Succesful integrated solution for strategic deadlock and tender offer by CMB on Euronav

Compagnie Maritime Belge (CMB) has successfully resolved the strategic and structural deadlock within Euronav through an agreement with Frontline, a world leader in the international seaborne transportation of crude oil and refined products, resulting in a mandatory takeover offer on Euronav.

CMB is a shipping group headquartered in Antwerp, Belgium. the group operates CMB.TECH, a cleantech company that builds, owns, operates and designs large marine and industrial applications that run on dual-fuel or monofuel (diesel-)hydrogen and (diesel-)ammonia engines. The largest division in CMB.TECH is the marine division. It builds, owns, operates and designs a wide range of low and zero-carbon ships powered by dual-fuel or monofuel (diesel-)hydrogen and (diesel-)ammonia engines: dry bulk vessels, container carriers, chemical tankers, tugboats, crew transfer vessels for the offshore wind industry, ferries and barges. Prior to the transaction, CMB was a reference shareholder in Euronav, holding approximately 25% of shares outstanding.

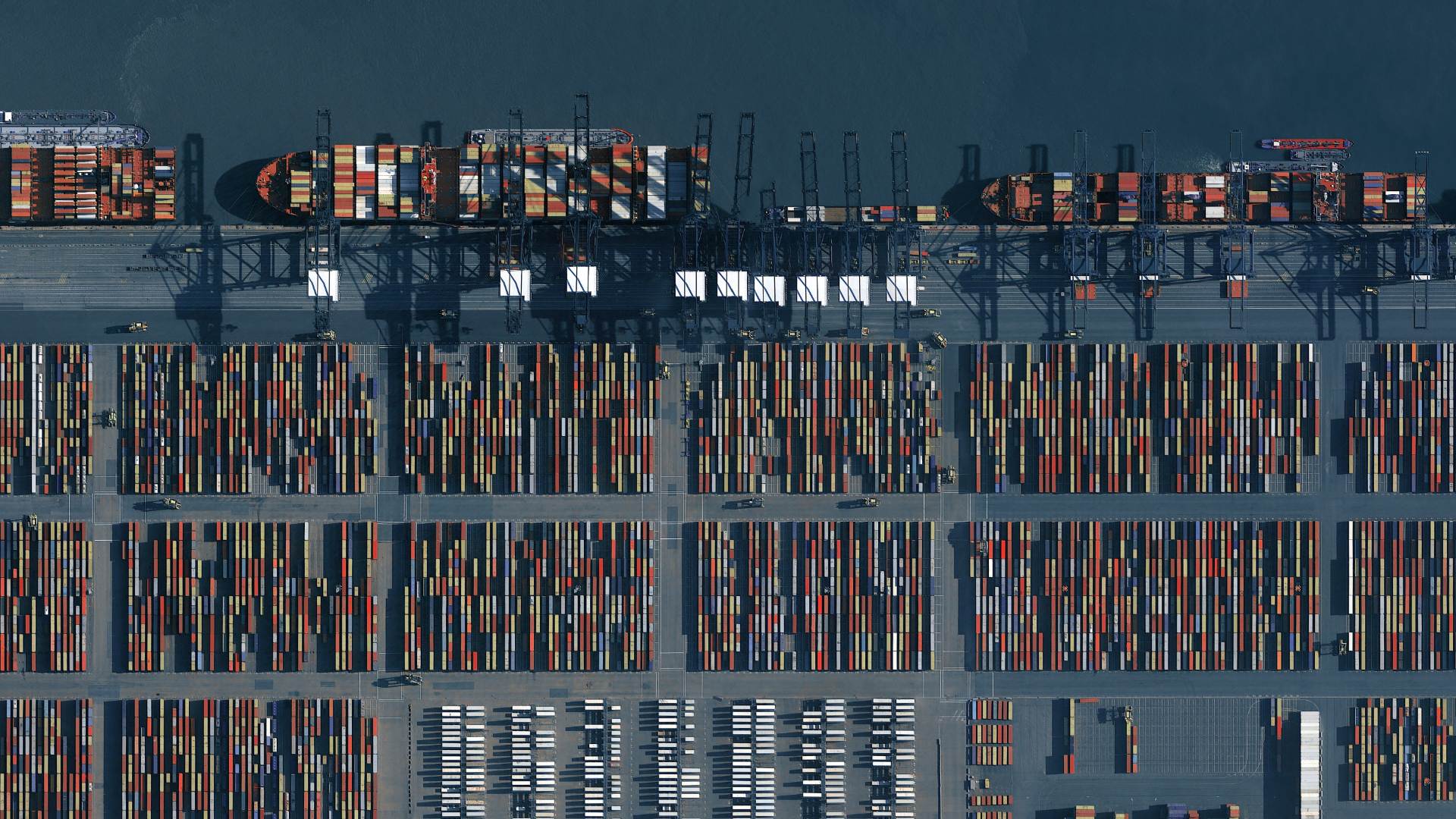

Euronav is a fully integrated provider of international maritime shipping and offshore services. Prior to the transaction, Euronav was the world’s largest independent quoted tanker company engaged in the ocean transportation and storage of crude oil. Prior to the transaction, the company owned a fleet of 73 vessels. Euronav is headquartered in Antwerp and has offices across Europe and Asia.

The transaction comprised three interdependent agreements: CMB acquires Frontline’s 26% stake in Euronav; Frontline acquires 24 VLCC tankers from Euronav; and CMB launches a mandatory takeover offer on Euronav after exceeding the 30% shareholding threshold following the completion of the share purchase. Through the acquisition, CMB is executing on its strategy to play a leading role in the decarbonization of the shipping sector. The integrated transaction resulted in the creation of the leading, future-proof diversified shipping platform through the combination of Euronav, one of the world’s largest NYSE and Euronext-listed tanker platforms, and CMB.TECH, market leader in green shipping, with an integrated hydrogen and ammonia value chain, active in a diversified range of end-markets. Euronav and CMB.TECH together represent a group with approximately 150 ocean-going vessels, including newdbuildings in dry bulk, container shipping, chemical tankers, offshore wind vessels and oil tankers. The group focuses on large marine and industrial applications of hydrogen or ammonia. It also offers hydrogen and ammonia fuel to customers through its own production or third-party producers. The focus lies on diversification, decarbonization and optimization of the fleet. The goal is to become the benchmark in sustainable shipping, with a special emphasis on using hydrogen and ammonia to achieve this. The company’s tagline says it all: “decarbonize today, navigate tomorrow.”

Oaklins’ team in Belgium is proud to have acted as lead advisor to CMB and centralizing agent throughout this complex transaction, from the agreement between reference shareholders leading to the bid obligation, to the settlement of the bid.

Prata med transaktionsteamet

Relaterade transaktioner

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Lär dig merLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Lär dig merMarco Peruana has been acquired by Zamine Perú

Marco Peruana S.A. has been acquired by Zamine Perú, a subsidiary of Marubeni Corporation, continuing the international consolidation of a global leader in the mining and industrial sectors. With its extensive track record, Marubeni represents the ideal partner to support Marco Peruana’s growth and further strengthen its leadership position in Peru.

Lär dig mer