Ecocompósitos has sold a majority stake to Crest Capital Partners

The private shareholders of Ecocompósitos, a Portuguese leader in pool products and composites, have sold a major stake in the company to Crest Capital Partners.

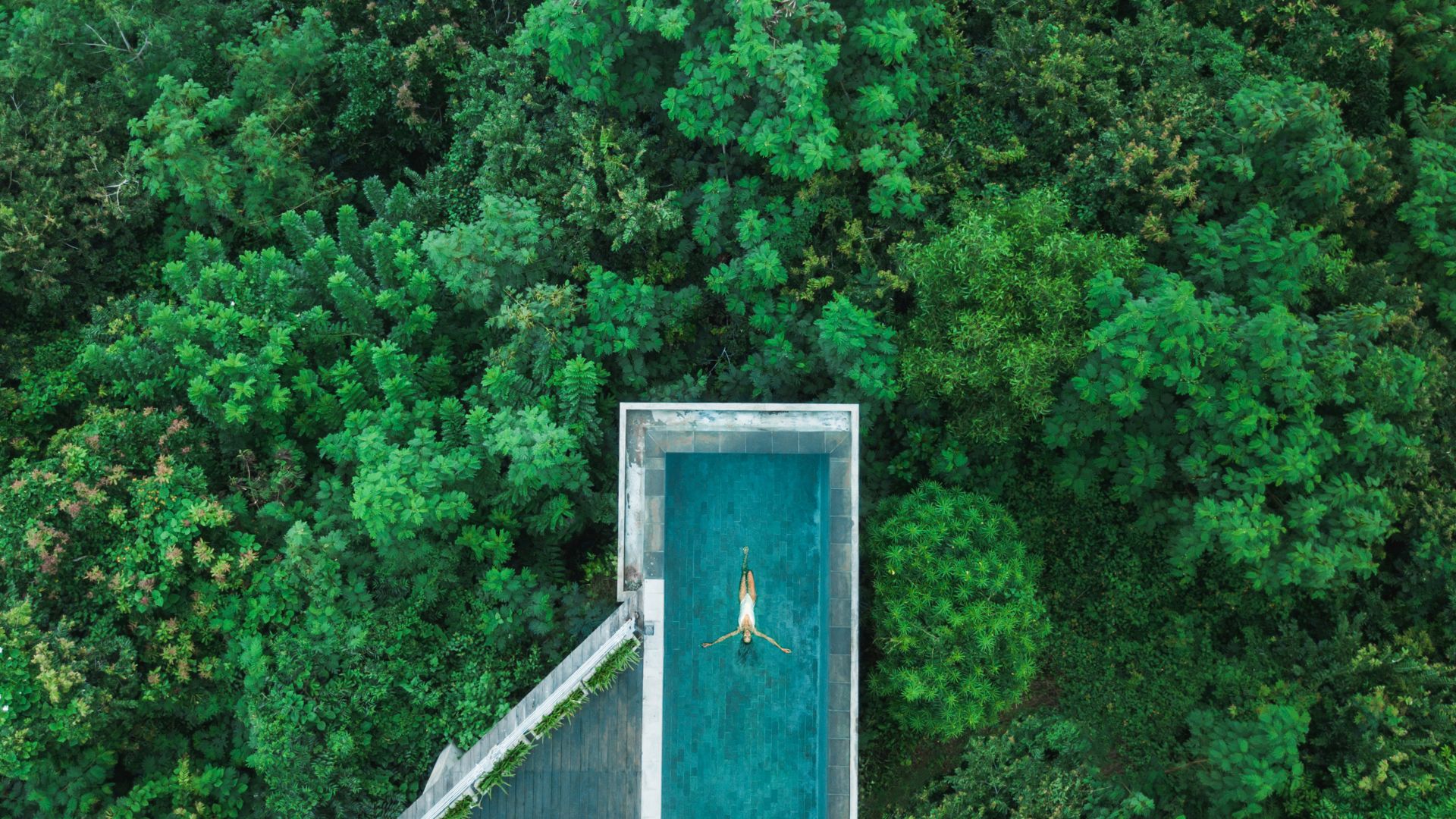

Established more than 30 years ago, Ecocompósitos distributes its products under a series of brands in three different business segments: consumer (pool products), industry (composites) and green spaces. It started its activity in industrial products and is now one of the leaders in the commercialization of pool and spa products.

Crest Capital Partners is a private equity firm focused on sustainable and competitive Portuguese businesses.

Oaklins’ team in Portugal acted as the exclusive M&A advisor to Ecocompósitos’ management team in this transaction.

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more