Understanding the energy transition from an M&A perspective

Get key insights from one of our leading energy experts

Partner

View profile

While the move towards renewable energies is increasingly prioritized by many governments and organizations, there are multiple factors and international trends at play that impact both the energy transition process and M&A within this sector. Oaklins has closed almost 115 deals in renewable energy in the past few years, becoming a trusted advisor for both investors and business owners around the world. Our global team of professionals provide the cross-border support and collaboration that are essential in today’s energy landscape.

Tom Snijckers is a senior M&A advisor at Oaklins Netherlands with a strong focus on the renewable energy sector. He has been involved in transactions covering battery storage, hydrogen, solar platforms, biofuels, and sustainability-focused software. His international collaborations span Europe and beyond. We talked to him about the characteristics of the current energy transition, trends in the market and the outlook for M&A.

Can you give us a brief overview of the energy transition that’s taking place at the moment, and the key areas of change?

The energy transition is a trend that is fundamentally reshaping how we generate, store and distribute energy. Around 15 years ago, it began as a push for decarbonization, but now it’s much more. We have geopolitical developments going on, such as the war in Ukraine. We have the need to protect competitive positions — high energy prices mean a less competitive position on a global scale. If the US and China have cheap energy, that’s a problem for European companies, especially for car- makers or energy-heavy production. And then there are technological development trends, for example, the rise of AI, which uses a lot of energy, and data centers in general. So what started as decarbonization has really become of strategic importance. That’s why we’re seeing massive investments into grid infrastructure, energy storage, solar, hydrogen and digitalization that is enabling smart systems. It’s not a single trend, it’s a systemic shift.

Energy needs to be on the European agenda, not just as a push for decarbonization but because it’s of strategic importance for the long-term position of the continent.TOM SNIJCKERS, PARTNER, OAKLINS NETHERLANDS

From your perspective, what are the most exciting developments in this energy transition?

I would say two things in particular. First, the shift from hardware to intelligence. Many developments have been made recently in smart energy systems — about when to use energy, when to store it, when to scale assets up and down. And second, we’re seeing a convergence between energy and other sectors — for example, mobility, real estate and agriculture, these are all industries where energy is becoming more and more important. I can give an example of deals we’ve closed. In the agricultural sector, the greenhouses need very good temperature controls. We supported the sale of a company that produces and develops coatings that can be put on greenhouses to regulate solar radiation. And in real estate, there’s a need to manage household energy to reduce consumption and increase efficiency, and now there are software systems for this. We advised on the sale of a company that maps energy usage in buildings and suggests ways to improve it.

How does Oaklins’ global footprint help when advising energy clients?

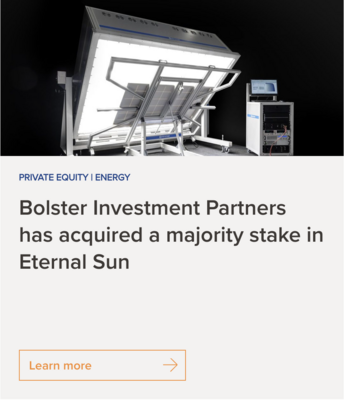

It’s essential because energy is global by nature, and our clients benefit from local intelligence in 45+ countries, whether for identifying the right buyers, navigating regulatory nuance or understanding regional value drivers. That combination is hard to replicate in siloed advisory models. To give an example, in May we were the sell-side advisors to a Dutch company that produces sunlight simulators, which is a very niche market. These sunlight simulators are used by manufacturers to measure the generation capacity of their solar panels. This company in the Netherlands operates on a global scale, they supply to manufacturers in the US, in Asia, in Europe. The technology is used across the world, so it’s important to have a global reach with a local footprint.

Which countries are particularly strong in renewables at the moment? Do you foresee other places becoming prominent in the near future?

We’ve seen quite a shift. So, for example, while Europe was for a very long time the strongest car manufacturer in the world, the shift to EV was a game-changer that allowed China to get a foothold. In general, I think this also ties back to the need for renewable energy to be on the European agenda more. In the US, they have the Inflation Reduction Act, massively accelerating US clean energy deployment through tax incentives of up to 30%. They are big in the production of solar panels, and obviously AI is a big thing in the US, so there are all these AI data centers fitted with solar power. Energy is a much more important topic there and also in China, while Europe is lagging a bit behind. Individual countries are successful in specific areas. So, the Nordics are creative and keep investing in renewables. Spain is very attractive at the moment for solar, the Netherlands has always been ahead in EV charging. Germany is doing quite well with residential solar PV plus battery storage. There are definitely positives everywhere, but at a European scale, we can do better. Notably, we are seeing increased M&A activity in the CEE region, driven by both strategic necessity and talent migration.

What are some common pitfalls that energy entrepreneurs or investors should avoid during M&A processes?

Transactions are often more complex than entrepreneurs initially estimate them to be. On the surface, they might seem very simple, but in the energy space, you’re dealing with technical dependencies, subsidy schemes, geopolitical trends, so you have to take all this into account. In addition, you’re often dealing with operating assets, pipelines, software layers and strategic partnerships — all in one deal. And regulatory regimes shift quickly. Deals in this space require the integration of technical, legal and commercial due diligence at a deeper level than most sectors. Another mistake is viewing M&A as a binary exit event. The most successful founders treat it as a strategic step in a broader journey.

What would you say are key success factors in closing deals in this sector?

Preparation is very important, so you can deal with all those complexities and anticipate investor concerns, to be ready well before going to the market. Storytelling is crucial. You need to know what investors are looking for and you need to strategically position the company so it creates the most attractive deal. And communicate not just the numbers but the mission — explain it properly so everyone understands the dynamics at play. Stamina is also essential because timelines often stretch.

Are there any patterns you’ve observed around valuation trends or investor appetite?

In general, recurring revenue, scalability and infrastructure are all important. Today we’re seeing interest in energy software, tech and infrastructure, which literally includes the grid. The grid will become congested because a lot more power needs to go over it, so a lot of money is needed to reinforce it and make it ready for the next 10, 20, 30 years, and that’s definitely a market that investors are very interested in. Battery storage, where you can take energy off the grid and supply it back, trade it, which is related again to software and tech, is also popular. What we’re seeing is the battery sector is following a similar curve to solar panels. If you go back 10 years, solar panels could generate maybe 200 W per hour and now it’s 400+. You see a similar trend now with batteries, and because we’re building mega-factories, we’re adapting that technology and it’s becoming better and cheaper.

What advice would you give to the founder of an energy business who is considering a strategic partnership or exit?

Our advice is always to start early. Even if you’re not yet ready to sell, keep in mind that one day you’re going to find an investor to facilitate further growth or a pre-exit, or you may have inbound interest from investors, so you need to be ready to act. That’s easiest if you’ve always kept this possibility in mind. Have your finances in order, make sure all contracts are in place and signed. It sounds basic but it’s very important to have your things in order. If your dream partner comes along and knocks on the door, and you want to move, then you should be ready to move.

Where do you see the greatest potential for innovation or investment in the next 3–5 years?

Everywhere! As we use technologies more, you see them improving. The more we produce and use solar panels, the better that technology is becoming. So there are specific trends within solar PV to increase generation capacity — for example, now there is a certain technology that only allows 25% efficiency as a maximum. All across the world, they’re doing research into additional technologies to further increase that generation capacity, such as placing different layers on top of each to use a broader spectrum of sunlight. This is basically the same for batteries — the more we use them, the better and cheaper they become. Waste management, reusing our waste for energy generation, is not necessarily new but it’s becoming more sophisticated. AI is probably going to play a bigger role. We’re going to be able to automate many things and that has significant advantages in many sectors. For example, with waste management, we’ll be able to more effectively separate waste because a computer can do it for us, and then we can reuse those inputs.

The future of energy isn't just renewable, it's intelligent. AI will be the brain behind how, when and where we produce, store and consume power.TOM SNIJCKERS, PARTNER, OAKLINS NETHERLANDS

A selection of Oaklins' closed Energy transactions

Discover the 300+ Energy transactions Oaklins has advised on.