Cad Railway Industries Ltd. has sold a minority stake to Sojitz

Sojitz has acquired a minority interest in Cad Railway Industries Ltd. for an undisclosed consideration.

Established in 1968, Cad Railway Industries performs structural, mechanical and electrical repairs for the rail, marine, mining and power generating industries. The company also specializes in remanufacturing any type of rolling stock. Among its clients, the company services Canadian National and Canadian Pacific, two of the largest railroad companies in the world.

Sojitz engages in a wide range of businesses globally, including buying, selling, importing, and exporting goods, manufacturing and selling products, providing services, and planning and coordinating projects, in Japan and overseas. The company also invests in various sectors and conducts financing activities. The broad range of sectors in which Sojitz operates includes automobiles, energy, mineral resources, chemicals, foodstuff resources, agricultural and forestry resources, consumer goods, and industrial parks. It is one of the largest trading companies in Japan with over US$20 billion in assets.

Oaklins' team in Montreal acted as the advisor to the seller in this transaction.

Contacter l'équipe de la transaction

Transactions connexes

Outsource Management Services has been acquired by IMI Supply Chain Solutions

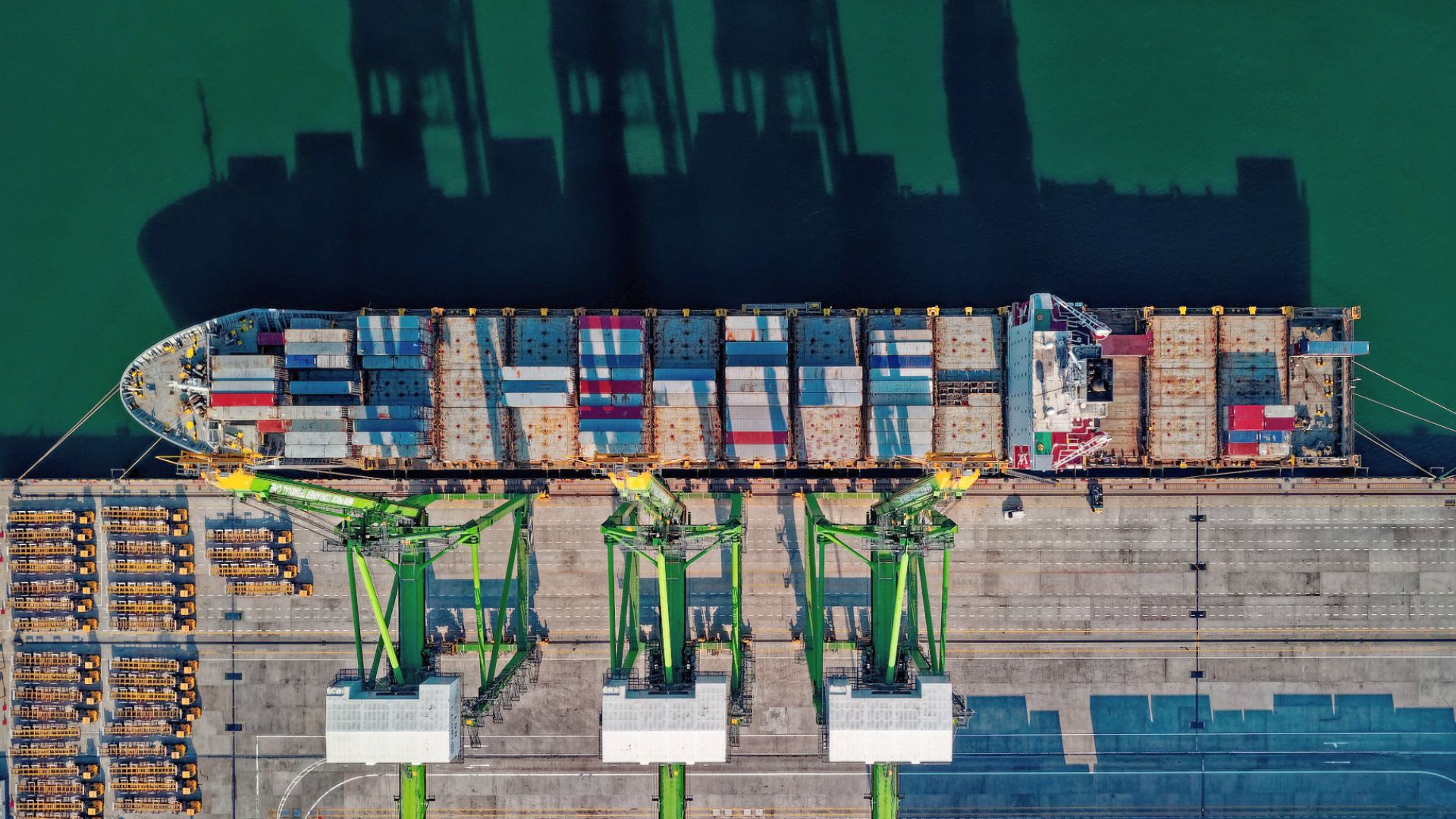

UK logistics software provider Outsource Management Services (OMS) has been acquired by IMI Supply Chain Solutions, a Sweden-based provider of supply chain management software solutions.

En apprendre plusNovasol Chemicals has joined forces with Hivest Capital Partners

Novasol Chemicals, a dynamic and rapidly expanding global distributor of specialty chemicals, has entered into a financial partnership with Hivest Capital Partners to support its next phase of growth. The partnership is intended to accelerate Novasol’s international expansion, with a focus on both organic growth and selective acquisitions, further strengthening the company’s position in a highly fragmented market.

En apprendre plusGrain de Sail has sold a minority stake to GO CAPITAL, Bpifrance and other investors

Grain de Sail, France’s leading producer of organic coffee and chocolate and a pioneer in sail-powered freight transport, has completed a capital increase subscribed by a group of investors led by GO CAPITAL and Bpifrance. The transaction provides new financial resources to support the company’s development and strengthen its position in the sustainable food and low-carbon maritime transport markets.

En apprendre plus