Adomex has sold a minority stake to Van Lanschot Participaties

The shareholders of Adomex have sold a minority interest to Van Lanschot Participaties. Financial details have not been disclosed.

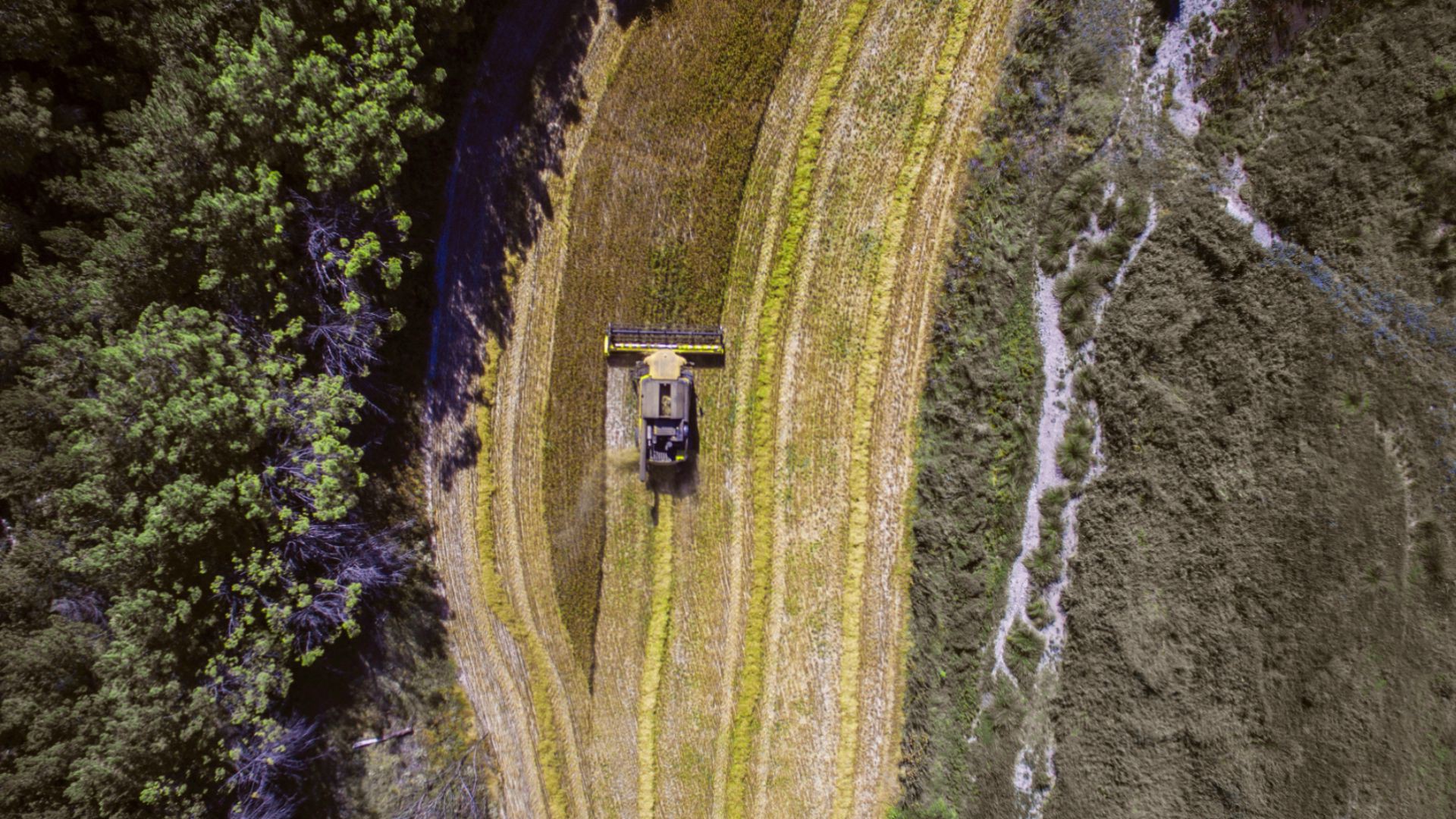

Adomex is a global importer of cut foliage and decoration greens and holds a leading position in this specialized market. The company’s client base includes bouquet producers, wholesalers, exporters, cash & carries and florists throughout Europe. Adomex is headquartered in Uithoorn, the Netherlands and operates additional locations in Aalsmeer, Rijnsburg, Naaldwijk and Herongen (Germany).

Van Lanschot Participaties, a subsidiary of Van Lanschot, is a Dutch private equity investor with a focus on minority participations. Since Van Lanschot Participaties is not a classic private equity fund, it has no time limits or exit pressures.

Oaklins' team in the Netherlands acted as the exclusive M&A advisor to the seller in this transaction.

Talk to the deal team

Related deals

Dania Software has been acquired by Omnidocs

The owners of Dania Software A/S have sold the company to Omnidocs.

Learn moreTop Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more