Capricorn Holding has been acquired by Forster Gruppe and Genossenschaft Migros Aare

The owners of Capricorn Holding AG have sold the company to Forster Gruppe AG and Genossenschaft Migros Aare, optimal buyers that will guarantee the continuation of the business in the future. The three parties have agreed not to disclose any financial information about the transaction.

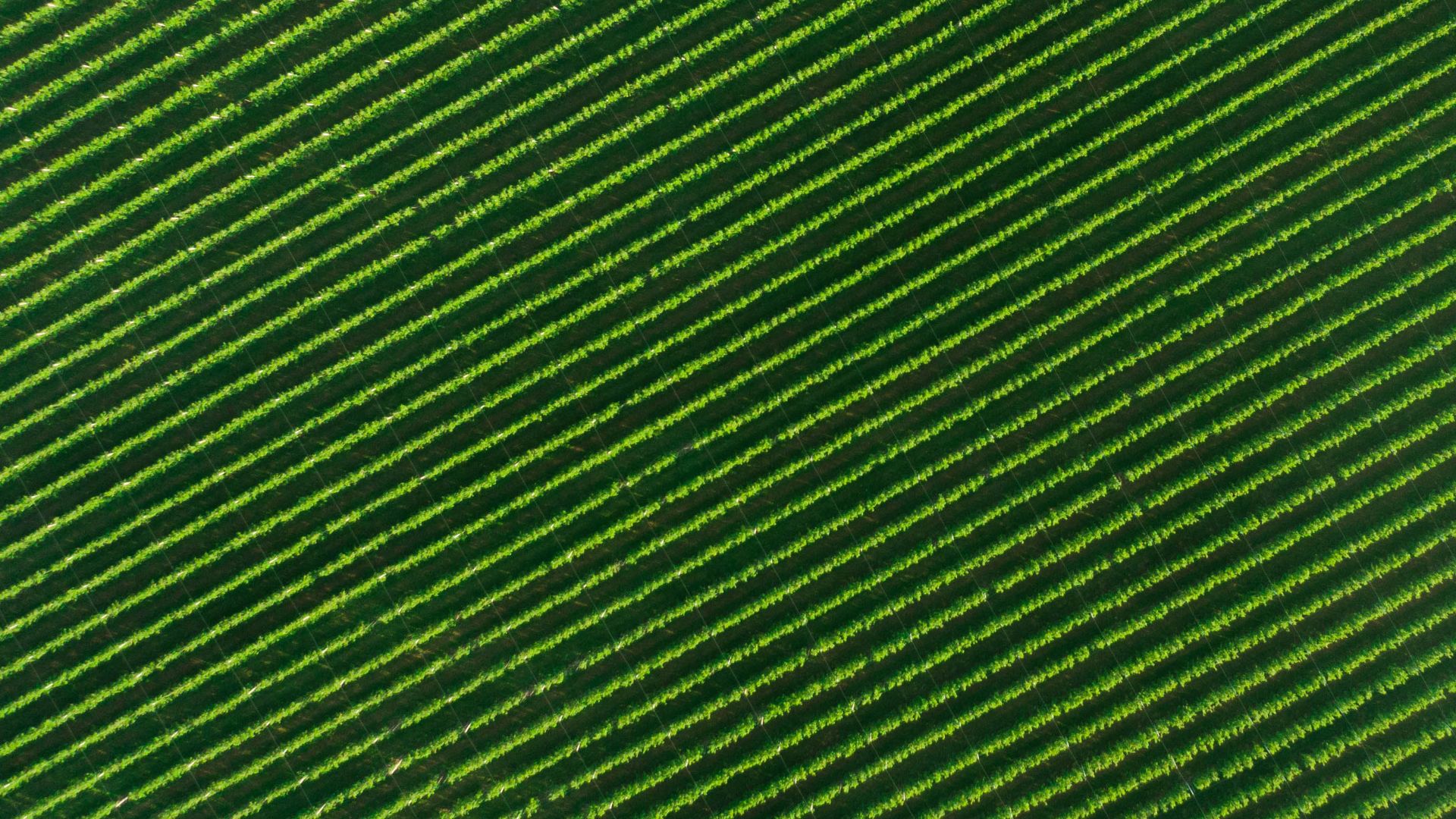

Capricorn Holding, which includes GEISER agro.com ag, active in the table fruit (apples and pears) sector, as well as stakes in Terralog ag, is one of the largest independent table fruit and potato logistics companies in Switzerland. The company supplies the Swiss retail and HORECA market and employs around 170 people.

The history of Forster Gruppe AG goes back to 1965 and started as a logistics and import business of fruits and vegetables, which were sold to HORECA customers. After Patrick Forster joined the company in 2007, in addition to the further expansion of the core business, two production companies of fresh vegetables were added to the group. The companies belonging to Forster Gruppe employ approximately 150 people.

Genossenschaft Migros Aare is part of the largest Swiss food retailer Migros cooperative and generates annual sales of US$3.8 billion. The company, with around 12,000 employees, includes 126 supermarkets, 28 shopping centers, 63 specialty stores and 68 food outlets in the cantons of Berne, Solothurn and Aargau.

Oaklins’ team in Switzerland supported the owners of Capricorn Holding AG during the entire sale process as exclusive M&A advisors. This included the preparation of the sale documents, the identification and approach of potential buyers, the supervision of the buy-side due diligence, as well as negotiations with several parties and support up to the signing and closing of the transaction.

Peter Bracher

Shareholder, Capricorn Holding AG and former CEO of GEISER agro.com ag

Contacter l'équipe de la transaction

Christoph Walker

Oaklins Switzerland

Transactions connexes

DP&S has become part of Verstegen Spice Group

Dutch Protein & Services (DP&S) has become part of the Verstegen Spice Group and will be positioned as an independent operating company within the group, the family-owned business of Michel Driessen, which also includes Verstegen Spices & Sauces. Through the transfer of shares from Chris Driessen to his brother Michel Driessen, the family businesses are reunited, creating a solid foundation for the next phase of growth.

En apprendre plusValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

En apprendre plusOutsource Management Services has been acquired by IMI Supply Chain Solutions

UK logistics software provider Outsource Management Services (OMS) has been acquired by IMI Supply Chain Solutions, a Sweden-based provider of supply chain management software solutions.

En apprendre plus