BeDimensional S.p.A. has completed a fundraising

BeDimensional S.p.A. has completed a second US$10 million Series B investment round led by CDP Venture Capital through the Evoluzione fund and subscribed by Novacapital and Eni Next.

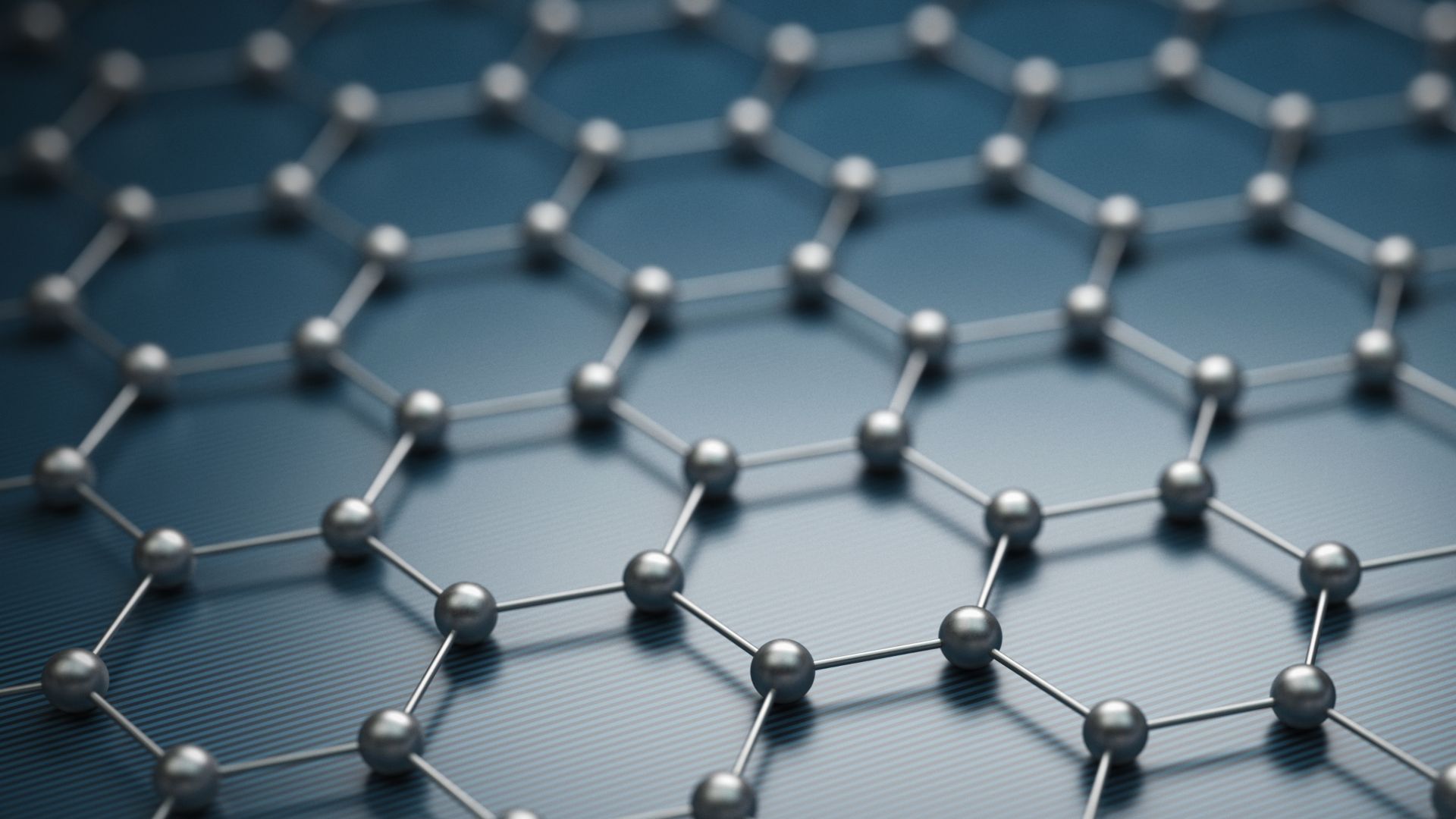

Founded in 2016 by two top Italian scientists, BeDimensional is a startup that operates in the chemical sector, producing innovative graphene (FLG) and two-dimensional materials composed of a number of atomic layers, between one and ten, with top performance and reliability. The process by which two-dimensional materials are obtained is the proprietary know-how of the company, which positions it in the top 10 companies worldwide active in the graphene industry in terms of patents per company. Currently, the two-dimensional materials are applied in three areas: lubricants, based on graphene and hexagonal boron nitride; energy, with a focus on Li-ion battery; and multi-functional coatings, with graphene-based electrically conductive adhesives and thermally conducting paints. BeDimensional is expected to generate a turnover of US$3 million in 2022 and US$35 million in 2025.

Oaklins Italy’s parent company Banca Akros acted as financial advisor to BeDimensional S.p.A.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more