Sandvik has acquired Portugal-based Frezite

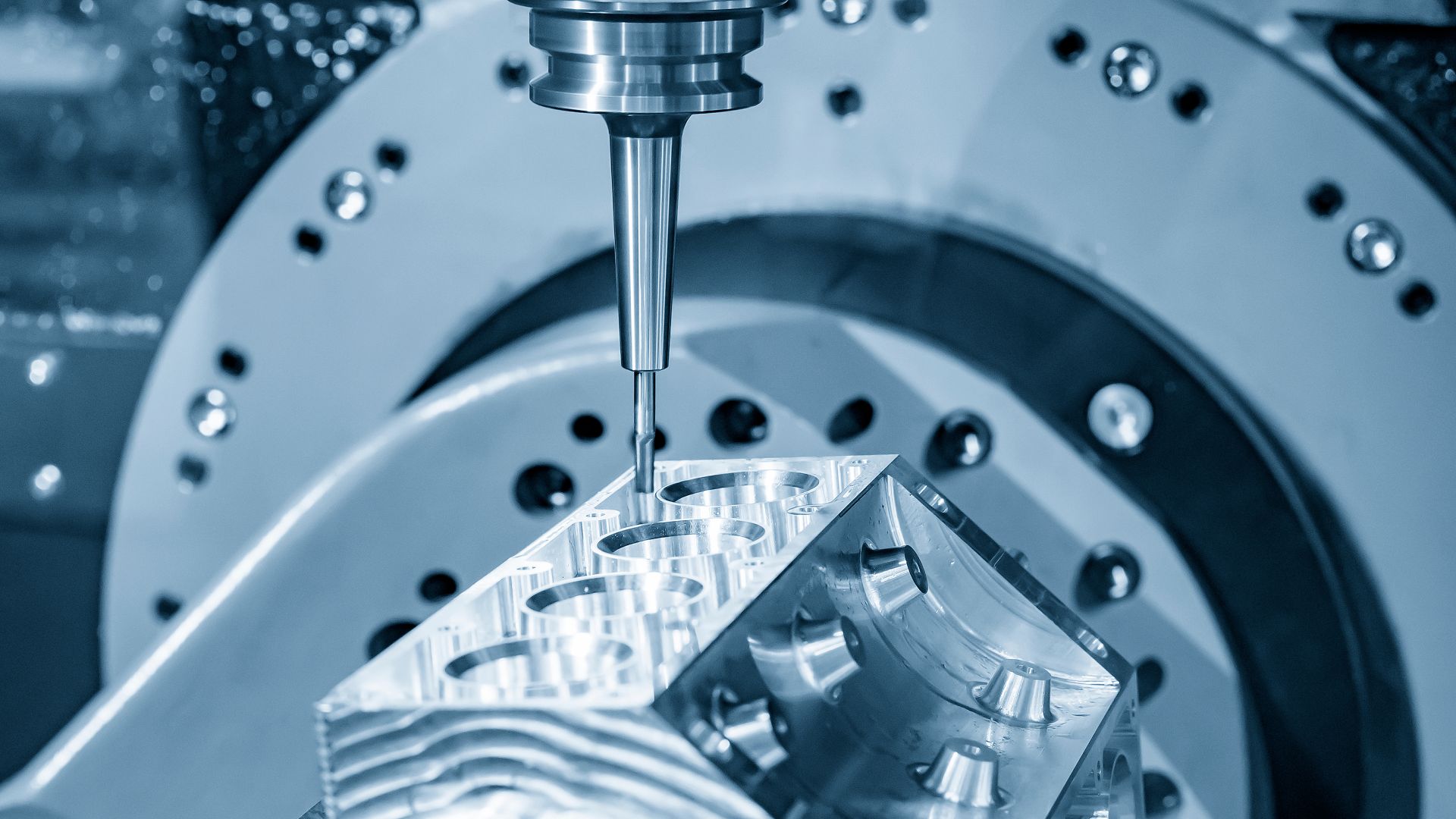

Walter, a division of Sandvik Manufacturing and Machining Solutions, has acquired Portugal-based Frezite, a family-owned polycrystalline diamond (PCD) tool manufacturer.

Sandvik is a global high-tech engineering group offering solutions that enhance customer productivity, profitability and sustainability for the manufacturing, mining and infrastructure industries. Sandvik is at the forefront of digitalization with a focus on optimizing customers’ processes, as well as having a world-leading offering, including equipment, tools, services and digital solutions for machining, mining, rock excavation, rock processing and advanced materials. In 2021, the group had approximately 44,000 employees and revenues of over US$9 billion in about 150 countries.

Founded in 1978, Frezite primarily offers made-to-order PCD tools for metal and wood applications, predominantly serving customers in the automotive, general engineering and aerospace segments. The company is headquartered in Trofa, Portugal, and is present in Europe, Mexico and Brazil. Frezite has approximately 450 employees and generated revenues of approximately US$45.5 million in 2021.

Oaklins’ Swedish and Portuguese teams acted as financial advisors to Sandvik and Walter throughout the acquisition process.

Nadine Crauwels

President, Sandvik Machining Solutions

Prata med transaktionsteamet

Relaterade affärer

Xeros Technology Group has completed a placing, subscription and retail offer

Xeros Technology Group plc has raised funds to drive forward its commercialization strategy.

Lär dig merSuccesful integrated solution for strategic deadlock and tender offer by CMB on Euronav

Compagnie Maritime Belge (CMB) has successfully resolved the strategic and structural deadlock within Euronav through an agreement with Frontline, a world leader in the international seaborne transportation of crude oil and refined products, resulting in a mandatory takeover offer on Euronav.

Lär dig merIndustrie Polieco - M.P.B. has sold a minority stake to RedFish Longterm Capital

T.P. Holding Srl, the company controlled by the Tonelli family, has sold Industrie Polieco - M.P.B. SpA to RedFish Longterm Capital SpA.

Lär dig mer