East Metal has been acquired by management and private investors

The Latvia-based metalworking company East Metal has been acquired from its former Danish owner, East Metal Holding, through a management buy-out (MBO) by a group of private investors, the current owners of Valpro, in partnership with the local management team. Financing for the transaction was provided by Signet Bank.

The investors completed the transaction through DD Holding, an acquisition vehicle majority-owned by Valpro. Based in Valmiera, Valpro is one of the largest metal processing companies in the Baltics, specializing in the production of metal fuel cans, fire extinguisher cylinders and systems, and providing periodic inspections of gas cylinders.

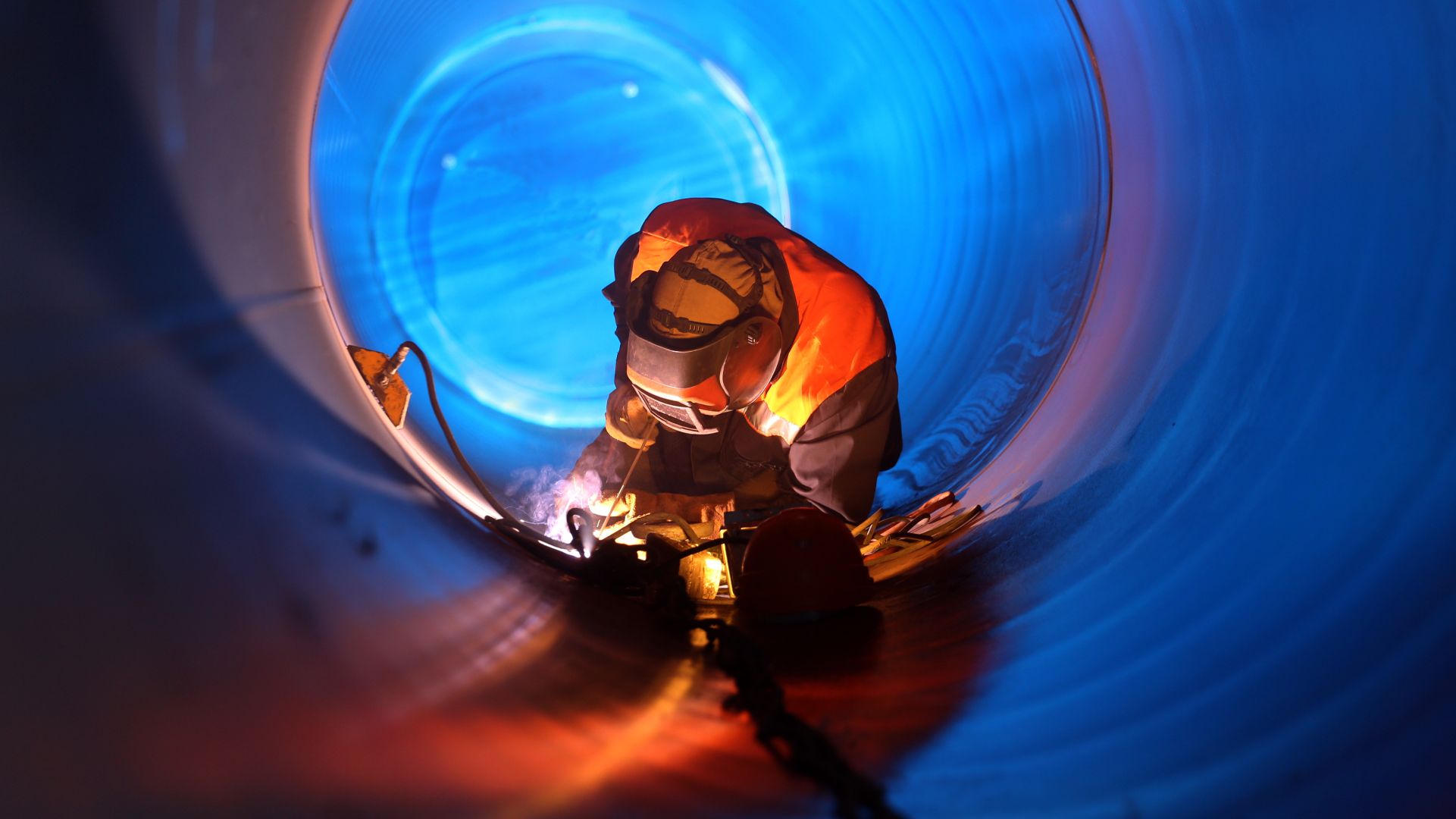

East Metal is a key player in the metalworking industry, with production facilities in Dobele and Daugavpils and more than 300 employees. Following the transaction, the company will focus on manufacturing high value-added products for both local and export markets, with a strategic emphasis on the renewable energy, transport and logistics and defense sectors.

“This transaction confirms our conviction that manufacturing companies in the metalworking sector of Latvia, especially their exportability and competitiveness, play a significant role in the economic growth of the country, as well as in strengthening the position of Latvia in the global market. We value and trust the professional team at East Metal, which has proven its ability to manufacture high-quality products and solutions for internationally renowned partners. Our aim is to help the company regain momentum and strengthen its position in the industry,” said Aivars Flemings, chairman of the board at Valpro.

Oaklins’ team in Latvia acted as the exclusive financial advisor to the incoming investors and the management team of East Metal in this transaction.

Prata med transaktionsteamet

Relaterade affärer

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Lär dig merLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Lär dig merQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Lär dig mer