Stanzwerk AG has been acquired by SITEM S.p.A.

The private shareholders of Stanzwerk AG have sold the company to SITEM S.p.A.. Financial details have not been disclosed.

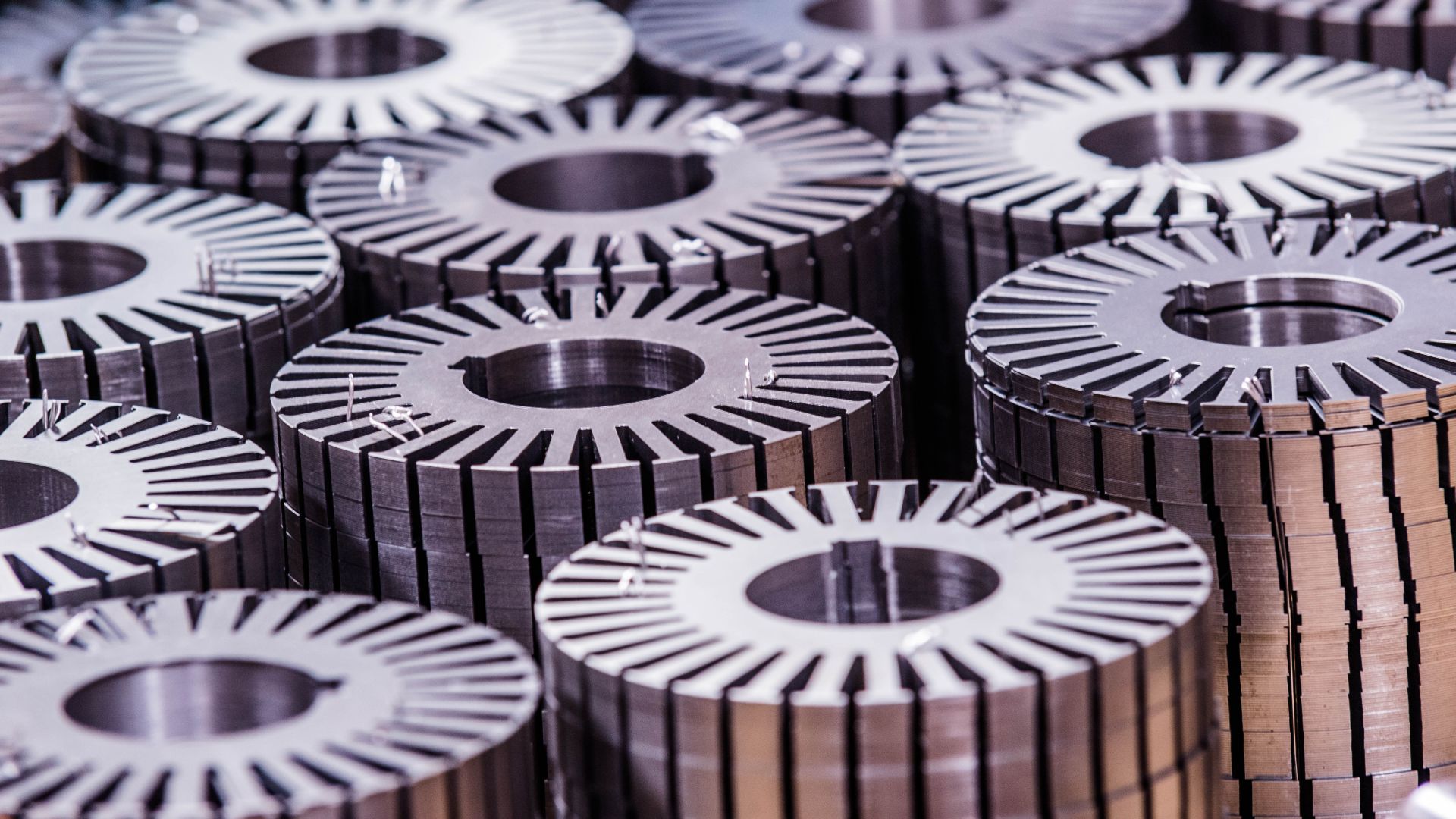

Stanzwerk AG specializes in the stamping and stacking of laminations. Using magnetic sheet metal, it manufactures stator and rotor stacks needed to construct electric motors. The latter are then used in drives, steering systems, electric tools and ventilation systems. The company looks back on a successful 50-year history and enjoys an outstanding reputation on the market as an expert and reliable partner for its customers. The high level of precision of its manufacturing processes and the fact that it makes its own tools, among other things, have contributed to this success. The export ratio of approximately 90% highlights Stanzwerk’s international focus.

SITEM S.p.A. is a family-owned European manufacturer of stamped electrical laminations and die-cast alloy components. The company was founded in 1974 and is headquartered in Trevi, Italy. SITEM has five divisions, three in Italy and one in France and Slovakia.

Oaklins' team in Switzerland advised the seller in this transaction. They conducted an individual tailored sales process in order to find the right buyer for Stanzwerk AG. The team had to find an investor who could succeed both in the ownership of Stanzwerk AG and at operational level. In addition, the investor should share the same basic values, believe in a successful industrial production in Switzerland and be prepared to expand this further to successfully lead Stanzwerk AG into the future.

Marcel Rüetschi

Owner and President, Stanzwerk AG

Talk to the deal team

Related deals

The assets of IMG have been acquired by SLV Mecklenburg-Vorpommern

The assets of Ingenieurtechnik und Maschinenbau GmbH (IMG) have been acquired by SLV Mecklenburg-Vorpommern GmbH (SLV-MV) through an asset deal as part of IMG’s insolvency proceedings.

Learn moreLauak Group has sold a majority stake to Wipro Infrastructure Engineering

After careful strategic reflection to secure the group’s future, Lauak Group’s shareholders have chosen an industrial partnership, in line with the ongoing consolidation trend in the market. Attracted by opportunities for innovation and international expansion, the Charritton family, founders and long-term shareholders, regard Wipro Infrastructure Engineering as a trusted industrial partner. The historical shareholders remain minority stakeholders, and the current CEO continues to lead Lauak.

Learn moreQuantum Base has completed a fundraise

Quantum Base Holdings plc (AIM: QUBE) has successfully completed a US$5.7 million fundraise.

Learn more