Extramet has been acquired by ADMETOS

EXTRAMET AG has been acquired by an investment company advised by ADMETOS GmbH. This transaction secures the succession of long-standing owner Hans-Jörg Mihm, who is retiring after more than four decades of entrepreneurial leadership. The new owner is committed to the company’s long-term development, with plans to strengthen its market position and unlock operational improvement potential.

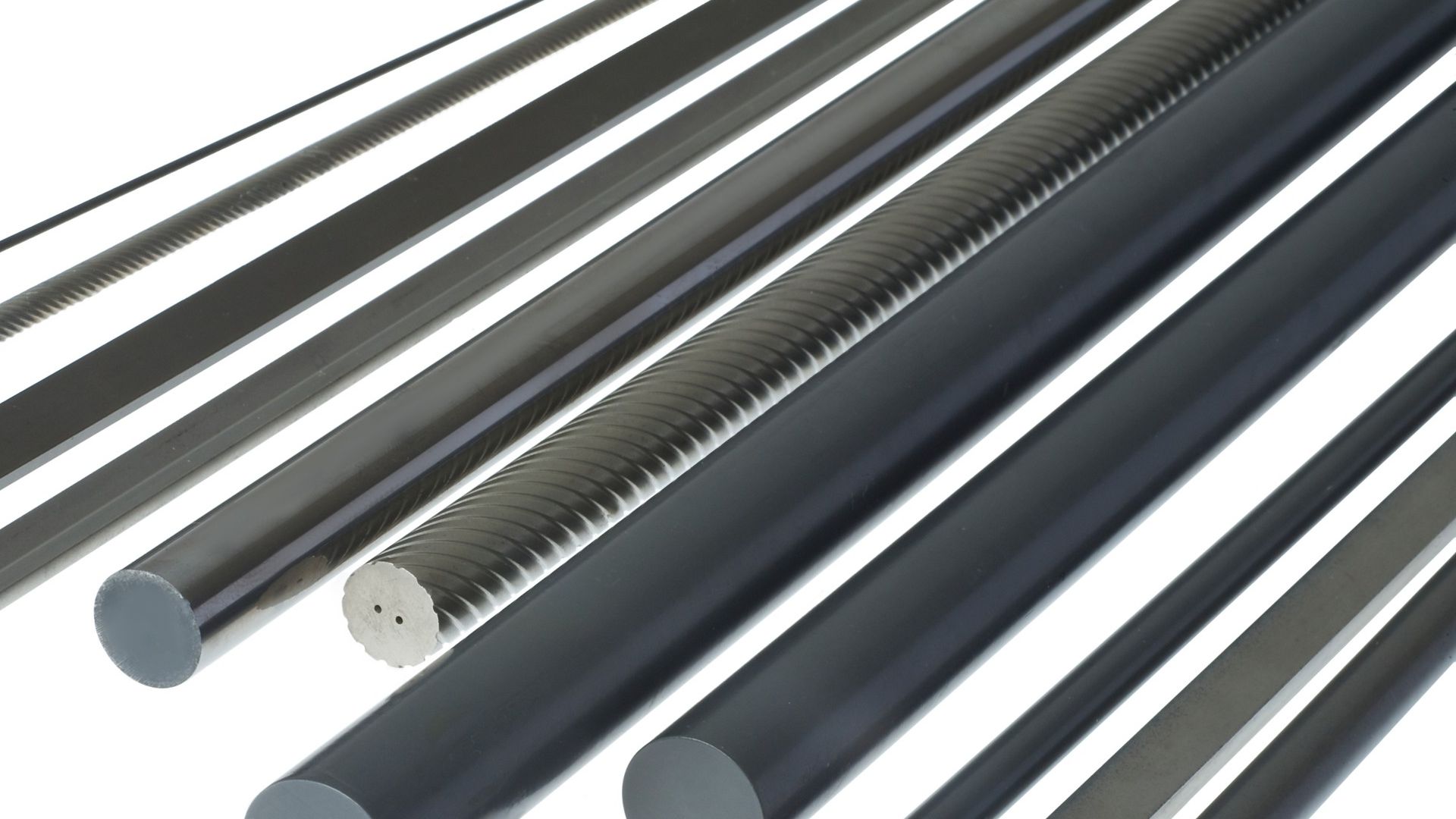

EXTRAMET, headquartered in Switzerland, is a leading manufacturer and solutions partner for high-quality carbide products. Committed to innovation, precision and advanced technology, the company specializes in the development and production of milling and drilling blanks for industries such as automotive, aerospace, precision and micro-mechanics, food and packaging and medical technology. EXTRAMET supplies leading industrial companies and customers worldwide.

ADMETOS is a diversified, owner-managed industrial and investment holding company based in Germany, specializing in direct investments in the European mid-market. The firm pursues an entrepreneurial, hands-on approach focused on the sustainable development and long-term value creation of its portfolio companies.

Oaklins’ team in Switzerland acted as the exclusive M&A advisor to the shareholder of EXTRAMET, providing comprehensive support throughout the entire sales process. This included preparation, buyer identification, due diligence and negotiation support through to the signing and closing of the transaction. Oaklins’ team in Germany supported the transaction.

Hans-Jörg Mihm

Owner, EXTRAMET AG

Prata med transaktionsteamet

Relaterade transaktioner

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Lär dig merLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Lär dig merQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Lär dig mer