Rooftop Energy has been acquired by NPM Capital

Rooftop Energy, a provider of rooftop- and ground-mounted solar PV systems, mainly to clients in the B2B sector, has been acquired by NPM Capital.

Rooftop Energy offers everything from development and design to arranging external financing, installation and operation of solar PV systems on large surface areas. Notable clients include AkzoNobel, Plantion Bloemenveiling, Kingfish Zeeland, Spanbeton and de Bavelse Berg. By the end of 2019, the installed capacity is expected to reach 100 MWp, which is equivalent to the energy consumption of 30,000 households.

NPM Capital is a leading Dutch investment company focused on medium to large Benelux companies.

Oaklins' team in the Netherlands acted as lead advisor to the seller. Rooftop Energy had been looking for a partner to support and accelerate further growth and scale-up as the company is currently in the middle of a transition from pioneer to leading player in the B2B sustainable energy market.

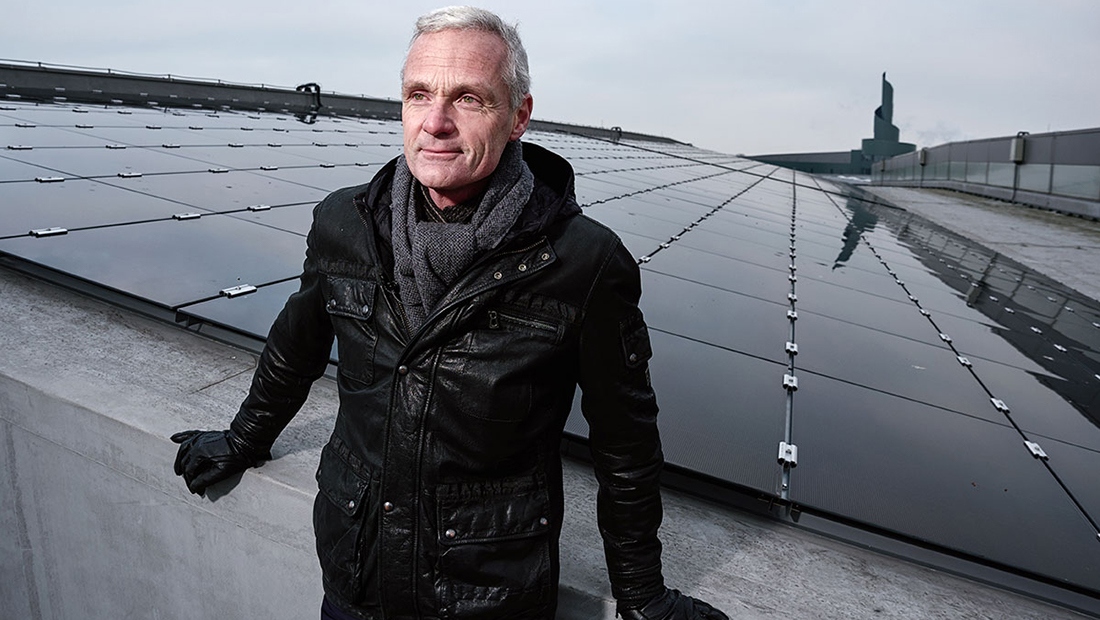

Leendert Florusse

CEO and co-founder, Rooftop Energy

Talk to the deal team

Related deals

Dolmans Landscaping Group has welcomed Foreman Capital as a new shareholder to support further growth

Dolmans Landscaping Group, a leading full-service provider of landscaping services, has welcomed Foreman Capital as a new shareholder. By partnering with Foreman Capital, which has extensive experience in building stronger companies in the maintenance of public spaces, Dolmans can accelerate its growth trajectory across core verticals and further professionalize the business.

Learn morePresight Solutions has been acquired by Banyan Software

Banyan Software, a leading acquiror and operator of mission-critical software businesses, has entered Norway with the acquisition of Presight Solutions AS, a SaaS company delivering advanced software for safety, operational integrity and regulatory compliance in high-risk industries. The transaction marks a new chapter for Presight, strengthening its ability to scale while preserving the product focus, sector expertise and customer trust built since its founding in 2003.

Learn moreBackspin has completed a mandatory public tender offer for the shares of Spindox

Backspin S.p.A. has completed a mandatory public tender offer for Spindox S.p.A.

Learn more