Geevers Auto Parts has been acquired by Autodis Group

The founder and shareholder of Geevers Auto Parts (Geevers) has sold the company to Autodis Group.

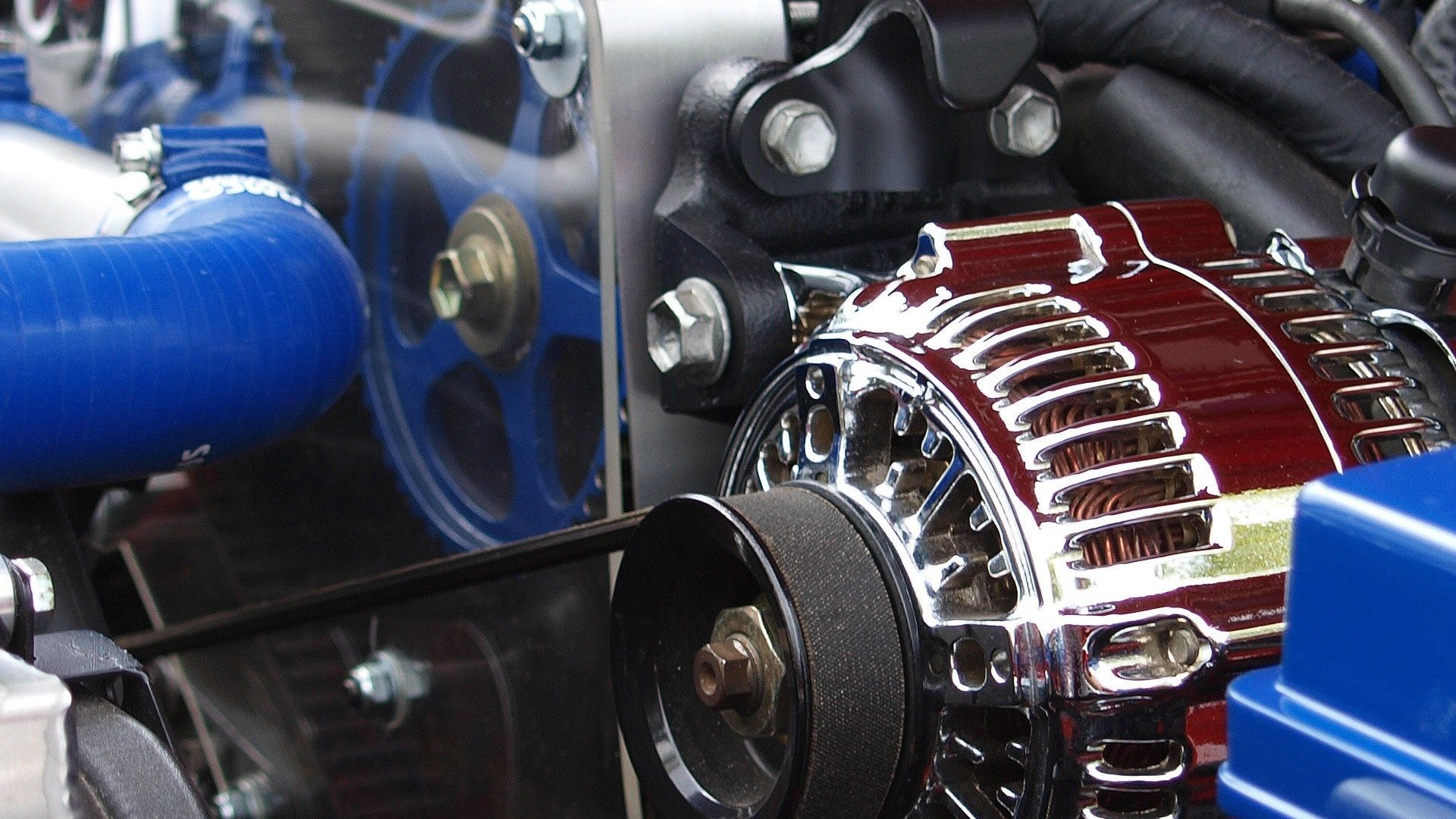

Geevers is the largest distributor of car spare parts to the Benelux collision repair market. The company offers a one-stop-shop for collision repair shops with OEM products from automotive players such as Audi, BMW and Toyota. Geevers’ philosophy has been built upon an unmatched value-added offering and best-in-class technical support services as well as in-house logistical capabilities. This strong positioning as resulted in continuous strong growth and market share increase.

Headquartered in France, Autodis Group is a European supplier of automotive spare parts for both the mechanical and collision repair markets. The company is actively following a buy-and-build strategy to grow its geographical footprint in Western Europe.

Oaklins' team in the Netherlands advised the shareholder on the sale of Geevers Auto Parts. Oaklins' team in France assisted in identifying and initiating contact with the buyer.

Talk to the deal team

Related deals

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Learn moreÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Learn moreUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Learn more