Renita Medical har samlat in riskkapital.

Renita Medical Oy, ett hälsoteknikföretag, har fått riskkapital som ger dem resurser för att slutföra utvecklingen och lansera produkten kommersiellt.

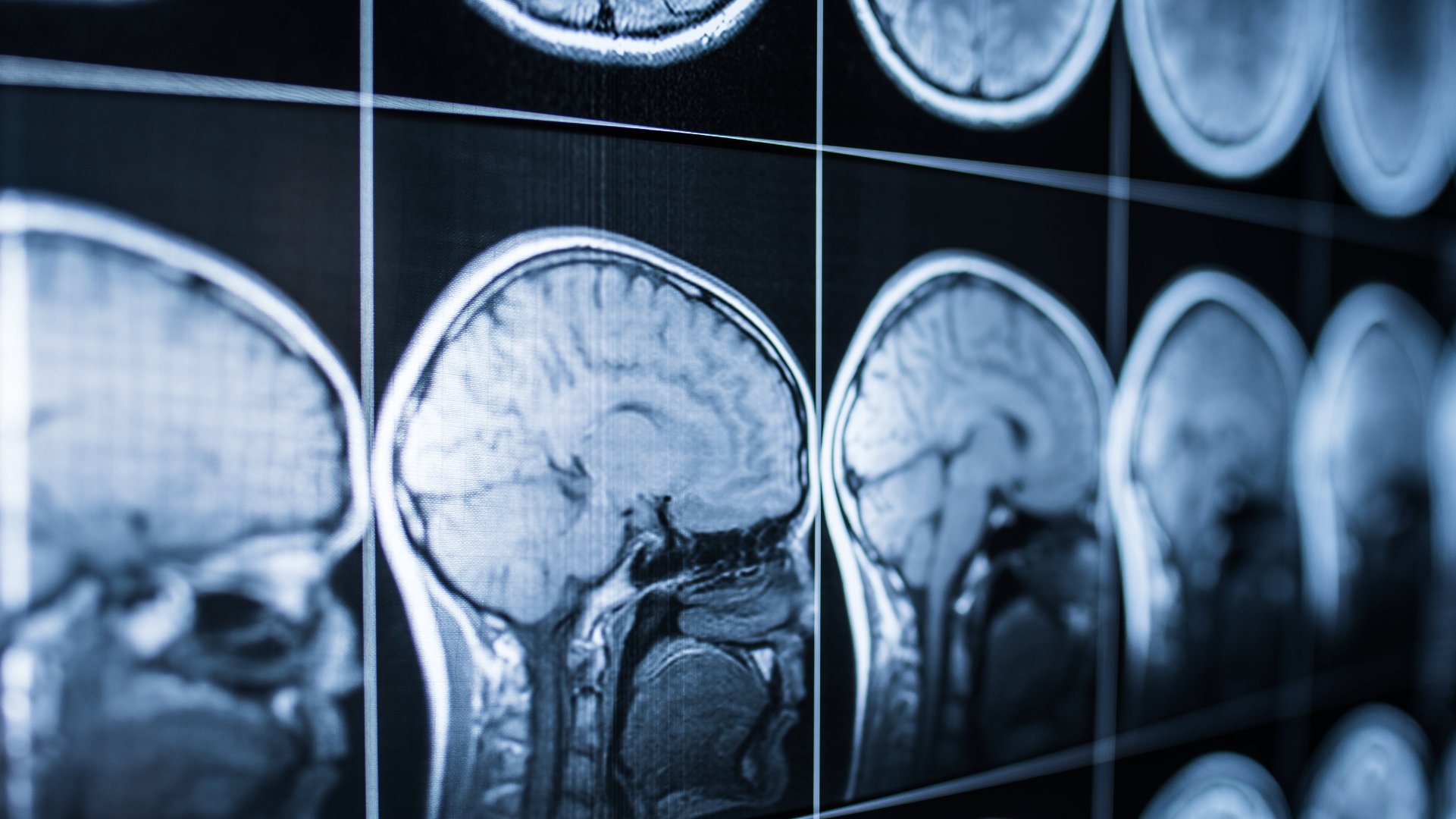

Renita Medical bygger en personlig hjärnhälsolösning. Företagets AI-baserade programvara, RENITA-plattformen, använder patientens egen funktionella hjärnaktivitet och kombinerar den med beprövade kognitiva bedömningsverktyg för att ge en omfattande och objektiv rapport som läkare kan basera sin neurologiska diagnos på. Plattformen kommer att förbättra den neurologiska diagnosprocessen och erbjuda ett effektivt sätt att övervaka hjärnhälsa.

Oaklins team i Finland agerade som finansiell rådgivare för rundan.

Prata med transaktionsteamet

Relaterade affärer

Middlecon has been acquired by Nion

Middlecon has been acquired by Nion, a digital consultancy backed by Stella Capital. The acquisition strengthens Nion’s capabilities in data management and advanced analytics, enabling it to undertake larger and more complex data-driven initiatives for its customers. The partnership with Nion provides Middlecon with a strong foundation for continued growth and expansion.

Lär dig merPresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Lär dig merBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Lär dig mer