Centro Diagnóstico Boris Berenstein has been acquired by DASA

The Berenstein family has sold Centro Diagnóstico Boris Berenstein (CDBB) to Diagnósticos da America S.A. (DASA).

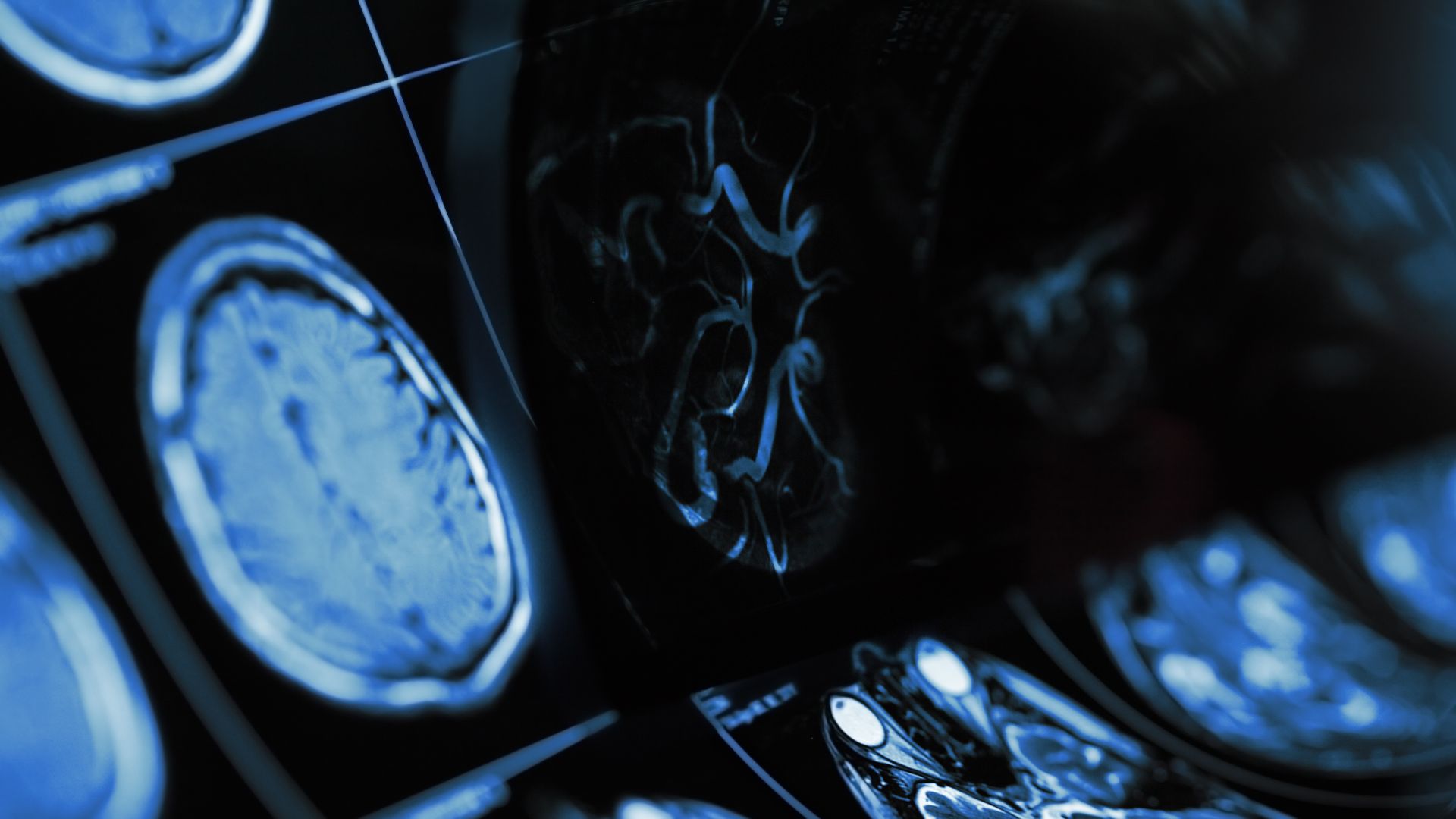

CDBB is among the most respected and well-known diagnostic imaging services in the Brazilian northeast region, focusing on MRIs, TC scans and ultrasound exams. It has six patient service centers, distributed in four different cities in the Recife metropolitan region.

DASA is one of the leading healthcare companies in Brazil, operating the biggest diagnostics business in LatAm with a nation-wide network of high-complexity hospitals, clinics, oncology centers and other healthcare management services. DASA serves more than 20 million patients every year and has around 40,000 employees and 250,000 hired physicians.

One of Oaklins’ teams in Brazil acted as the exclusive financial advisor to the seller and the management of CDBB in the preparation of the sale process and due diligence, the approach and parallel negotiations with potential buyers, and assisted them until closing.

Boris Berenstein

Former Owner and President, Centro Diagnóstico Boris Berenstein

Talk to the deal team

Denis Morante

Oaklins Fortezza Partners

Related deals

Rare Patient Voice has been acquired by Konovo

Rare Patient Voice has been acquired by Konovo, a technology-first healthcare intelligence company backed by Fraser Healthcare Partners.

Learn moreLindenhofgruppe has sold its majority stake in LabPoint to Affidea Switzerland

LabPoint Medical Laboratories AG has been acquired by Affidea Switzerland AG. Through the transaction, Lindenhofgruppe AG gains a strong strategic partner to support the further development of LabPoint and will remain a shareholder with a reduced stake, continuing as a key customer of the company. It lays the foundation for LabPoint’s sustainable development under a new anchor shareholder, with the aim of further strengthening and selectively expanding its position in laboratory diagnostics.

Learn moreClinical Partners has raised new debt facilities

Clinical Partners Ltd. has successfully restructured and upsized its debt facilities to better reflect the scale of the business. The company increased its original US$9.4 million facility, comprising a US$3.4 million term loan and a US$6 million revolving credit facility (RCF), to a US$27 million RCF.

Learn more