Astorg has had a PPA conducted for the acquisition of AutoForm

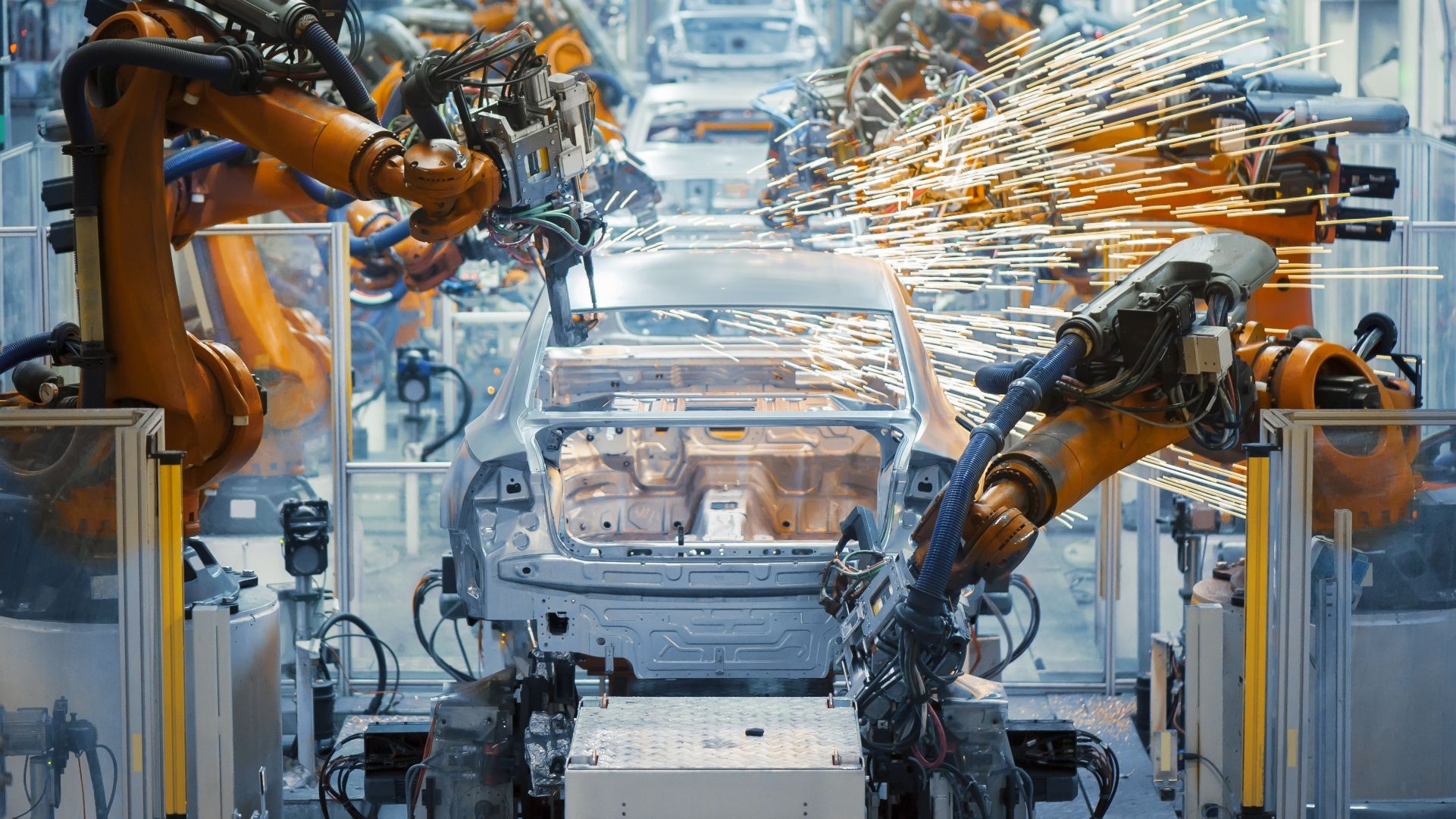

On 22 July 2016, the French private equity firm Astorg acquired AutoForm, the global market leader in engineering software for sheet metal forming processes in the automotive industry, for an undisclosed consideration. Subsequent to the transaction, a purchase price allocation (PPA) was conducted for accounting purposes.

Astorg is an independent private equity group with over US$5 billion of assets under management. The firm has offices in London, Paris and Luxembourg. Astorg acquires European companies with a global presence and sales. The company employs 360 people in 15 countries around the world.

AutoForm was founded in 1995 as a spin-off from the Swiss Federal Institute of Technology. It offers software solutions for the die-making and sheet metal forming industries along the entire process chain. Producing tremendous improvements in quality, time and cost, AutoForm is an acknowledged industry standard at virtually every automotive OEM and at leading suppliers of tooling, stamping and materials worldwide.

Oaklins' team in Switzerland advised Astorg and AutoForm during the post transaction phase and produced a PPA report in accordance with IFRS 3. The report contained the allocation of the consideration paid to all identifiable assets acquired and liabilities assumed.

Anton Haas

CFO, AutoForm

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreSTAC has been acquired by n2 Group

Strategic Technology Analysis Center (STAC), a world leader in financial-technology benchmarking and events, has been acquired by n2 Group, the UK specialists in advanced computation and IT infrastructure.

STAC joins NAG and VSNi in the growing community of n2 Group companies dedicated to advancing computation through collective innovation, technical excellence and long-term strategic growth. STAC will operate as an independent business within n2, maintaining its brand, identity and ethos.

Winking Studios Limited completes a secondary fundraising of US$20 million

Winking Studios has successfully raised US$20 million to fund its business strategy and future plans, such as strategic acquisitions, alliances and joint ventures as well as secondary or dual listings, to grow the group’s market share and broaden its customer base globally.

Learn more