M&A INDUSTRY UPDATE | Marine Equipment

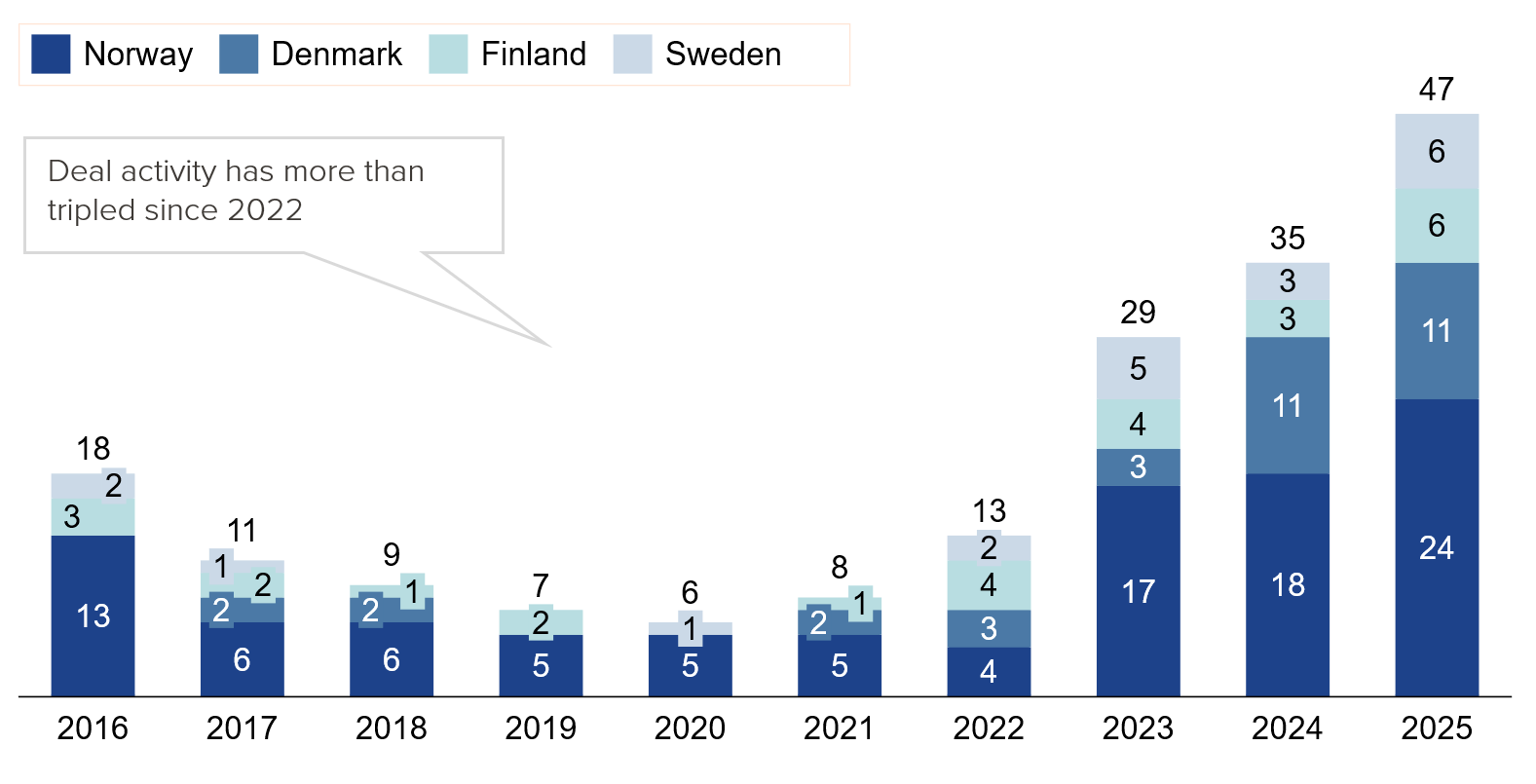

Record Nordic deal volumes in 2025 underline continued investor confidence in marine equipment companies with technology differentiation and aftermarket exposure.

M&A activity in the Nordic marine equipment sector remained strong in 2025, supported by structural market fundamentals, sustained investor interest and a broad, competitive buyer universe. While newbuilding activity has normalized following a highly active period, demand continues to be underpinned by an ageing global fleet, elevated newbuilding prices and increasing regulatory and technological requirements.

These dynamics are shifting value creation towards aftermarket exposure, retrofits and technology-enabled solutions, driving continued consolidation across the sector.

Nordic M&A activity within Marine Equipment, by target geography

Public market valuations remain supportive. On-board electronics companies command the highest multiples (median 17.4x EV/EBITDA), reflecting exposure to digitalization, stronger margins and more recurring revenue, while engines & propulsion and deck equipment trade at lower multiples primarily due to higher newbuild exposure.NIKOLAI LUNDE, marine equipment specialist and managing partner at Oaklins Norway

Read and download our full report

Reach out to our industry team

Managing Partner

View profile

Partner

View profile

Partner

View profile

Partner

View profile