CVA EOS Srl has completed a mandatory public tender offer on Renergetica SpA

CVA EOS Srl has acquired Renergetica SpA.

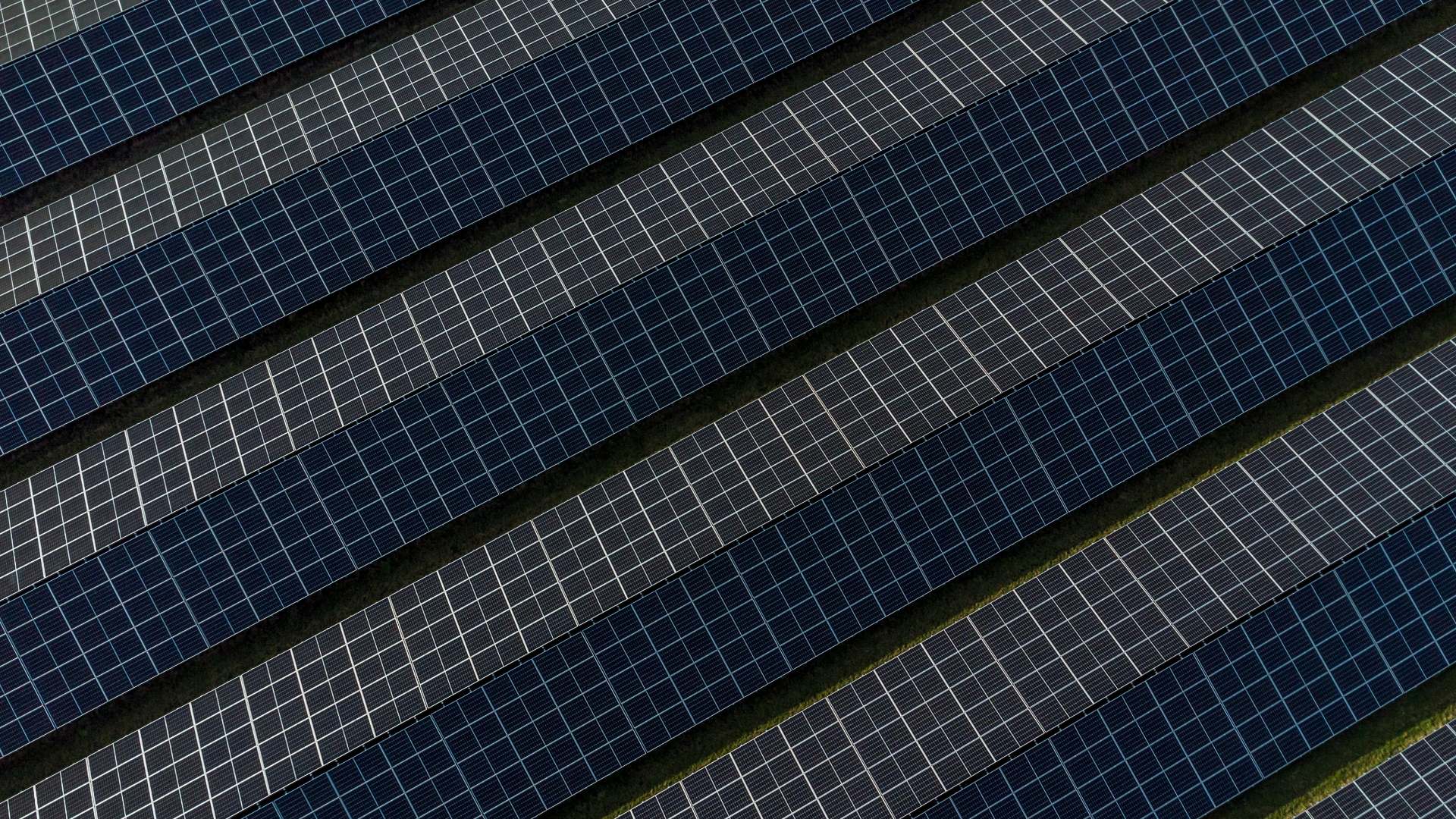

CVA EOS is a company operating in the wind and photovoltaic sector, wholly owned by CVA SpA (Compagnia Valdostana delle Acque).

Headquartered in Italy, Renergetica is a listed entitynt hat engages in the design of engineering solutions for the renewable energy sector. The company specializes in the development of renewable energy plants, hybrid power generations systems and hybrid grids.

Oaklins’ team in Italy acted as financial advisor to CVA EOS and appointed broker for the collection of the shares in the total mandatory public tender offer of 17.8% of the shares of Renergetica SpA by CVA EOS Srl.

Sprechen Sie mit dem Deal-Team

Relevante Transaktionen

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Weitere InformationenXeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Weitere InformationenEVIO has raised funds from Lince Capital for its international expansion

EVIO has secured a second fundraising round lead by Lince Capital, a Portuguese private equity firm, in order to fund its international expansion and reinforce its commercial activity.

Weitere Informationen