Snorkel has sold a 49% stake to Xtreme Manufacturing LLC

The Tanfield Group plc (Tanfield) has sold a 49% stake in Snorkel, a manufacturer of self-propelled aerial work platforms, to a new company controlled by Xtreme Manufacturing LLC (Xtreme) for US$80 million.

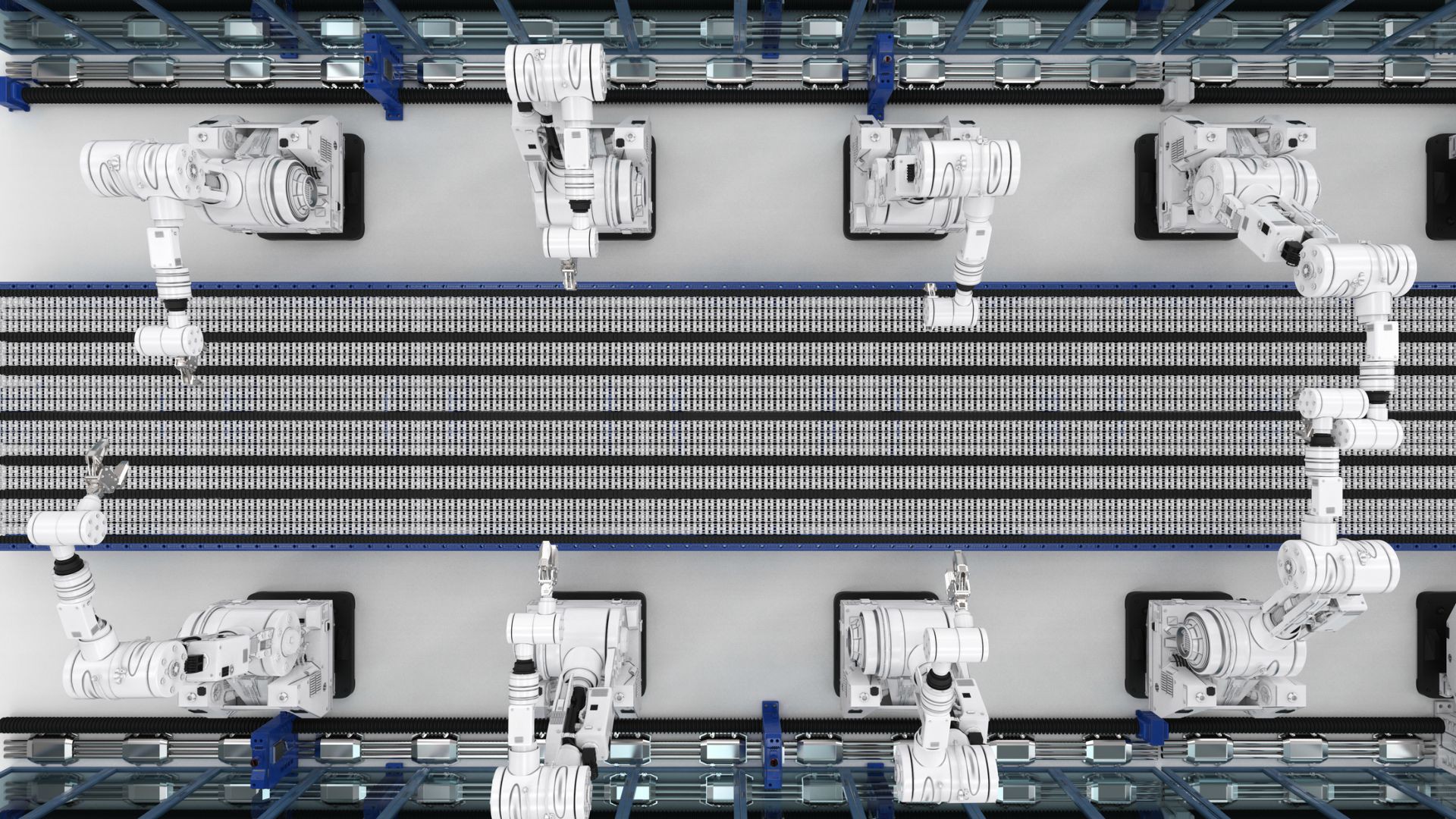

Snorkel has manufacturing facilities across the globe and supplies a range of cherry-pickers used in building, construction and infrastructure projects.

Xtreme is a manufacturer of telescopic material handlers, under the control of Don Ahern. Mr Ahern owns Ahern Rentals, Inc., one of the largest privately held equipment rental companies in the world and a long-standing customer of Snorkel. Xtreme has committed working capital facilities of up to US$50 million to support Snorkel’s growth plans and Tanfield will retain a 49% interest in Snorkel along with a preferred interest position of US$50 million.

In early 2013, the Board of Tanfield took the decision to appoint Cavendish to help find a purchaser for Snorkel. Following the global economic downturn in 2008, Snorkel suffered a catastrophic collapse in its market. In the four years ended 31 December 2012, the cumulative losses of Snorkel were circa US$80 million. For the first six months of 2013 Snorkel suffered further losses of over US$13 million. Market demand has now improved but Snorkel has continued to struggle due to working capital constraints.

Oaklins Cavendish, based in the UK, advised the seller in this transaction.

Talk to the deal team

Lord Leigh of Hurley

Oaklins Cavendish

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn moreGSP Group has secured an upsized growth refinancing package from HSBC

The GSP Group has refinanced its growth facilities through an upsized financing package provided by HSBC.

Learn more