IHC Vremac Cylinders has been acquired by VAPO

Royal IHC, a supplier of equipment, vessels and services for the offshore, dredging and wet mining markets, has sold IHC Vremac Cylinders to VAPO.

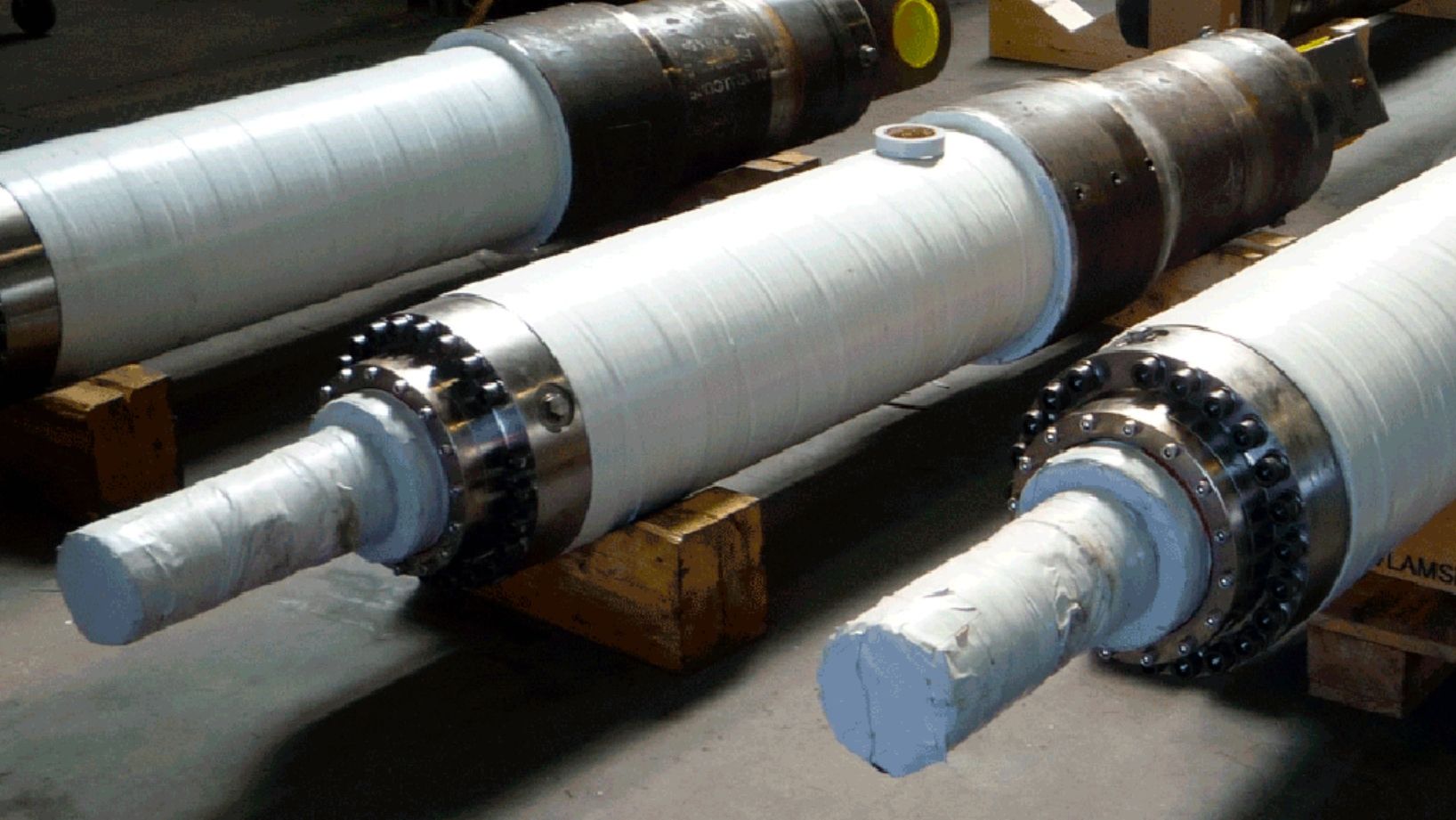

IHC Vremac Cylinders (Vremac) is a designer and manufacturer of top quality customized and project-engineered hydraulic cylinders, accumulators and swivels for all applications in the dredging and offshore, civil engineering, transport and loading, and heavy-duty machinery industries. Vremac has a strong global client base in multiple end markets. Renowned customers include Caterpillar, Mammoet, SPIE, Huisman and Boskalis. Vremac operates from a custom-build facility in Apeldoorn that was opened in 2017 and employs 90 full-time employees.

VAPO is a Belgian designer and manufacturer of hydraulic cylinders, hydraulic systems and components. VAPO is backed by Belgian private equity firm Vybros, a hands-on firm focused on small- and medium-sized companies.

Oaklins' teams in the Netherlands and Belgium advised the sellers in this transaction.

Dave Vander Heyde

CEO, Royal IHC

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more