Private Equity

In the increasingly competitive environment of private equity, great deals are harder to find and the exceptional risk becomes the rule. With deep expertise across many industries and 800+ professionals providing M&A, growth equity and ECM, debt advisory and corporate finance services globally, we deliver a deal flow consisting of the very best opportunities on the market — and help you gain the upper hand.

Contact advisor

BlueGem Capital Partners has acquired Light & Living

BlueGem Capital Partners has acquired Light & Living LLC from Mentha Capital.

Learn moreLucardi has been acquired by Mentha Capital

The shareholders of Lucardi, a leading jewelry chain in the Netherlands, have sold the company to Mentha Capital.

Learn moreMarinetrans and BGL have sold a majority stake to Waterland Private Equity

The shareholders of Best Global Logistics (BGL) and Marinetrans, both logistics service providers, have completed a combined sale of the companies to Waterland Private Equity Investments (Waterland).

Learn more

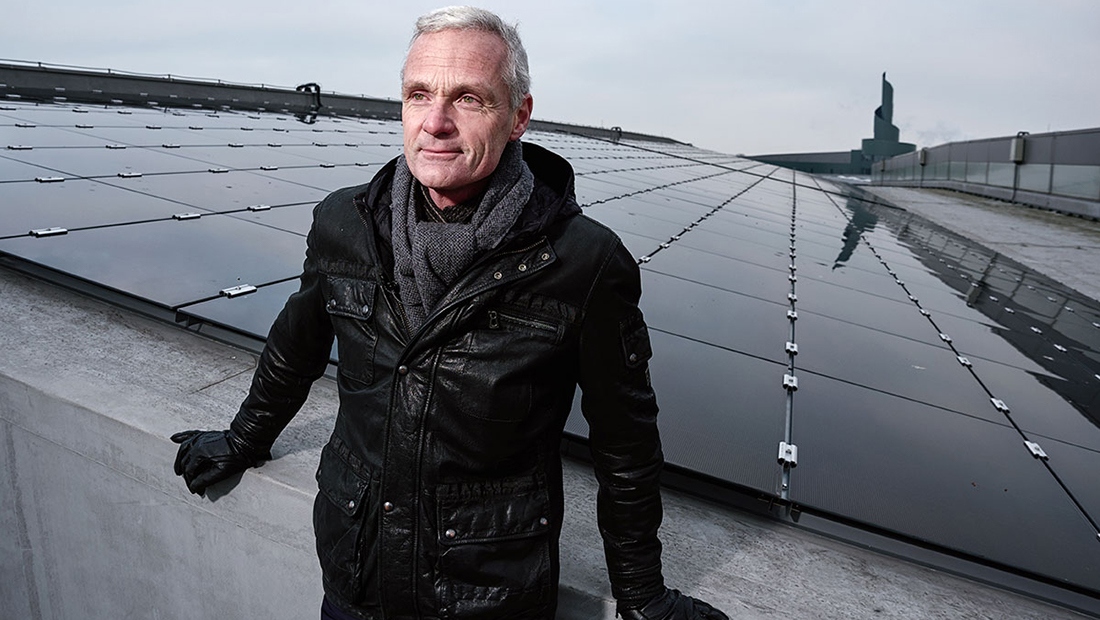

Leendert Florusse

CEO and Co-founder, Rooftop Energy

Read more

Oaklins Netherlands Welcomes New Partners and Launches Valuation Services

Amsterdam, April 2024 - Oaklins Netherlands is proud to announce the appointment of two seasoned experts to its Partner ranks and the launch of Valuation Advisory services. These strategic moves reflect Oaklins' commitment to strengthening its focus on Private Equity and offering comprehensive Valuation Solutions to clients across various sectors.

Learn more

Talk to our local specialists

Meet our global industry specialists

Brian Livingston

Oaklins Evelyn Partners

Reed Phillips

Oaklins DeSilva+Phillips