Cad Railway Industries Ltd. has acquired Caltrax Inc.

Cad Railway Industries Ltd., the largest rolling-stock repair and remanufacturing facility in Canada, has acquired Caltrax Inc., a full service independent railcar repair service facility. The transaction’s terms have not been disclosed.

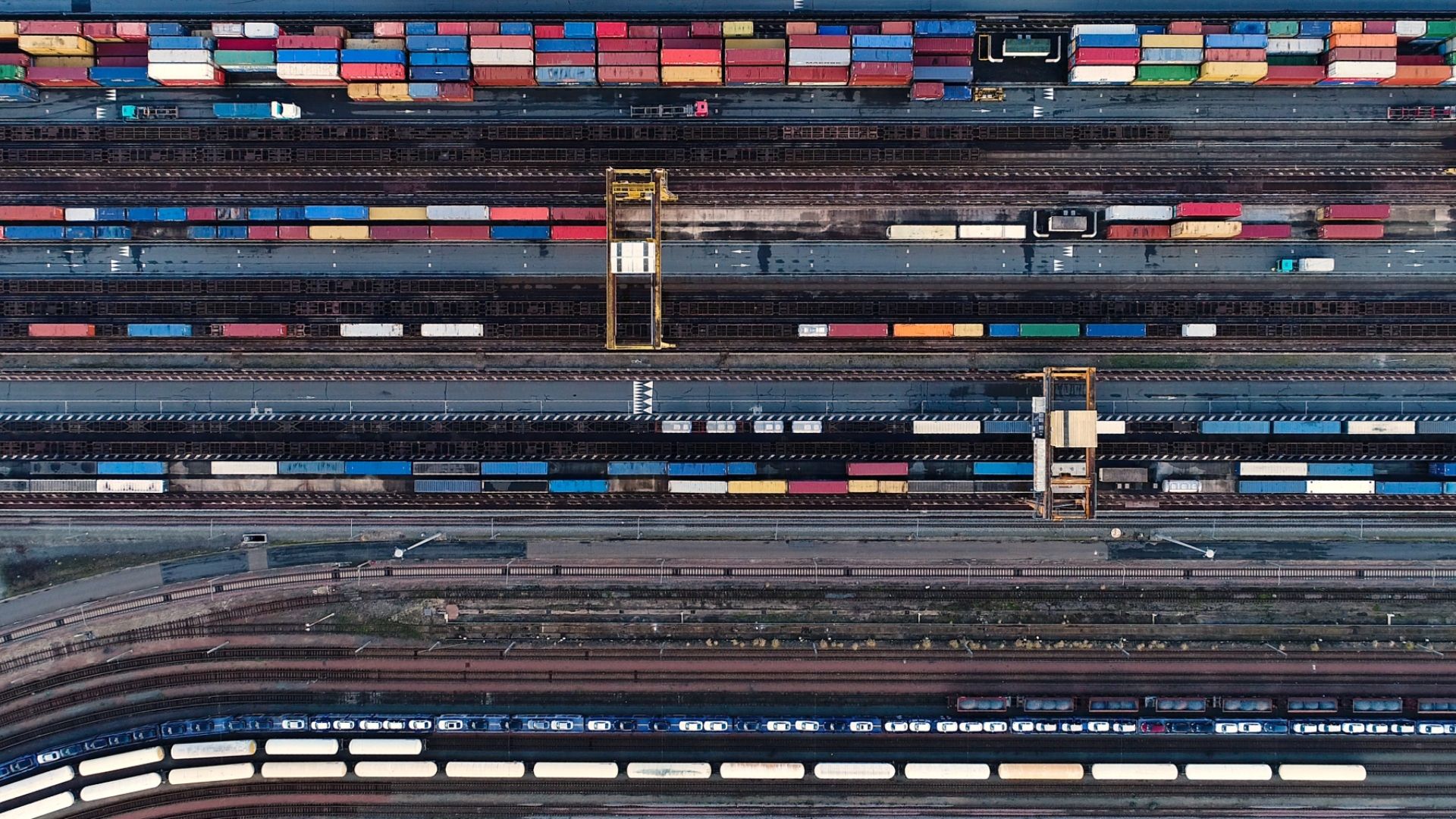

Cad Railway Industries, founded 45 years ago in Lachine, Quebec, is a manufacturing company servicing the rail, marine, mining, and power generation industries. The company offers its main customers in these industries integrated remanufacturing, repair, refurbishment and upgrading services for locomotives, freight cars, passenger diesel engines and components.

Caltrax is a privately owned railcar servicing company located in Calgary, Alberta. Since 1990, the company has serviced the needs of the rail transportation sector and today is the only independent full service railcar service shop in western Canada. Caltrax provides a premium service with an emphasis on quality workmanship with expedited service turnaround time. Caltrax is active in all areas of tank and freight car repair, including painting, interior lining and cleaning. The company is ideally situated with immediate access to the Canadian Pacific Railway (CP Rail) yard to the south and west, and a Canadian National Railway (CN Rail) line to the east.

Vada Capital is an independent, family-backed private equity firm that partners with passionate management teams to achieve growth. Vada’s investments are industry agnostic, with a preference for majority ownership.

Oaklins' team in Montreal advised the buyer in this transaction.

Talk to the deal team

Related deals

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreThrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Learn morePerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Learn more