Daun & Cie. AG has sold TWD Group to 4K Invest AG

The shareholders of TWD Group, based in Germany, have sold the company to the Luxembourg investment fund 4K Invest AG. Financial details of this transaction have not been disclosed.

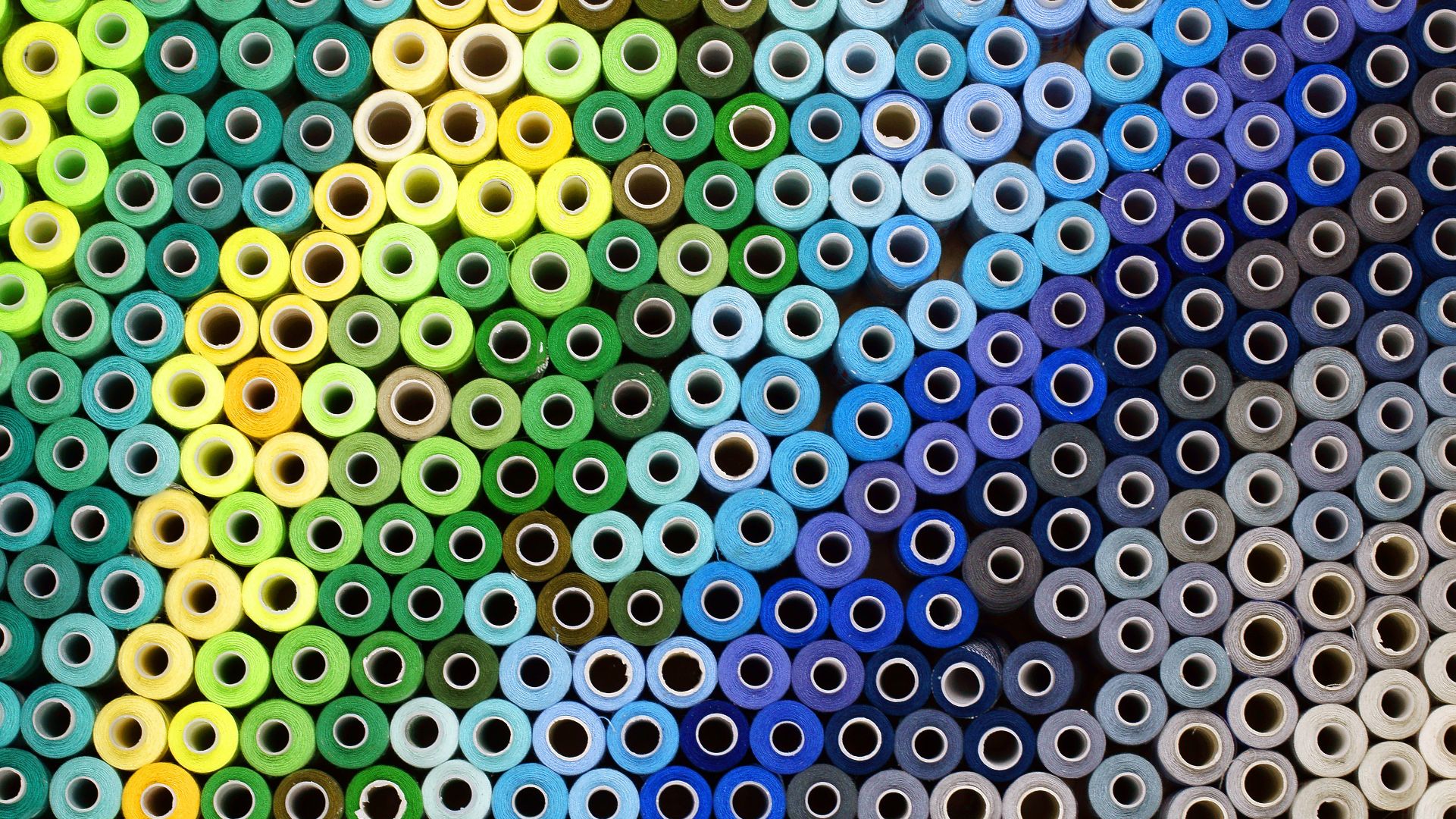

TWD Group is a leading German manufacturer of high-quality specialty yarns for use in the automotive, apparel and home textile industry. With its highly specialized products and the close relationship with its customers, the globally acting company is well positioned to respond with flexibility to changing customer demands. In 2005, TWD Group was acquired by Daun & Cie. AG, a private holding company with an industry focus in the textile sector Since then, the company's custom-tailored products, have increased from 5% to over 50%.

4K Invest AG is a Luxembourg investment fund that invests in medium-sized European companies in order to achieve sustainable results.

Oaklins' team in Germany exclusively advised the shareholders of TWD Group in this transaction. In a structured international sale process, the Luxembourg investment fund 4K Invest was selected over 100 companies and the transaction was successfully closed.

Sprechen Sie mit dem Deal-Team

Transaktionen

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Mehr erfahrenUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Mehr erfahrenÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Mehr erfahren