Astorg has had a PPA conducted for the acquisition of AutoForm

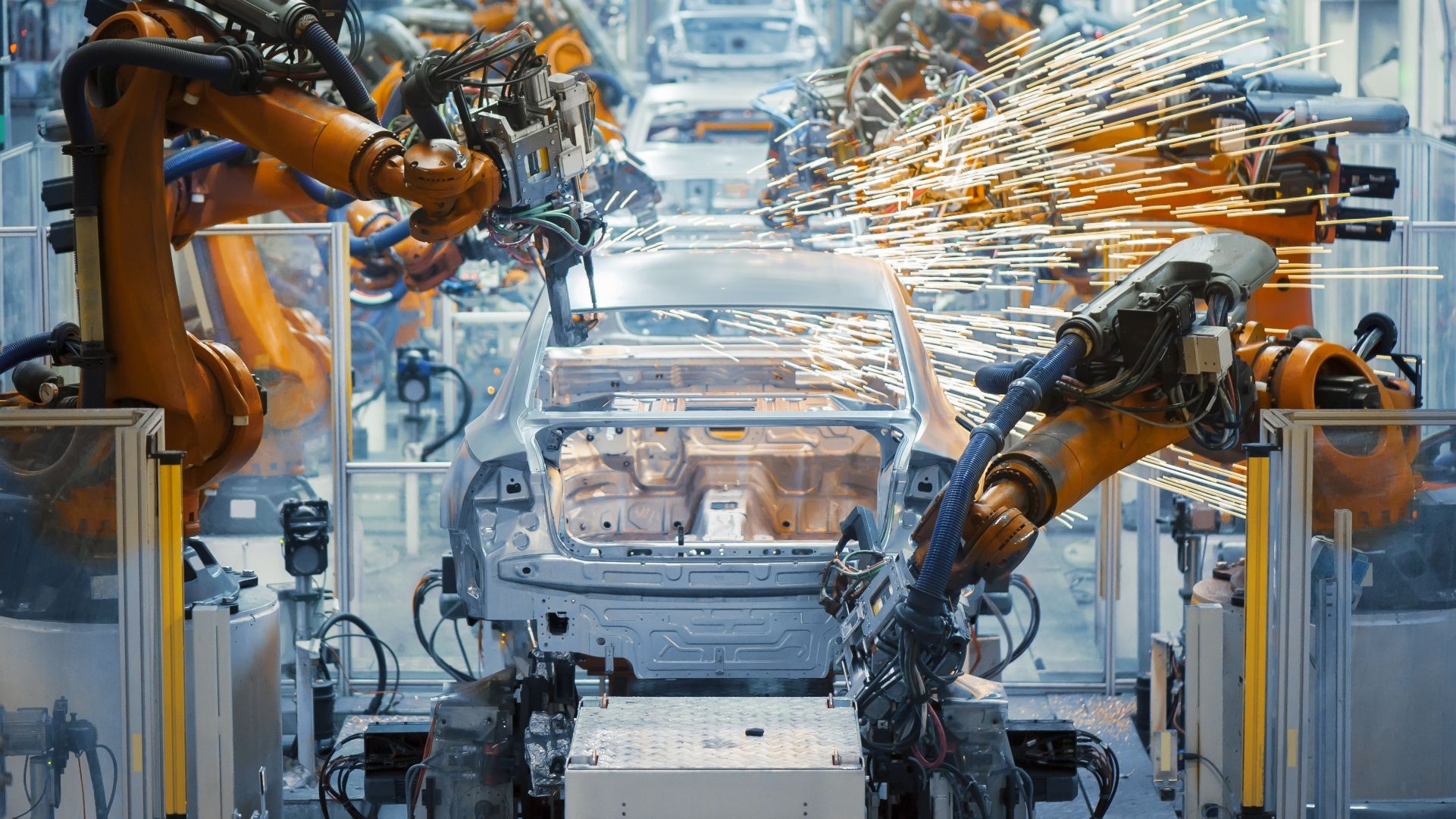

On 22 July 2016, the French private equity firm Astorg acquired AutoForm, the global market leader in engineering software for sheet metal forming processes in the automotive industry, for an undisclosed consideration. Subsequent to the transaction, a purchase price allocation (PPA) was conducted for accounting purposes.

Astorg is an independent private equity group with over US$5 billion of assets under management. The firm has offices in London, Paris and Luxembourg. Astorg acquires European companies with a global presence and sales. The company employs 360 people in 15 countries around the world.

AutoForm was founded in 1995 as a spin-off from the Swiss Federal Institute of Technology. It offers software solutions for the die-making and sheet metal forming industries along the entire process chain. Producing tremendous improvements in quality, time and cost, AutoForm is an acknowledged industry standard at virtually every automotive OEM and at leading suppliers of tooling, stamping and materials worldwide.

Oaklins' team in Switzerland advised Astorg and AutoForm during the post transaction phase and produced a PPA report in accordance with IFRS 3. The report contained the allocation of the consideration paid to all identifiable assets acquired and liabilities assumed.

Anton Haas

CFO, AutoForm

Talk to the deal team

Related deals

Top Systems teams up with Holland Capital to create the premier Dutch battery-based solutions provider

Holland Capital, a Netherlands-based private equity firm, has acquired a stake in Top Systems, a leading provider of complete battery-based power solutions, with a unique value-added services proposition.

Learn moreSoler & Palau Ventilation has acquired subsidiaries of United Enertech Holdings

Soler & Palau Ventilation, Inc. (S&P) has acquired subsidiaries of United Enertech Holdings, LLC. (UEH). The subsidiaries included Air Conditioning Products, LLC; Air Performance, LLC; Metal Form Manufacturing, LLC; and United Enertech Corp.

Learn moreInfotreasury has been sold to Matera

Matera, a leading banking software company with world-class instant payments and core banking solutions, has acquired Infotreasury.

Learn more