Supporting the development of a growth by acquisition strategy in equipment rental

The management team of Stephenson’s Rental Services has received strategic advisory related to the development of its growth by acquisition strategy, with a focus on the province of Quebec.

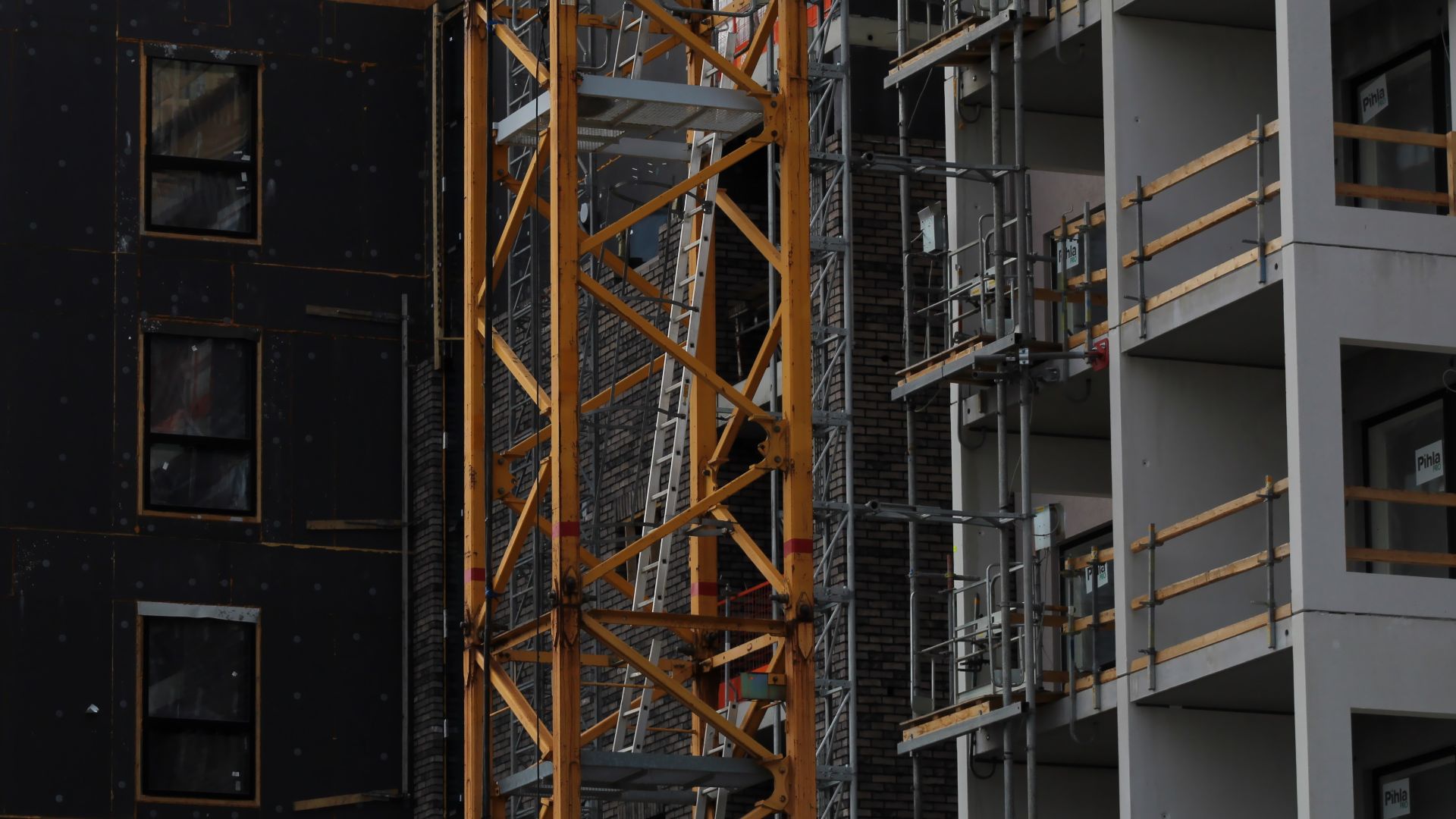

Stephenson’s Rental Services is one of the largest independent equipment rental companies in Canada, with 45 branches in Ontario and Alberta. It offers rental services for general tools and equipment, including general tools, light and heavy construction equipment, heating and scaffolding tools. The company also sells various consumables and new equipment, such as saw blades, drill bits and sandpaper, as well as used rental equipment. In addition, it provides complementary services, including equipment delivery, repair, damage waiver protection and the assembly and dismantling of scaffolding systems. Stephenson’s Rental Services serves commercial traders, home and condominium builders, general contractors, do-it-yourself clients, and institutional and industrial customers. The company is headquartered in Mississauga, Canada.

Oaklins’ team in Canada supported the management team of Stephenson’s Rental Services in this transaction.

Karim Nensi

CFO, Stephenson’s Rental Services

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreGuard has strengthened its Danish platform with the acquisition of Holtec

Guard Automation AS, a leading Nordic provider of automation services, insight and process optimization, has acquired Holtec AS, a Danish engineering and automation company. The acquisition strengthens Guard’s presence in Denmark and supports its strategy of combining strong local expertise with digital platforms. Together with X Automation, Holtec will form a strong Danish automation platform, enabling knowledge sharing, best-practice transfer and enhanced capabilities across the Nordics.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more