RECIF Technologies has been acquired by Accuron Technologies

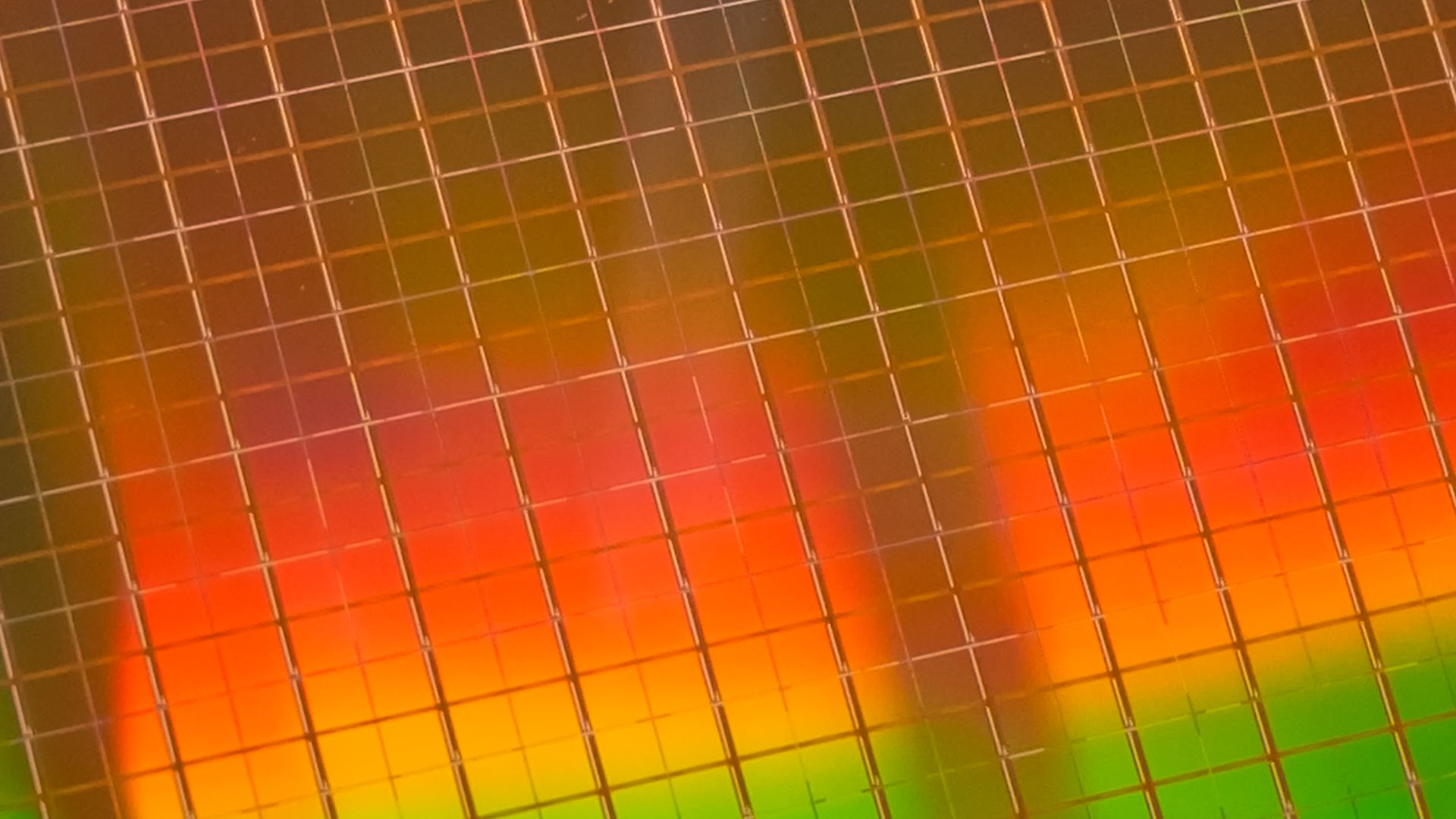

RECIF Technologies, one of the world’s top three manufacturers of wafer handling equipment for semiconductor factories, has joint Mechatronic SystemTechnik GmbH as part of Accuron Technologies Limited, an international leader in precision technology and engineering.

RECIF Technologies is the only European company designing, manufacturing and selling wafer handling equipment for the semiconductor industry. Restructured as a fablight company since 2008, RECIF is dedicated to R&D and final assembly of components produced by a network of local subcontractors. The company also offers a full range of product-related services, such as installation, maintenance and training. With an international presence and two subsidiaries in the US and Taiwan, RECIF has 60 employees and serves the world leaders in the semiconductor industry, such as Samsung, TSMC and SMIC. As a truly cutting-edge company, RECIF Technologies is today one of the rare SMEs to be involved in European collaborative programs in this industry. Alain Jarre, chairman of RECIF Technologies since 2008, has successfully managed the group’s restructuring, transformation and redeployment to build a world leader in the sector, firstly with the support of the Gorgé Group, BNP Développement and BpiFrance and, since 2021, with the financial sponsorship of Yotta Capital and Sofiouest.

Accuron Technologies is an international engineering and technology group based in Singapore, specialized in precision manufacturing, material processing, systems design and integration. Founded in 1981 with the sponsorship of Singapore’s sovereign wealth fund Temasek, the group has been built up through successive acquisitions and provides high-performance solutions to the semiconductor, aerospace, medical and industrial equipment sectors. The group employs 2,500 people working across more than 30 sites worldwide. Its businesses include Singapore Aerospace Manufacturing (SAM), Sitec Aerospace, esmo, Mechatronic SystemTechnik, ZASCHE handling, flextos and WAAM3D. The acquisition of RECIF Technologies marks a new stage in Accuron Technologies’ international growth within the semiconductor industry ecosystem.

Yotta Capital Partners is an independent private equity fund focused on investing in French industrial SME, supporting carbon-efficient developments and innovations of SME. Sofiouest is a French investment company with a diversified portfolio, investing from innovation and development capital to sustainable real estate.

Oaklins’ team in France advised the shareholders of RECIF Technologies, Yotta Capital Partners, Sofiouest and the management team, in the strategic sale of the company. After a selective process implying major strategic buyers, Accuron Technologies Limited was selected as the new industrial partner and owner of the company.

Sprechen Sie mit dem Deal-Team

Raphaël Petit

Oaklins France

Relevante Transaktionen

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Weitere InformationenBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Weitere InformationenCenterbridge Partners has announced a minority interest investment in Pure Cremation

Centerbridge Partners, L.P. has announced a structured minority interest investment in Pure Cremation. The investment includes both loan and equity instruments and is subject to regulatory approval, with completion expected in the first half of 2026.

Weitere Informationen