Rooftop Energy has been acquired by NPM Capital

Rooftop Energy, a provider of rooftop- and ground-mounted solar PV systems, mainly to clients in the B2B sector, has been acquired by NPM Capital.

Rooftop Energy offers everything from development and design to arranging external financing, installation and operation of solar PV systems on large surface areas. Notable clients include AkzoNobel, Plantion Bloemenveiling, Kingfish Zeeland, Spanbeton and de Bavelse Berg. By the end of 2019, the installed capacity is expected to reach 100 MWp, which is equivalent to the energy consumption of 30,000 households.

NPM Capital is a leading Dutch investment company focused on medium to large Benelux companies.

Oaklins' team in the Netherlands acted as lead advisor to the seller. Rooftop Energy had been looking for a partner to support and accelerate further growth and scale-up as the company is currently in the middle of a transition from pioneer to leading player in the B2B sustainable energy market.

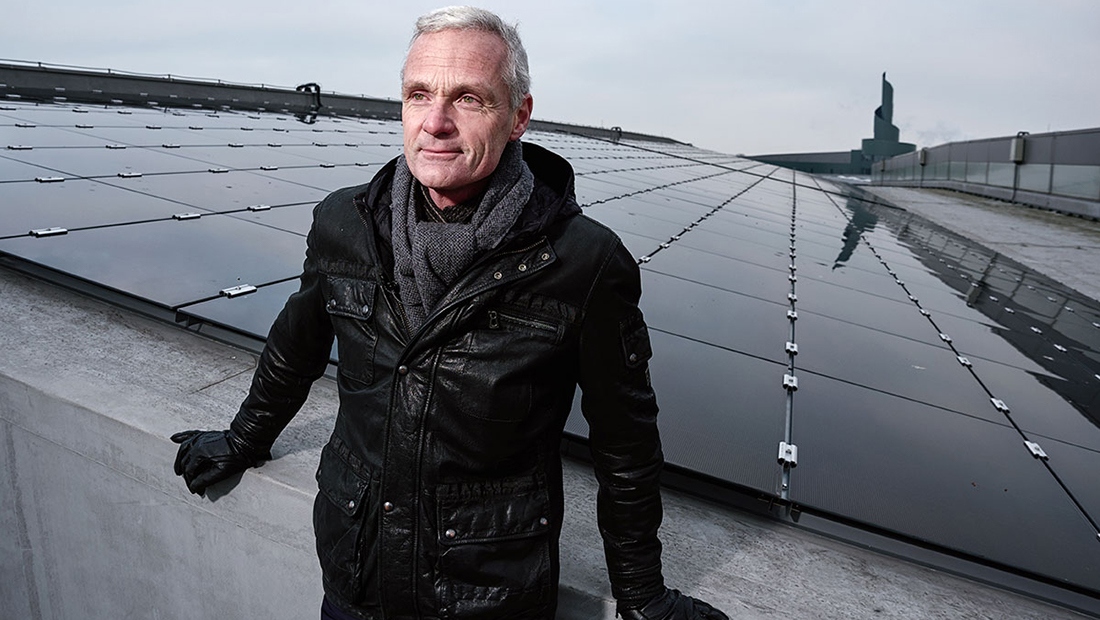

Leendert Florusse

CEO and Co-founder, Rooftop Energy

Talk to the deal team

Related deals

Dania Software has been acquired by Omnidocs

The owners of Dania Software A/S have sold the company to Omnidocs.

Learn moreTop Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn more