Great Range Capital has sold Fairbank Equipment to Pfingsten Partners

Fairbank Equipment Holdings, Inc. (Fairbank), a portfolio company of Great Range Capital, has been sold to Pfingsten Partners.

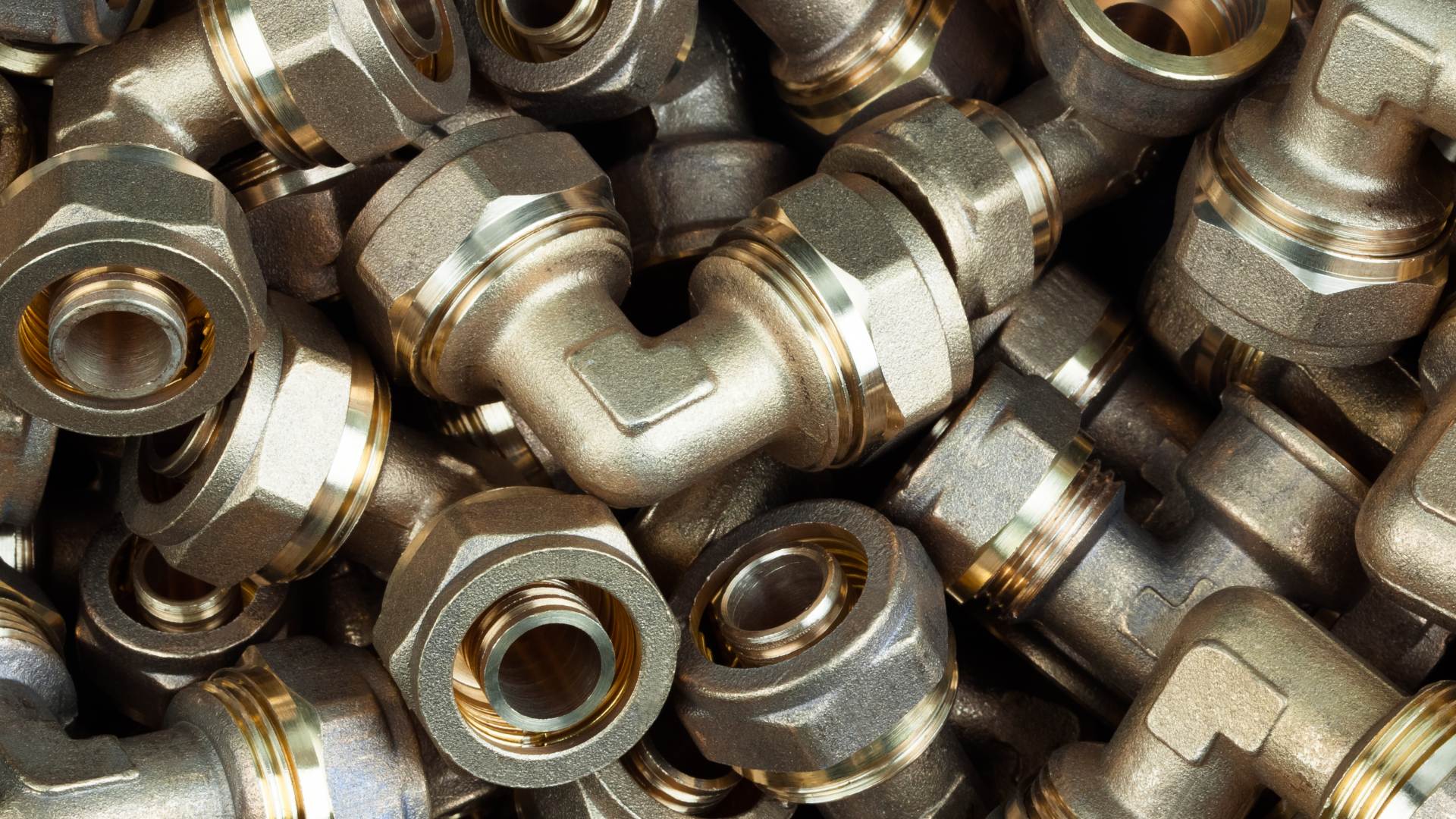

Based in Wichita, Kansas, Fairbank is a leading specialty distributor and dealer of agricultural and propane parts, specialty components and equipment add-ons.

Founded in 1989 and headquartered in Chicago, Illinois, Pfingsten Partners is a highly regarded private equity firm that invests in manufacturing, distribution and business services companies.

Great Range Capital is a leading middle-market private equity firm based in the greater Kansas City area, primarily investing in the niche manufacturing, business and industrial, consumer and retail, and healthcare services sectors.

One of Oaklins’ teams in the USA served as the exclusive financial advisor to Fairbank Equipment Holdings, Inc. in this transaction.

Ryan Sprott

Managing Partner, Great Range Capital

Contáctese con el equipo de la transacción

Allan C. Cruickshanks

Oaklins TM Capital

Transacciones relacionadas

Bolster Investment Partners has acquired a majority stake in Eternal Sun

Bolster Investment Partners, a Netherlands-based investment firm, has acquired a majority stake in Eternal Sun, a global technology leader in advanced solar panel testing equipment, from ABN AMRO Sustainable Impact Fund, a private impact fund based in the Netherlands, and Vermec, a Belgium-based investment firm.

Ver másiwell raises US$31 million to deploy its leading European smart battery storage solutions into new markets

iwell, a developer of smart energy management (EMS) and battery storage systems (BESS), has successfully closed a US$31 million (€27 million) funding round. The round was led by Meridiam, with Invest-NL and Rabobank participating, alongside existing investors.

Ver másLargest AIM IPO in the business support services sector over the past five years has been completed

MHA plc raised US$131 million (£98 million) through a placing and retail offer, achieving a market capitalization of approximately US$363 million (£271 million) on admission. This was the largest AIM IPO in the business support services sector over the past five years. The IPO provides a platform for continued investment in technology, talent and acquisitions, supporting the group’s ambition to become a top 10 UK professional services firm.

Ver más