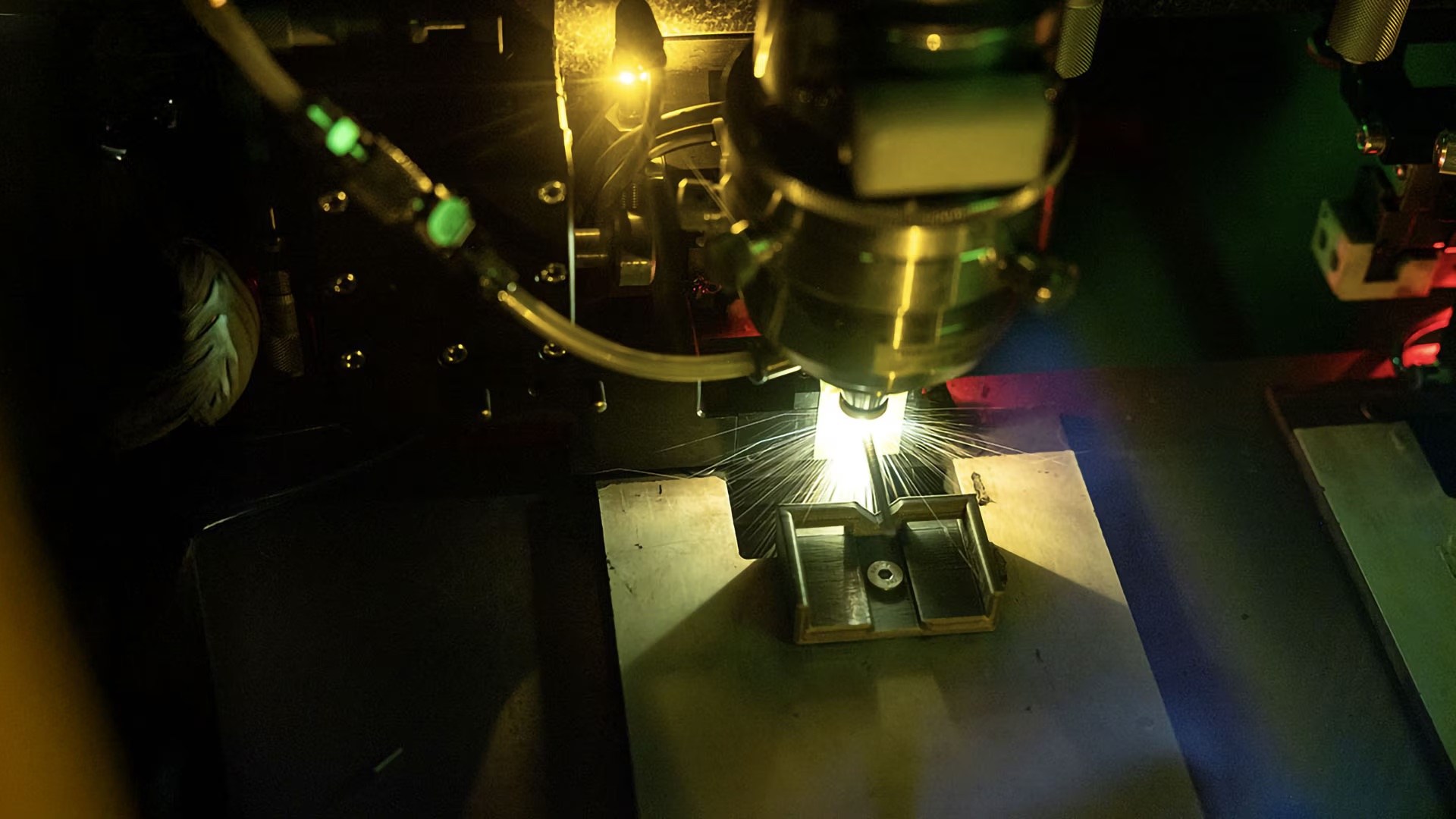

Located at the Brightlands Chemelot Campus in Geleen, the Netherlands, Fortimedix operates a fully equipped R&D and pilot manufacturing facility that allows the seamless integration of product development and pilot manufacturing under a single roof.

Oaklins’ team in the Netherlands acted as the exclusive sell-side M&A advisor to Fortimedix in its sale to Medtronic. This transaction underscores Oaklins’ strong international track record in the medical technology sector, demonstrating their ability to unlock significant value in a rapidly evolving, innovation-driven industry. Leveraging deep sector expertise and a global network of strategic buyers, the team ensured a smooth and successful transaction process for all parties involved.

Wout Bijker

CEO, Fortimedix Surgical

Talk to the deal team

Related deals

Rare Patient Voice has been acquired by Konovo

Rare Patient Voice has been acquired by Konovo, a technology-first healthcare intelligence company backed by Fraser Healthcare Partners.

Learn moreLindenhofgruppe has sold its majority stake in LabPoint to Affidea Switzerland

LabPoint Medical Laboratories AG has been acquired by Affidea Switzerland AG. Through the transaction, Lindenhofgruppe AG gains a strong strategic partner to support the further development of LabPoint and will remain a shareholder with a reduced stake, continuing as a key customer of the company. It lays the foundation for LabPoint’s sustainable development under a new anchor shareholder, with the aim of further strengthening and selectively expanding its position in laboratory diagnostics.

Learn moreEuroHospital Varna has been acquired by Intermedica Group

EuroHospital Varna has been acquired by Intermedica Group, allowing the business to continue to grow and deliver high-quality healthcare services to its patients. Through the transaction, Intermedica Group expands its healthcare presence and intends to build a new model of integrated personalized care focused on preventive, holistic and digital medicine.

Learn more