Impressive achievements of Oaklins in the European league tables

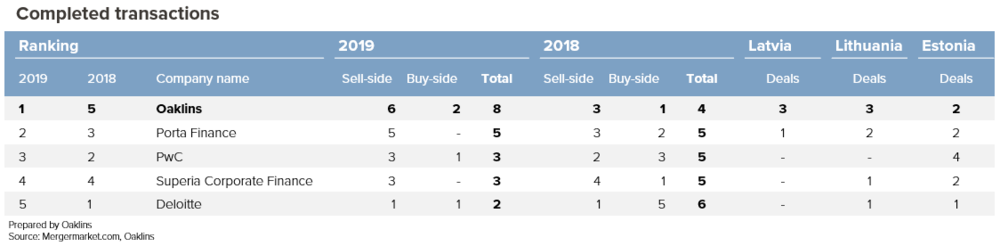

With the transaction data published by Mergermarket, Oaklins' team in Baltics has summarized our completed transaction activity in 2019 and compared it to other consultants in the region. We are happy to share that the unity binding the three Baltics states has proven to be our indispensable asset yet once again. Based on the data, Oaklins' team in Baltics has successfully closed two buy-side and six sell-side transactions in 2019, boosting our ranking as the leading consultant across the three countries. Such a great achievement only proves our combined sector and regional experience, as well as continuous dedication we put when serving our clients' needs.

Zooming into the most interesting cases we completed during the year, in April, the team in Lithuania advised FCR Media Baltics, a group of digital media companies, in the sale of FCR Media Lietuva, an advertisiting service and business information dissemination firm, to YNOT Media.

Oaklins' team in Estonia consulted private shareholders of Digital Future, an Estonia-based outdoor media group active in digital out-of-home (DOOH), traditional billboard advertising and digital signage, in their sale to UP Invest, a local investment company, and acted as the exclusive advisor to a Dutch-based private investor in the sale of Signaal TM, the leading traffic management products and services provider in Estonia, to US Invest, another local investment company.

The team in Latvia closed more transactions than any other consultant in the country. The team consulted a private equity firm Baltcap in the sale of 61 automatized post terminals of Post Service Kurzeme to Latvijas Pasts, a state-owned postal service provider, acted as a sell-side advisor to the owners of Smiltenes Piens, one of the leading dairy companies in the country, in their sale to a private investor. The transaction was backed by the alternative capital fund BPM Mezzanine Fund who provided financing for the acquisition.

The team at Oaklins was extremely professional, united and had a steady approach to every stressful situation. I am very pleased with the final deal and felt confident during each step of the transaction thanks to their deep industry expertise and dedication to meeting every one of our requirements.GITA MŪRNIECE, CO-OWNER, SMILTENES PIENS

By balancing our global perspective with an understanding of local challenges and opportunities, we help companies find the best domestic and cross-border deals.

We are celebrating with the whole Oaklins family!

Our drive to help our clients reach their full potential has yet again earned Oaklins a global ranking in the top 20 of both the Mergermarket and Thomson Reuters league tables. As per the official Mergermarket mid-market league tables, with 110 closed transactions in Europe and 144 globally, we are ranked as the #9 and #18 financial advisor respectively.

We celebrate our clients and understand the uniqueness of their businesses. We hope to show many more evolving companies how our collaborative approach can help bridge their ambitions with world-class opportunities.