Private Equity

Met de continu groeiende competitie in private equity zijn goede deals moeilijker te vinden en wordt risico nemen steeds gangbaarder. Met jarenlange ervaring in een groot aantal sectoren en meer dan 900 M&A-professionals over de hele wereld, bieden wij een dealflow die bestaat uit de allerbeste kansen op de markt – en helpen we u de overhand te krijgen.

Spreek de adviseur

Plain Vanilla Investments has sold its portfolio company Euphoria Mobility to Sofindev

Sofindev has reached an agreement with the shareholders of Euphoria Mobility, including private equity firm Plain Vanilla Investments, to acquire a majority stake in the company. This strategic partnership will enable Euphoria to accelerate its European expansion, reinforce its presence in the Benelux region and further enhance its product offering.

Lees verderMarinetrans and BGL have sold a majority stake to Waterland Private Equity

The shareholders of Best Global Logistics (BGL) and Marinetrans, both logistics service providers, have completed a combined sale of the companies to Waterland Private Equity Investments (Waterland).

Lees verderLucardi has been acquired by Mentha Capital

The shareholders of Lucardi, a leading jewelry chain in the Netherlands, have sold the company to Mentha Capital.

Lees verder

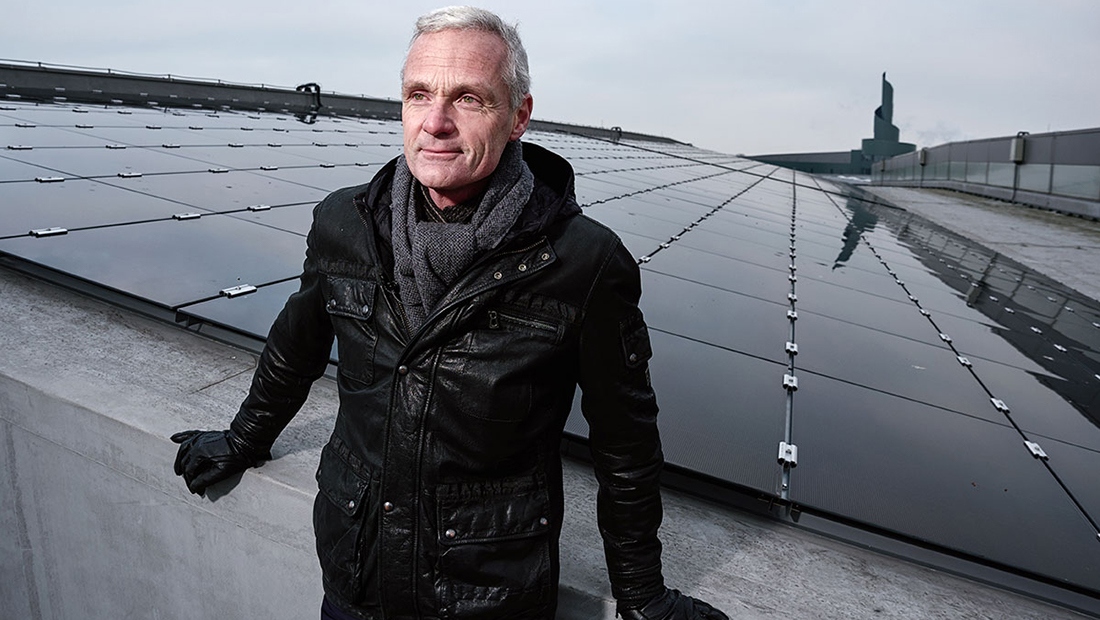

Leendert Florusse

CEO and co-founder, Rooftop Energy

Lees verder

Autotech & automotive SaaS inzetten voor schaal, groei en waardevermeerdering van de automotive sector

WEBINAR UITNODIGING: Neem deel aan het Oaklins webinar waar experts hun visie delen op de toekomst van automotive SaaS-platformen.

Lees verder