MEK Holding SA and subsidiaries have been acquired by Kowema Beteiligungs AG

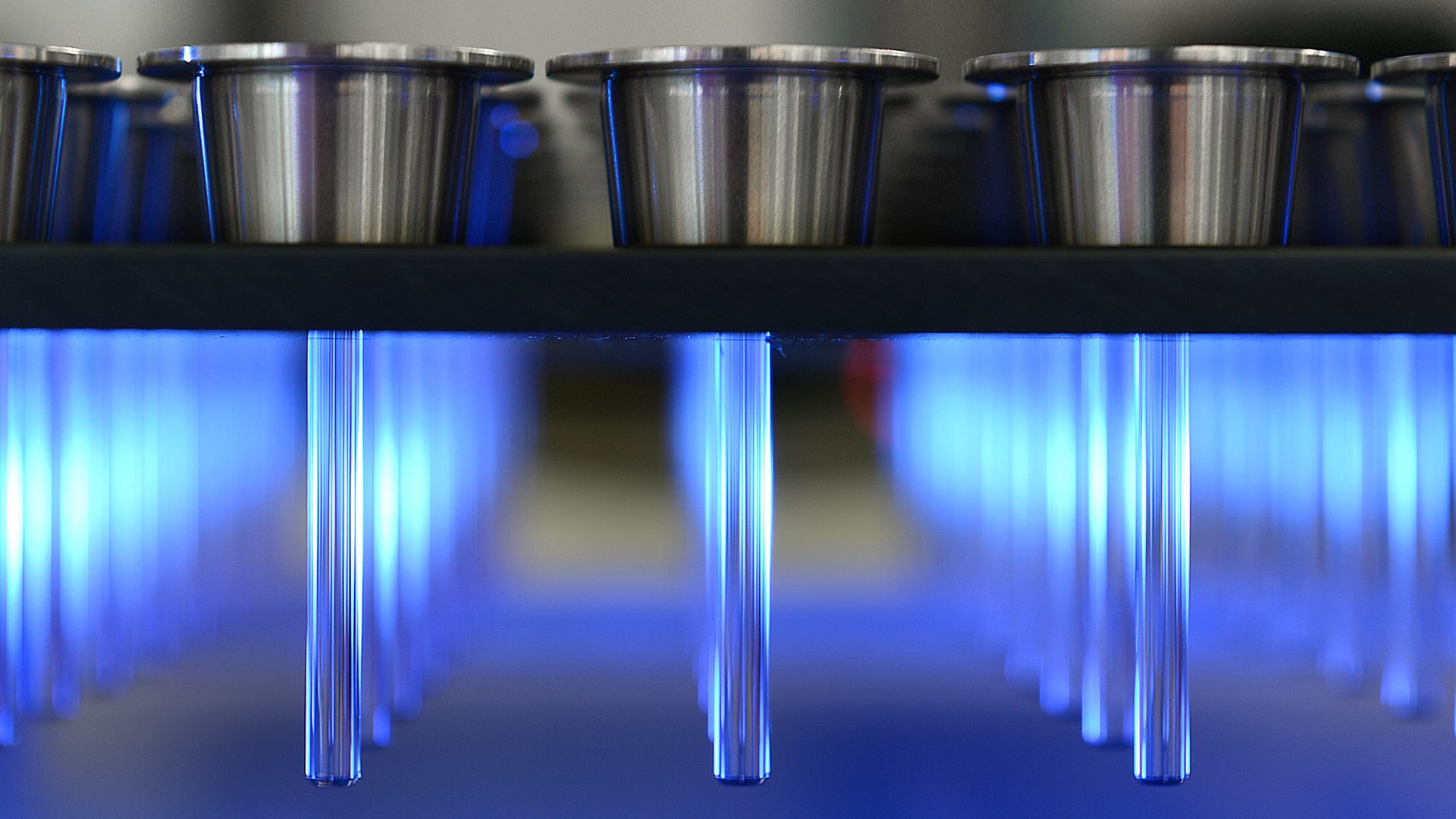

Kowema Beteiligungs AG (Kowema), an investment vehicle funded by Swiss pension funds, has acquired MEK Holding SA together with its subsidiaries Nova Werke AG, operating under the highly-renowned Novaswiss brand, Ceramaret SA, a producer of components made of extremely hard materials, and Maillard Frères SA, specializing in the processing of ruby, sapphire and advanced ceramics mainly for the watchmaking industry. Financial terms of this transaction have not been disclosed.

MEK Holding SA has been owned by the Knechtli family for 25 years. The owners preferred a package sale of the holding company, even though it had activities in various industry sectors. The three companies had limited operational synergies but the seller preferred to divest the entire group to the same buyer.

Kowema is an alternative investment vehicle exclusively owned by Swiss pension funds. It was founded in 2007 and so far operates through two groups of companies. Kowema' strategy is to acquire eight to ten independent Swiss mid-cap companies in order to contribute to the development of Swiss economy and generate attractive returns for its shareholders.

Oaklins' team in Switzerland advised the seller, a private individual, on the entire succession process, including assistance in preparing the companies for the sale, the identification and approach of potential buyers, and assistance in negotiating and closing the transactio

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn moreValmiermuižas Alus has been acquired by Cēsu Alus

Valmiermuižas Alus has been acquired by Cēsu Alus AS through the purchase of 100% of its shares. The transaction enabled the founder’s exit and strengthened the company’s platform for continued growth within a consolidating Baltic beverage market.

Learn more