Solstyce has completed an LBO alongside NextStage

The private shareholders of Solstyce have completed a primary LBO alongside NextStage AM.

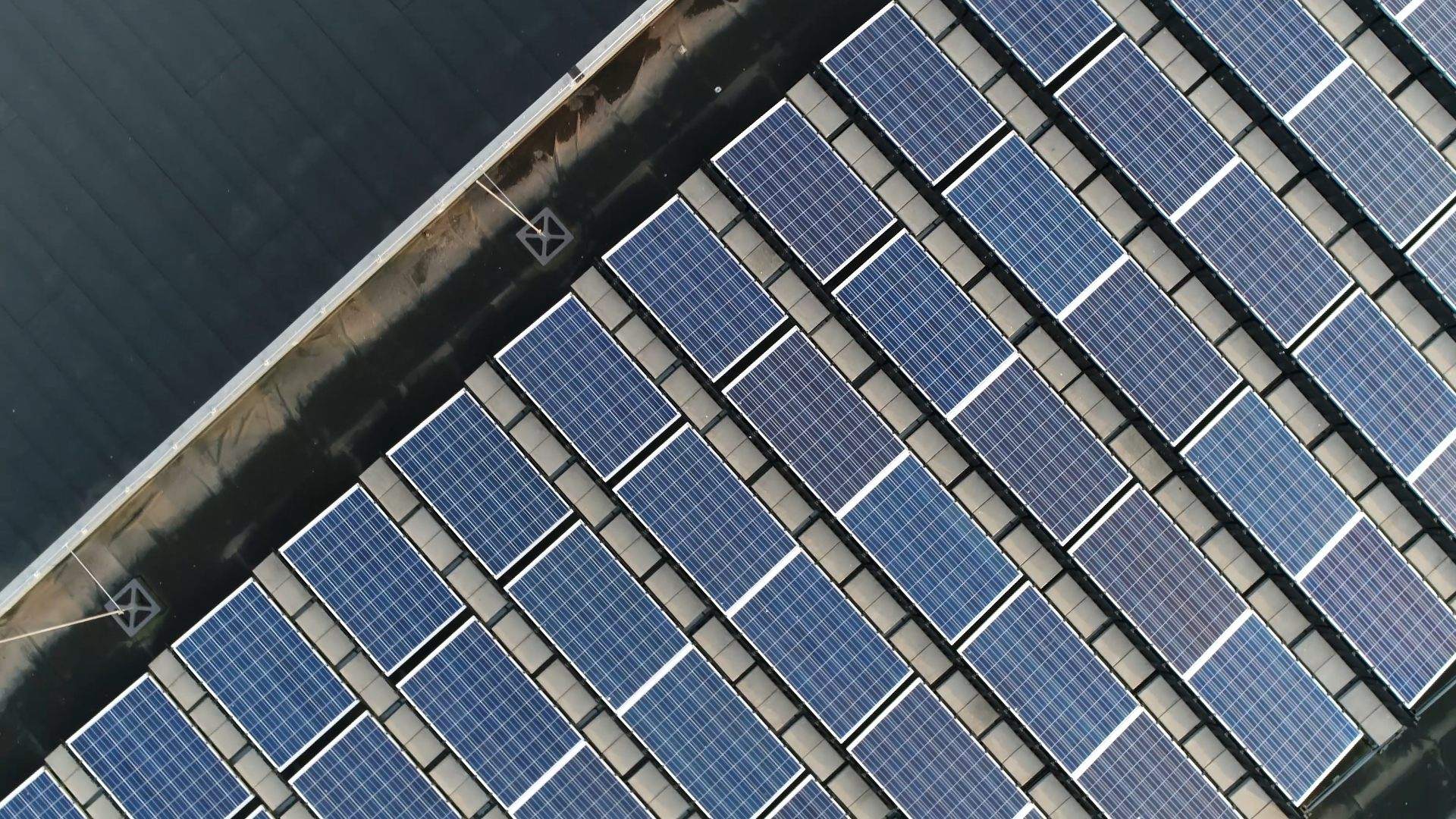

Solstyce is a renewable energy group that provides global services, such as development, building, operating and maintenance in the photovoltaic, e-mobility, carbon footprint and water tightness industries. The firm has an integrated model implementing comprehensive solutions where energy production, mobility and the creation of smart grids deliver an essential three-pronged approach in the transition towards clean energy to building the cities of the future. Solstyce also builds and maintains solar power stations. It has a cutting-edge engineering department and an integrated multi-disciplinary installation team, as well as a maintenance and operations department to ensure the optimal performance of facilities throughout their lifetime. For the last 10 years, Solstyce has been involved in electric mobility. It has a unique partnership with Group Renault, providing electric vehicle charging solutions for its customers’ fleets. The company is also establishing and implementing a low-carbon strategy.

NextStage AM has been supporting growth entrepreneurs in their development since 2002 with its multi-strategy private equity platform, which at the end of December 2020 represented more than US$7.2 billion of assets under management, directly and indirectly collected from institutional investors and individuals.

BPIfrance Investment is also co-investor in the operation with its fund FIEE dedicated to energy and ecological transition. BPIfrance Investment is the French Sovereign Fund investing in startups, SMEs and mid-caps through direct investment and a fund of funds activity.

Oaklins’ team in France acted as the exclusive advisor to the shareholders of Solstyce in this transaction.

Kontakt ansvarlige rådgivere

Relaterte transaksjoner

Dania Software has been acquired by Omnidocs

The owners of Dania Software A/S have sold the company to Omnidocs.

Les merTop Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Les merSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Les mer