SKK Group has acquired Nortécnica

SKK Group has entered the electrical equipment and materials sector through the acquisition of 100% of Nortécnica.

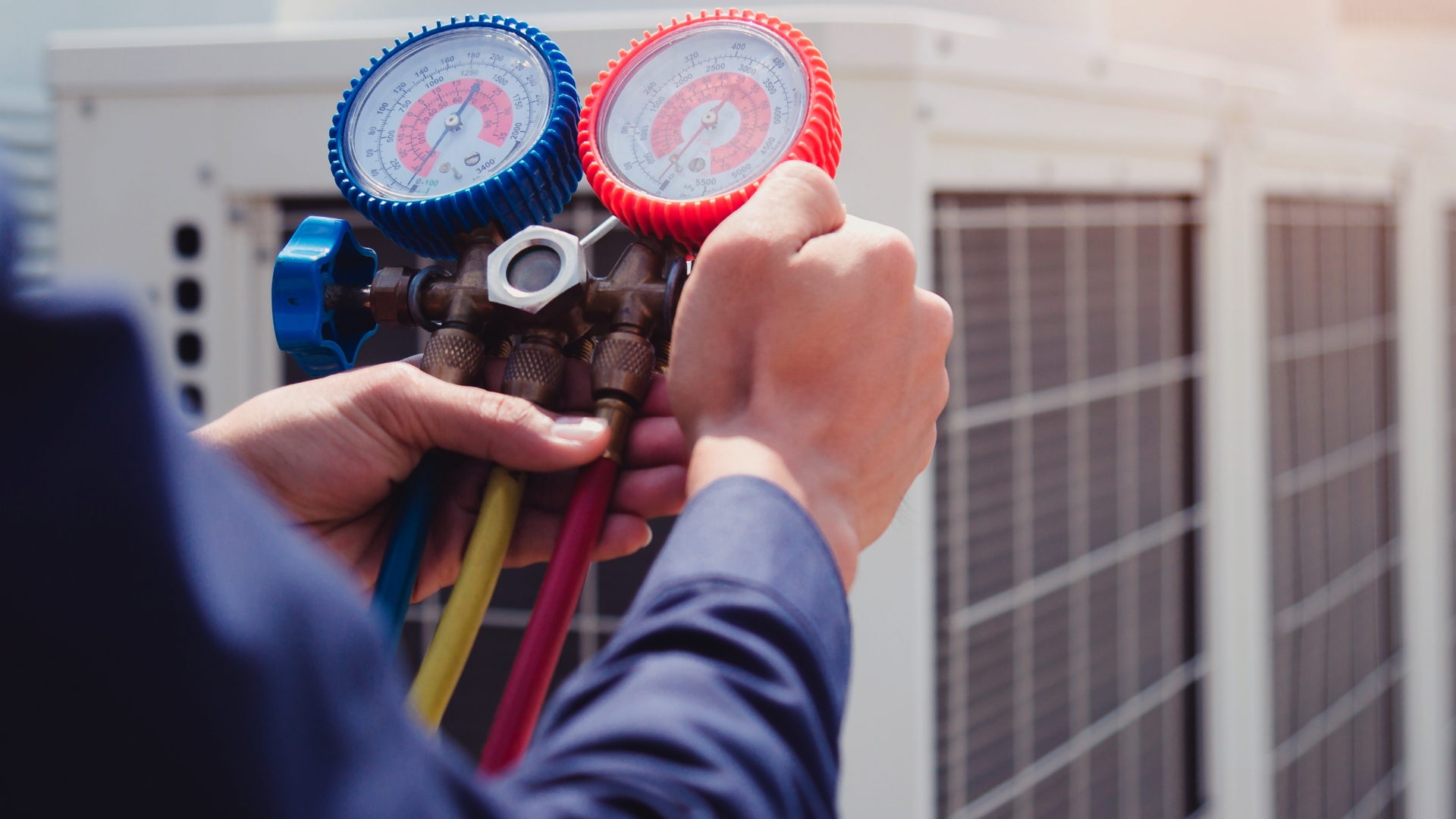

SKK Group is dedicated to the design of engineering solutions and distribution of refrigeration and HVAC systems for commercial and industrial spaces. It also operates in the areas of commercial and office building maintenance and facilities management.

With over 50 years of experience in the sector, Nortécnica Group operates in the distribution of electrical equipment, materials and products. It caters to the B2B segment, offering multibrand products to national installers and resellers. The group is comprised of three companies: Nortécnica, Fedirbra and Gonfil.

Oaklins’ team in Portugal advised SKK Group on the acquisition of Nortécnica.

Kontakt ansvarlige rådgivere

Relaterte transaksjoner

Soler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Les merVarsteel, Ltd. has acquired Pacific Steel, Inc.

Pacific Steel, Inc. has been acquired by Varsteel, Ltd.

Les merSibelco has received strategic advisory related to the exit of a minority shareholder

SCR Sibelco has received strategic advisory related to the exit of a minority shareholder. Different options were considered. On 8 December 2023, Sibelco announced its intention to launch a share buyback program, via a tender offer, to acquire up to 18.94% of outstanding shares for a price of €6,850 per share and a total deal consideration of €609 million. The program offered liquidity optionality to the exiting shareholder, as well as other minority shareholders looking forward to crystallizing some value. Sibelco is delighted to pursue with its ambitious mid-term growth plan thanks to a refocused shareholder register and the support of the founding families. Further information on the transaction can be found in the prospectus of the tender offer.

Les mer