Supporting the development of a growth by acquisition strategy in equipment rental

The management team of Stephenson’s Rental Services has received strategic advisory related to the development of its growth by acquisition strategy, with a focus on the province of Quebec.

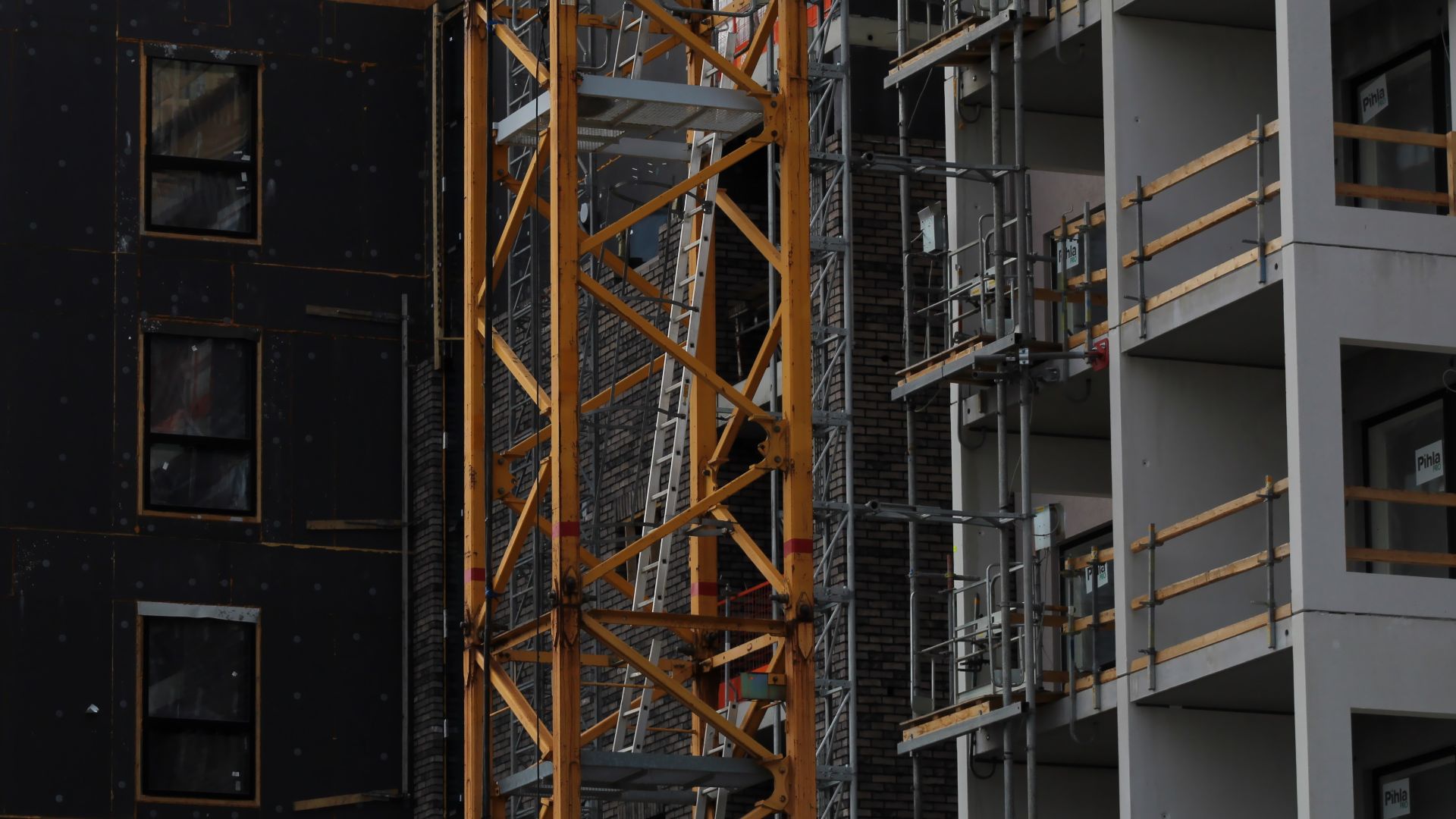

Stephenson’s Rental Services is one of the largest independent equipment rental companies in Canada, with 45 branches in Ontario and Alberta. It offers rental services for general tools and equipment, including general tools, light and heavy construction equipment, heating and scaffolding tools. The company also sells various consumables and new equipment, such as saw blades, drill bits and sandpaper, as well as used rental equipment. In addition, it provides complementary services, including equipment delivery, repair, damage waiver protection and the assembly and dismantling of scaffolding systems. Stephenson’s Rental Services serves commercial traders, home and condominium builders, general contractors, do-it-yourself clients, and institutional and industrial customers. The company is headquartered in Mississauga, Canada.

Oaklins’ team in Canada supported the management team of Stephenson’s Rental Services in this transaction.

Karim Nensi

CFO, Stephenson’s Rental Services

Talk to the deal team

Related deals

Dania Software has been acquired by Omnidocs

The owners of Dania Software A/S have sold the company to Omnidocs.

Learn moreTop Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more