Industrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

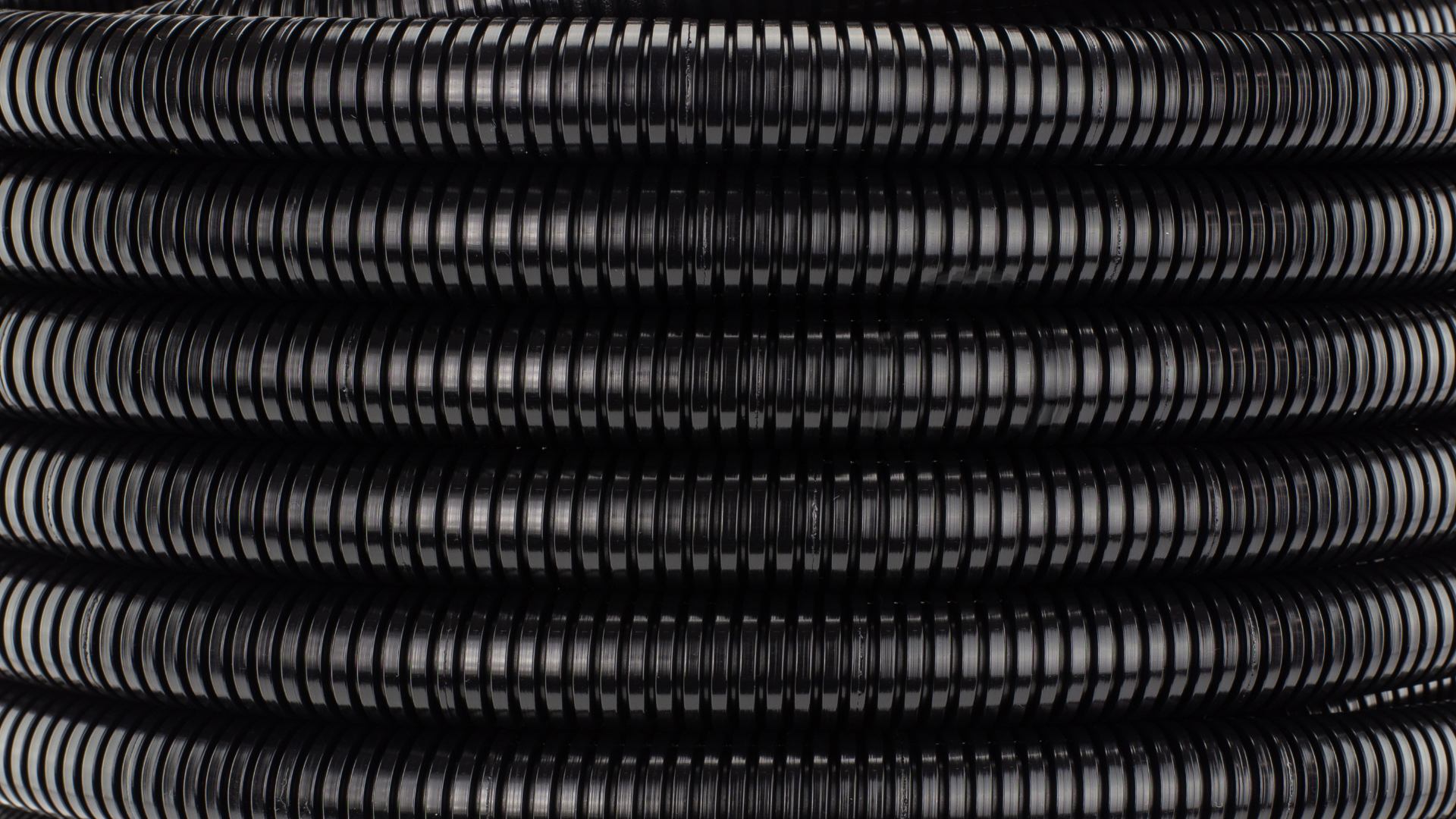

Industrie Polieco - M.P.B. is a leading European company in the production of corrugated pipe systems and manhole covers in composite material. It is also among the key players globally in the oil and gas and packaging sectors for manufacturing compounds and adhesives.

RedFish Longterm Capital operates as an investment company. It engages in the acquisition of long-term stakes in small- and medium-sized Italian companies operating mainly in the precision mechanics, aeronautics, railways, agrifood, information and communication technology, oil and gas and telecommunications industries.

Oaklins’ team in Italy acted as financial advisor of T.P. Holding Srl and Industrie Polieco - M.P.B. SpA.

Sprechen Sie mit dem Deal-Team

Relevante Transaktionen

Royal Reesink has sold Motrac Industries to Anders Invest

Royal Reesink and Anders Invest have completed the sale of Motrac Industries, a specialist in hydraulic and electrical engineering.

Weitere InformationenÑaming, SL has been acquired by DeA Capital S.p.A.

Spain’s leading producer of sandwiches, fresh and ultra-fresh products, Ñaming, has sold a majority stake to Italian fund DeA Capital.

Weitere InformationenUniKidz has partnered with Karmijn Kapitaal

Karmijn Kapitaal has acquired a majority stake in UniKidz, a talent development organization that provides a scientifically-based developmental approach through high-quality childcare. Through the partnership with Karmijn Kapitaal, UniKidz can take the next step in bringing their unique concept to even more children.

Weitere Informationen