Hydraulex has been acquired by BBB Industries

The private shareholders of Hydraulex have sold the company to BBB Industries, a portfolio company of Clearlake Capital Group.

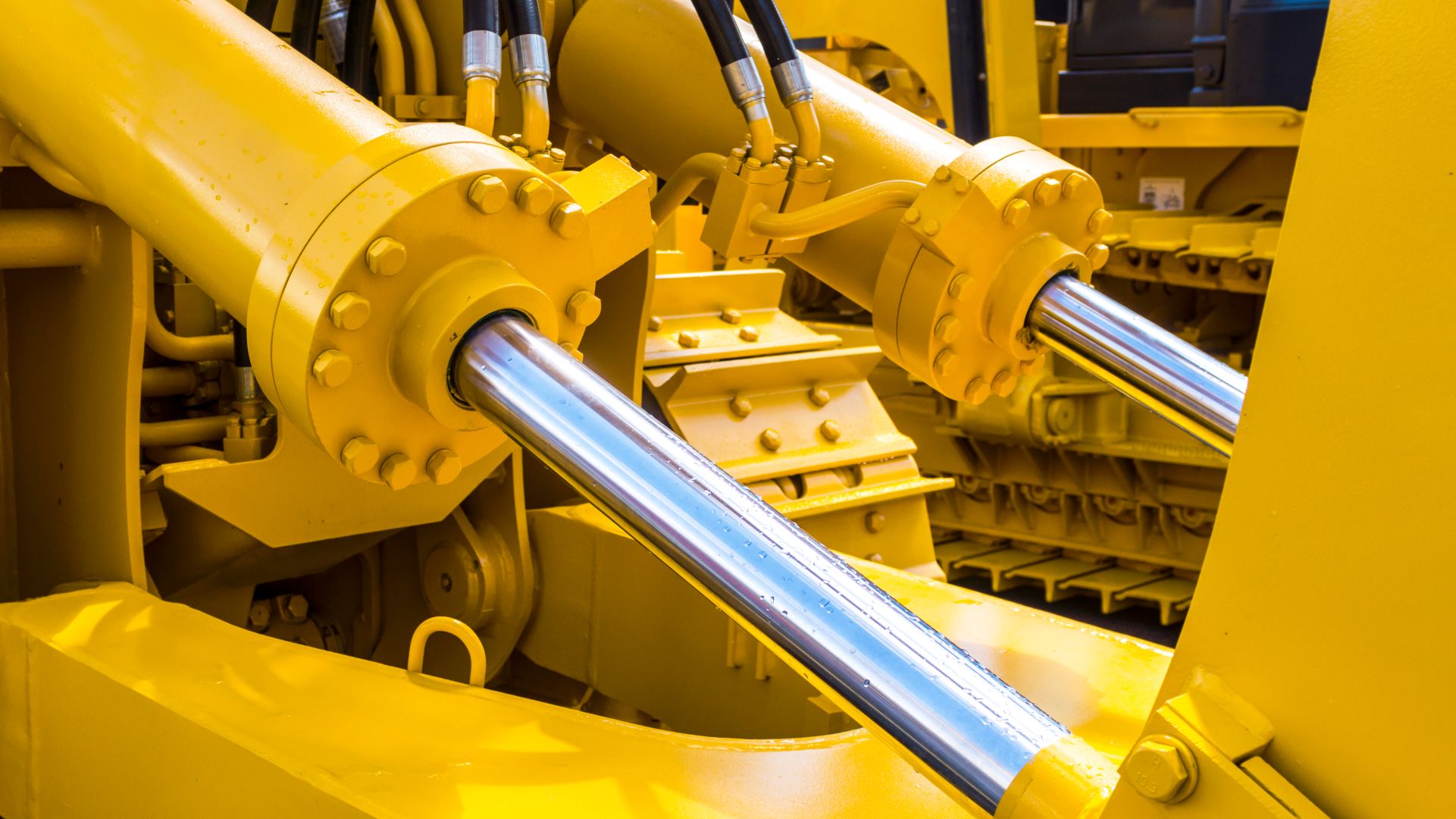

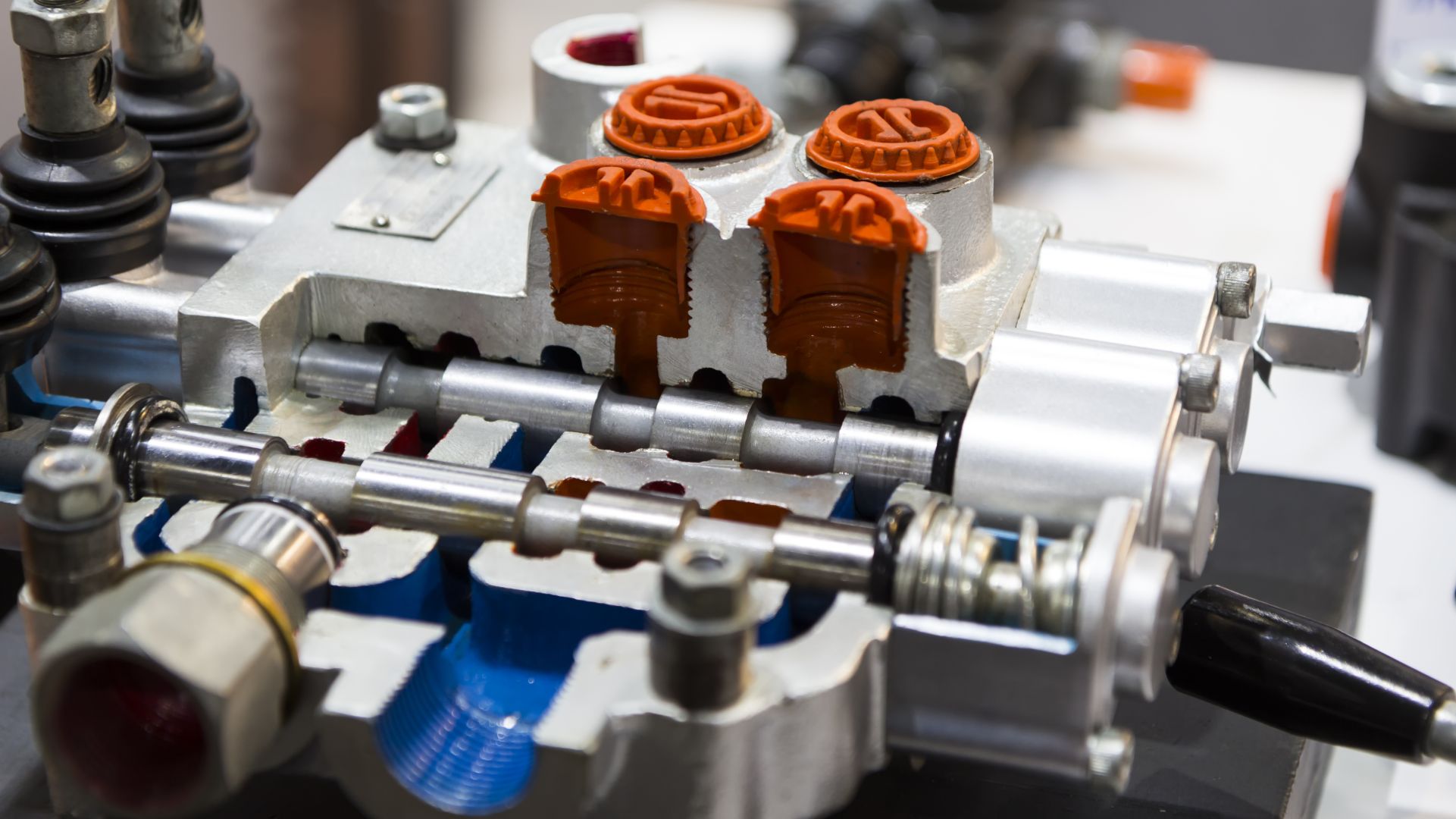

Hydraulex is a one-stop-shop provider of mission-critical aftermarket remanufactured, repair and new replacement hydraulic solutions. Headquartered in Chesterfield, Michigan, with additional facilities in Memphis and the greater Seattle area, Hydraulex provides need-it-now products, including pumps, motors, cylinders, valves and other parts to OEMs, distributors, repair shops and end users.

Founded in 1987, BBB Industries is a leading sustainable manufacturer of aftermarket parts for the automotive, industrial, energy storage and solar markets. BBB conducts business in over 90 countries, with facilities located throughout North America and Europe. Headquartered in Santa Monica, California, Clearlake Capital Group is a private equity firm with over US$70 billion of assets under management.

Oaklins TM Capital in the US served as the exclusive financial advisor to Hydraulex in this transaction.

Brian Tinney

CEO, Hydraulex

Contacter l'équipe de la transaction

Paul R. Smolevitz

Oaklins TM Capital

Matt Rosenthal

Oaklins TM Capital

Transactions connexes

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

En apprendre plusSuccesful integrated solution for strategic deadlock and tender offer by CMB on Euronav

Compagnie Maritime Belge (CMB) has successfully resolved the strategic and structural deadlock within Euronav through an agreement with Frontline, a world leader in the international seaborne transportation of crude oil and refined products, resulting in a mandatory takeover offer on Euronav.

En apprendre plusIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

En apprendre plus