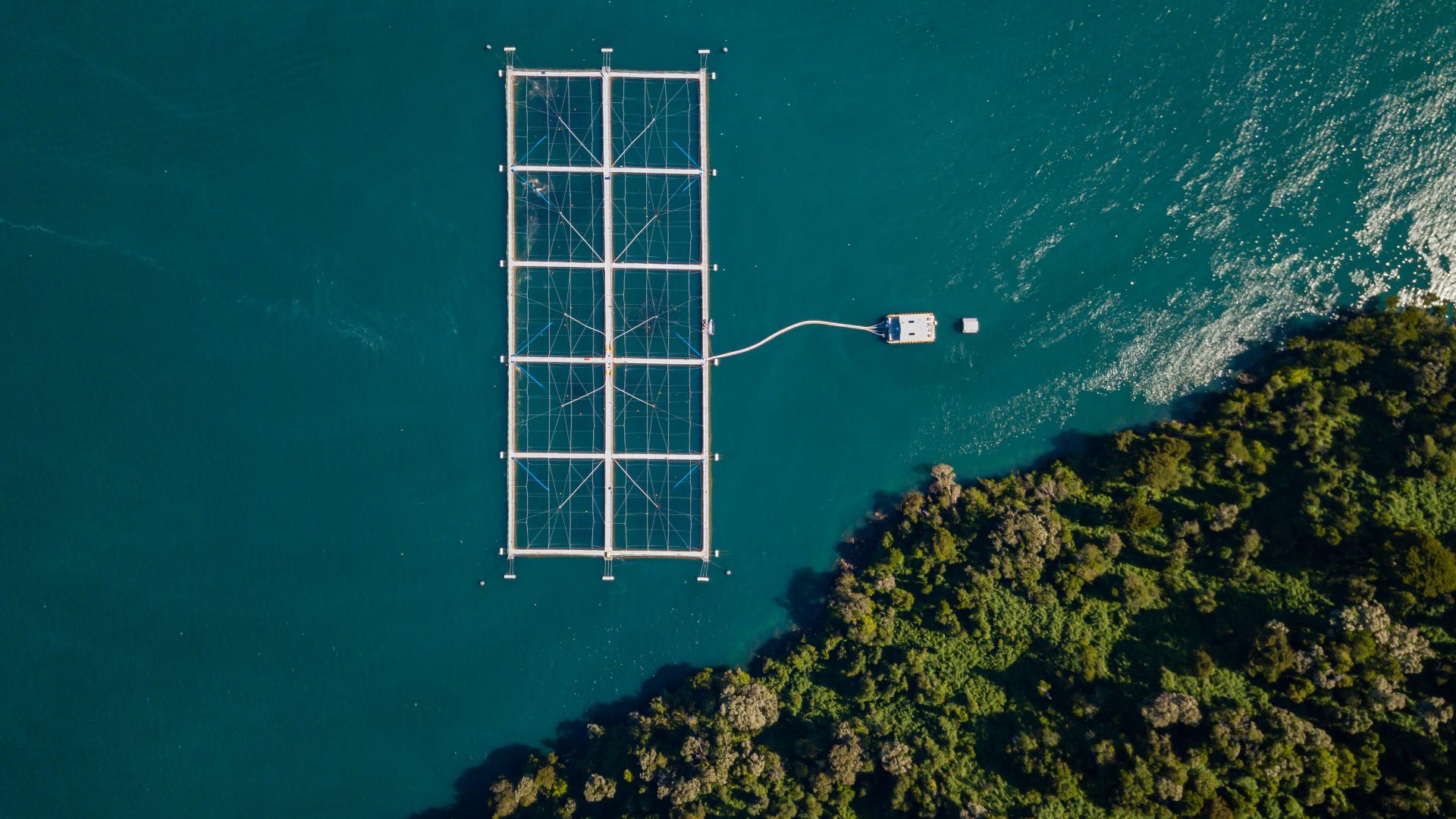

Salmon Processing Plant Cermaq Chile has been acquired by Salmones Aysén

Cermaq Chile S.A. has sold its salmon secondary processing plant in the south of Chile, Salmon Processing Plant Cermaq Chile, to Salmones Aysén.

Cermaq Chile S.A., a subsidiary of Mitsubishi Corporation, operates as a salmon farming company in Chile, Norway and Canada, with more than 25 years of experience in the industry. Due to the various regulatory changes adopted in recent years within the aquaculture industry in Chile, Cermaq began an internal restructuring process in which they decided to close and sell two of their processing plants in the X Region in Chile.

Salmones Aysén is one of the top 10 salmon farming companies in Chile, specialized in Pacific Salmon (Coho), with operations in the south of Chile.

Oaklins’ team in Chile acted as financial advisor in the sale process of both processing plants. The primary processing plant was sold in 2020, and the Processing Plant Cermaq Chile (secondary processing) in 2022.

Contáctese con el equipo de la transacción

Transacciones relacionadas

DP&S has become part of Verstegen Spice Group

Dutch Protein & Services (DP&S) has become part of the Verstegen Spice Group and will be positioned as an independent operating company within the group, the family-owned business of Michel Driessen, which also includes Verstegen Spices & Sauces. Through the transfer of shares from Chris Driessen to his brother Michel Driessen, the family businesses are reunited, creating a solid foundation for the next phase of growth.

Aprenda másValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Aprenda másTecnosafra has been acquired by Tranorte

Tecnosafra Sistemas Mecanizados Ltda. has been acquired by Tranorte reinforcing their commitment to delivering agricultural equipment and high-quality service to producers across their regions. The integration expands geographic coverage, strengthens after-sales capabilities and enhances access to agriculture technologies, parts availability and field support teams.

Aprenda más