American Casting Company has been acquired by Arcline Investment Management

Arcline Investment Management has completed a strategic investment in American Casting Company (ACC), a leading provider of highly engineered investment castings for aerospace, defense, medical and specialty industrial applications.

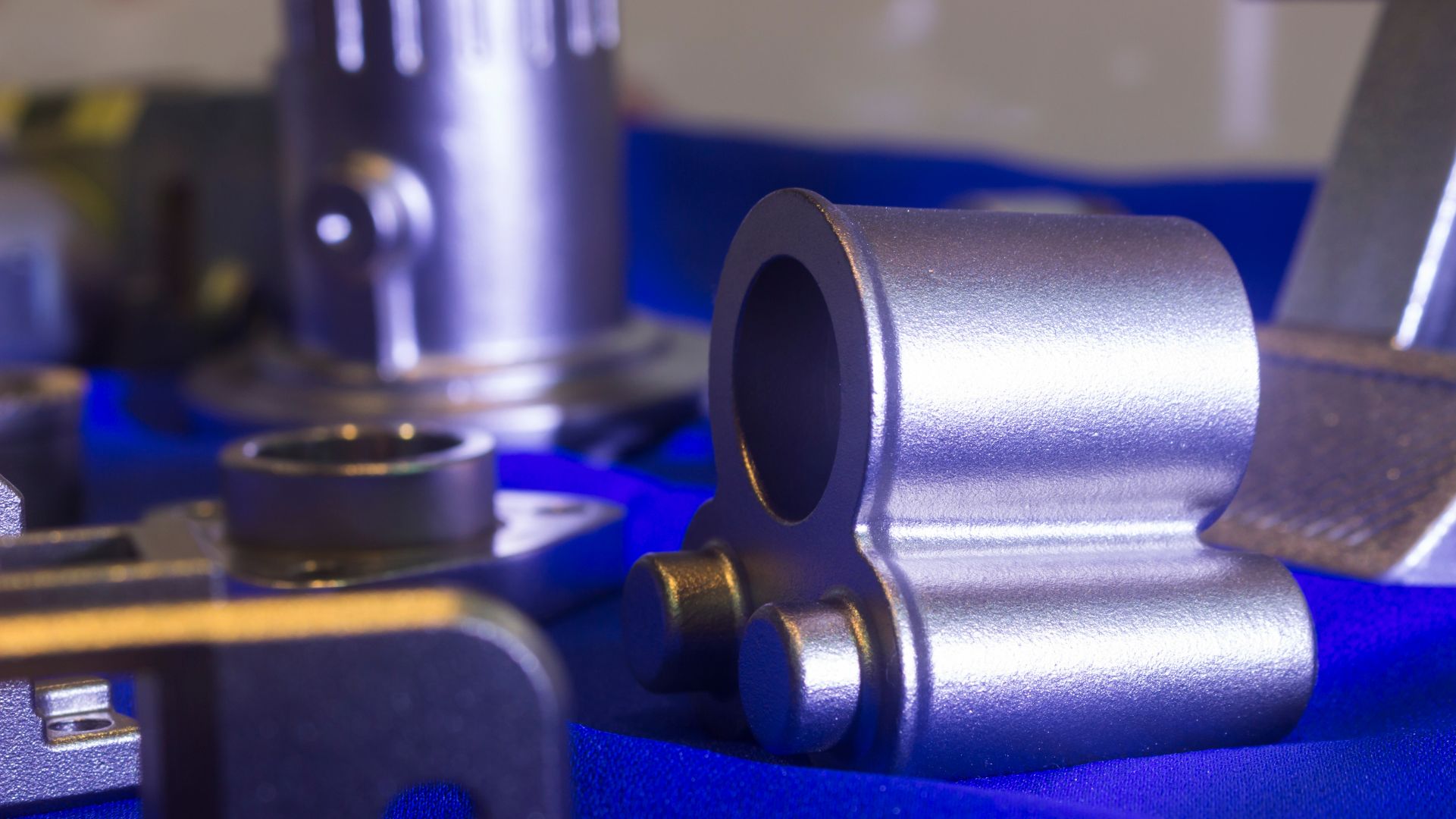

Founded in 1974, American Casting Company specializes in casting complex, tight-tolerance geometries from superalloys and other difficult-to-pour materials. Its capabilities enable customers to achieve lighter-weight designs, higher operating temperatures and improved performance. With rapid prototyping expertise and end-to-end process control, the company is a trusted supplier of demanding aerospace and defense programs, including marquee aircraft engines and next-generation unmanned systems.

Arcline Investment Management is a growth-oriented private equity firm with over US$20 billion in assets under management. The firm invests in businesses with persistent demand, limited disruption risk and fragmented industry structures.

Oaklins Janes Capital, based in Irvine, USA, served as the exclusive financial advisor to American Casting Company on its sale to Arcline Investment Management.

Christopher St. John

CEO, American Casting Company

Contacter l'équipe de la transaction

Stephen Perry

Oaklins Janes Capital

Transactions connexes

Lauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

En apprendre plusOSL has been acquired by Terma

OSL Group Limited, a leader in counter-drone security and safety systems, has been acquired by Terma AS, a Denmark-based global provider of mission-critical solutions for defense, aerospace and security.

En apprendre plusScanfiber Composites has been acquired by Fjord Defence Group

Scanfiber Composites AS, a leading manufacturer of advanced ballistic protection solutions, has been acquired by Fjord Defence Group. The transaction represents a strategic step in expanding Fjord Defence’s footprint in the European defense market and provides Scanfiber with a strong platform to support its continued growth.

En apprendre plus