Rooftop Energy has been acquired by NPM Capital

Rooftop Energy, a provider of rooftop- and ground-mounted solar PV systems, mainly to clients in the B2B sector, has been acquired by NPM Capital.

Rooftop Energy offers everything from development and design to arranging external financing, installation and operation of solar PV systems on large surface areas. Notable clients include AkzoNobel, Plantion Bloemenveiling, Kingfish Zeeland, Spanbeton and de Bavelse Berg. By the end of 2019, the installed capacity is expected to reach 100 MWp, which is equivalent to the energy consumption of 30,000 households.

NPM Capital is a leading Dutch investment company focused on medium to large Benelux companies.

Oaklins' team in the Netherlands acted as lead advisor to the seller. Rooftop Energy had been looking for a partner to support and accelerate further growth and scale-up as the company is currently in the middle of a transition from pioneer to leading player in the B2B sustainable energy market.

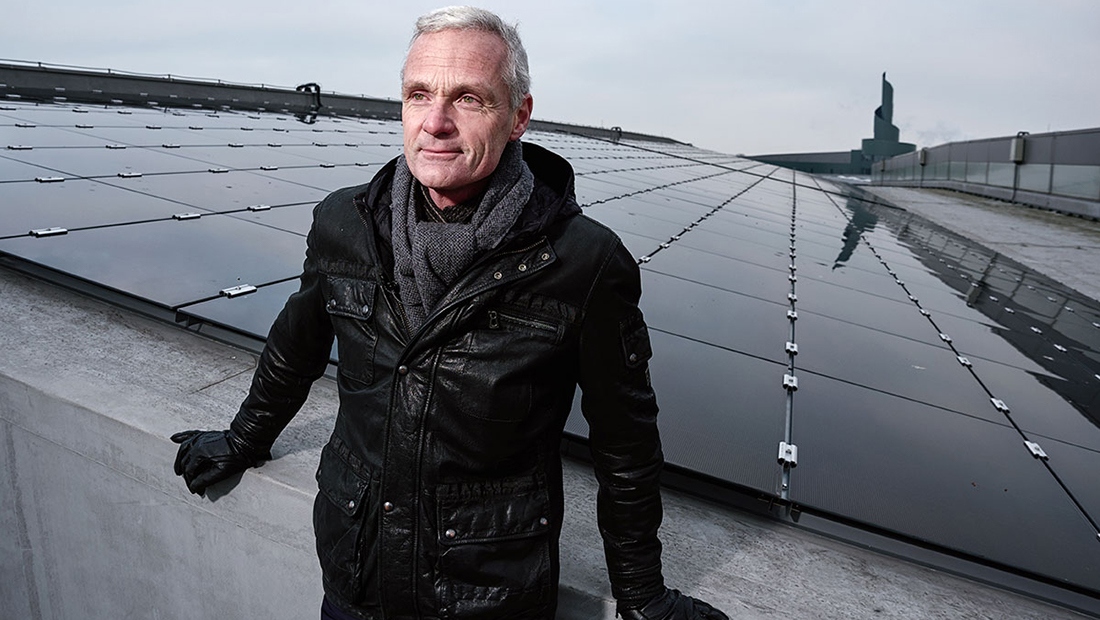

Leendert Florusse

CEO and Co-founder, Rooftop Energy

Neem contact op met het dealteam

Gerelateerde deals

Thrive Freeze Dry has successfully sealed the acquisition deal with Paradiesfrucht GmbH

Paradiesfrucht GmbH, a gobal freeze dryer of fruits, fruit preparations, drops, powders and granulates, has been acquired by Thrive Freeze Dry (Thrive), a portfolio company of Entrepreneurial Equity Partners (e2p) and Mubadala Capital. The transaction is expected to close in 2024, subject to customary closing conditions, including antitrust approval.

Lees verderPerkbox has been acquired by Great Hill Partners

Molten Ventures has sold Perkbox to Great Hill Partners.

Lees verderArculus Cyber Security has been acquired by Bridewell

The shareholders of Arculus Cyber Security (Arculus) have sold the business to Bridewell. The deal will bolster Bridewell’s growing roster of accreditations as well as strengthen its public sector footprint, enabling the expansion of its end-to-end cyber security offering for clients across the globe.

Lees verder