Hannecard has raised capital from BNPPF Private Equity

The shareholders of Hannecard have raised capital from BNP Paribas Fortis Private Equity.

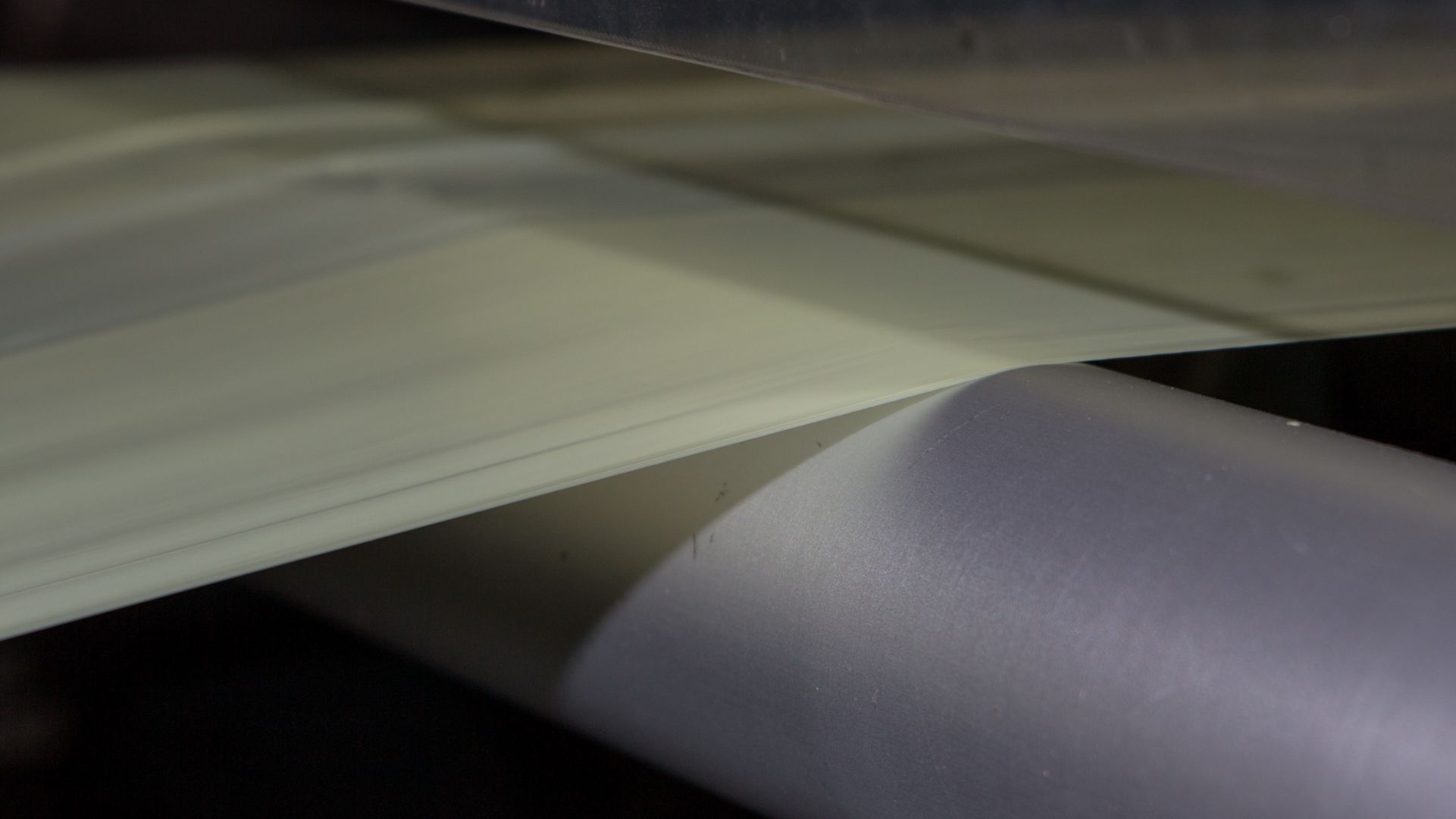

Hannecard, founded in 1896 and headquartered in Ronse, Belgium, is Europe’s leading supplier of industrial roller coverings, employing over 600 people worldwide

Through its 13 subsidiaries and eight joint ventures, it has a strong international presence, with more than 20 production units in 16 countries. The group offers over a thousand custom-made roller covering solutions, from rubber and polyurethane to composite and spray coating, for a broad range of industries, including paper, metal and packaging. Hannecard also provides a wide range of services such as roller maintenance, repair and management.

BNP Paribas Fortis Private Equity is a long-term Belgian private equity investor established in 1982, with around 30 direct investments in its portfolio across various sectors. Its direct investments team has ample experience as a minority investor in expanding companies with a focus on profitable growth. With over 40 years of experience in the sector, BNP Paribas Fortis Private Equity is regarded as a stable, reliable, flexible and long-term shareholder.

Oaklins’ team in Belgium acted as the exclusive M&A advisor to Hannecard in this transaction.

Dirk Vidts

CEO, Hannecard

Contáctese con el equipo de la transacción

Bart Delusinne

Oaklins KBC Securities

Thomas Roelens

Oaklins KBC Securities

Pieter Vanhoudt

Oaklins KBC Securities

Transacciones relacionadas

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Conozca másXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Conozca másSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Conozca más